Goldman Sachs 2003 Annual Report Download

Download and view the complete annual report

Please find the complete 2003 Goldman Sachs annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

every catalyst elicits a reaction

goldman sachs 2003 annual report

Table of contents

-

Page 1

goldman sachs 2003 annual report e v e ry c ata lys t elicits a r e ac t i o n -

Page 2

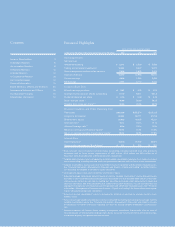

... Board Members, Officers and Directors International Advisors and Offices Our Business Principles Shareholder Information 3 10 14 18 22 26 28 31 104 110 111 112 Operating Results Net revenues Investment banking Trading and principal investments Asset management and securities services Total... -

Page 3

... as Goldman Sachs play a vital role in allocating capital and managing risk so that sophisticated global issuers and investors can maximize their opportunities in today's marketplace. As we conduct our broad-reaching businesses in ever more complex markets, our people must continually find new ways... -

Page 4

... of Goldman Sachs leaders. John had a long and successful career at Goldman Sachs, distinguished by his character, rigorous intellect and devotion to the firm's culture. He helped Goldman Sachs transition from a private partnership to a public corporation, encouraged new business development... -

Page 5

... up from 11% in 2002. Our return on average tangible shareholders' equity was 20%, well above the 15% earned in 2002. By its nature, our business doesn't lend itself to predictable recurring earnings. As we often remind our people, Goldman Sachs cannot control the market environment in which we work... -

Page 6

..., in hindsight we and others could have done a better job. However, we had already begun implementing changes in our research business long before the final settlement, and we have been working diligently to comply in every respect with the new ground rules. 4 GOLDMAN SACHS 2003 ANNUAL REPORT -

Page 7

... case" scenario. Shortfalls on a single day can exceed reported VaR by a large amount. In addition, shortfalls can accumulate over a longer period, such as a number of consecutive trading days. As a predictor of trading results, VaR historically has worked relatively well in stable markets and less... -

Page 8

... increase in average assets under management, the contribution from the acquisition of Ayco and increased incentive income. Total assets under management increased 7% to a record $373 billion. Two closely related factors are critical to building our business: the 6 GOLDMAN SACHS 2003 ANNUAL REPORT -

Page 9

... bolt-on deals where we can add new clients or acquire new products to provide to our existing clients. 2003 offered us a number of such opportunities. In July, we acquired The Ayco Company, a leading provider of sophisticated, fee-based financial counsel- GOLDMAN SACHS 2003 ANNUAL REPORT 7 -

Page 10

Letter to Shareholders ing in the United States. Ayco enables us to develop further our high-net-worth and asset management businesses by using its extensive portfolio of financial planning capabilities, including tax, estate and charitable planning services. We also made two acquisitions of power ... -

Page 11

... in Australian and New Zealand equities trading and research and Goldman Sachs' premier global investment banking, fixed income and equities capabilities. This transaction demonstrates Goldman Sachs' commitment to Australia and New Zealand and to offering significantly enhanced services to our... -

Page 12

a s t r at e g i c r e ac t i o n -

Page 13

We help companies find capital to grow their ideas. -

Page 14

..., the Goldman Sachs team arranged a $2 billion secured credit facility as interim funding. Goldman Sachs has been advising Sears for over a century, including helping to manage the company's IPO in 1906. WE HELP COMPANIES FIND CAPITAL TO GROW THEIR IDEAS. Fueling business growth and nurturing high... -

Page 15

... Sachs partnership in 1986. YELL GROUP PLC Goldman Sachs jointly led the international directories business's highly successful initial public offering. demand into an increased offering size, rapid execution, attractive pricing and a broad distribution of shares. Our Investment Banking, Equity... -

Page 16

an i n n ovat i v e r e ac t i o n -

Page 17

We help investors find the ideas that make their capital grow. -

Page 18

...produce competitive returns. As market dynamics grow more complex, our investing clients call upon Goldman Sachs to help them access new opportunities, as well as to protect and enhance the value of existing investments. Research insights, such as our 2003 report on Global Energy, help guide clients... -

Page 19

... Goldman Sachs Private Wealth Management advised Louis and Helene Galen on a landmark $35 million sponsorship of a new events center at the University of Southern California. Knowing the importance to the Galens of philanthropy and their desire to express their commitment to USC, the Private Wealth... -

Page 20

a resilient r e ac t i o n -

Page 21

We help markets find ways to connect ideas and capital. -

Page 22

... in Linden, New Jersey. In December, we acquired privately owned Cogentrix Energy, Inc., owner of interests in 26 power plants with significant production capacity. These holdings are expected to generate stable, long-term cash flows and greater opportunities for trading and risk management. From... -

Page 23

GENERAL MOTORS CORPORATION General Motors (GM) asked Goldman Sachs Asset Management (GSAM) to propose an investment strategy that would reduce the volatility of GM's pension portfolio without compromising its targeted return. GM, with the largest corporate pension plan in the U.S., sought an ... -

Page 24

a g l o ba l r e ac t i o n -

Page 25

We help societies use their ideas and capital to move forward. -

Page 26

...billion offering, as well as the Moody's foreign currency credit rating upgrade that coincided with it, underscored confidence in China's long-term growth prospects and stability. Goldman Sachs served as credit rating advisor to the Ministry of Finance and acted as joint book-running lead manager on... -

Page 27

... its future growth, complementary strengths and preserved strong saw a merger as an opportunity to create a relationships with their licensing partners. biotechnology company with a broader product HM TREASURY (HER MAJESTY'S TREASURY) Goldman Sachs jointly led a $3 billion debt offering that... -

Page 28

a c o o p e r at i v e r e ac t i o n -

Page 29

...needs of our communities. JOHANNESBURG, SOUTH AFRICA TOKYO, JAPAN NEW YORK, USA Goldman Sachs continued its relationship this year with the Mveledzandivho Primary School, a 12-classroom school in the township of Soweto, accommodating 700 students aged 5-14. Goldman Sachs volunteers renovated the... -

Page 30

...core businesses Goldman Sachs is a leading global investment banking, securities and investment management firm that provides a wide range of services worldwide to a substantial and diversified client base that includes corporations, financial institutions, governments and high-net-worth individuals... -

Page 31

... $1,331 $1,509 DEBT EQUITY 01 02 03 INVESTMENT BANKING NET REVENUES 01 02 03 FINANCIAL ADVISORY NET REVENUES 01 02 03 UNDERWRITING NET REVENUES (in millions) (in millions) (in millions) Financial Advisory includes advisory Underwriting includes public offerings assignments with respect to... -

Page 32

...securities lending services to mutual funds, pension funds, hedge funds, foundations, endowments and high-net-worth individuals. Our Asset Management and Securities Services segment is divided into two components: Asset Management and Securities Services. ASSET MANAGEMENT SECURITIES SERVICES $2,405... -

Page 33

... Taxes . Note 12 - Employee Incentive Plans . Note 14 - Regulated Subsidiaries . Note 15 - Business Segments ... ... ... ... ... Short-Term Borrowings Credit Ratings ... ... Contractual Obligations and Contingent Commitments Risk Management Market Risk . Credit Risk . Derivatives ... supplemental... -

Page 34

... brokerage, ï¬nancing services and securities lending services to mutual funds, pension funds, hedge funds, foundations, endowments and high-net-worth individuals. Unless speciï¬cally stated otherwise, all references to 2003, 2002 and 2001 refer to our ï¬scal years ended, or the dates, as the... -

Page 35

..., for many of our trading businesses and for wealth creation, which contributes to growth in our asset management businesses. In recent years, we have been operating in a challenging environment for many of our businesses, characterized by equity market declines from record highs, lower levels of... -

Page 36

... trading partners. Corporate proï¬tability improved and investment spending rose strongly through the year. The Bank of Japan continued to provide substantial liquidity to the market and continued to hold shortterm interest rates at zero percent through the year. The Ministry of Finance engaged... -

Page 37

... impact on Goldman Sachs of a reduction in our credit ratings, see " - Capital and Funding - Credit Ratings." operational and infrastructure risk - Our businesses are highly dependent on our ability to process, on a daily basis, a large number of transactions across numerous and diverse markets in... -

Page 38

...of $1.07 billion in employee-owned merchant banking funds that were consolidated in 2003. cash trading instruments - The fair values of cash trading instruments are generally obtained from quoted market prices in active markets, broker or dealer price quotations, or alternative pricing sources with... -

Page 39

... (for example, option premiums or cash paid or received pursuant to credit support agreements) and may change signiï¬cantly from period to period based on, among other factors, changes in our trading positions and market movements. The fair values of our exchange-traded derivatives are generally... -

Page 40

... values of our OTC derivative assets and liabilities by product and by remaining contractual maturity: OTC DERIVATIVES (IN MILLIONS) AS OF NOVEMBER 2003 0-6 MONTHS 6-12 MONTHS 1-5 YEARS 5-10 YEARS 10 YEARS OR GREATER ASSETS TOTAL Contract type Interest rates Currencies Commodities Equities Total... -

Page 41

...and loss, and review of valuation models by personnel with appropriate technical knowledge of relevant markets and products. For a further discussion of how we manage the risks inherent in our trading and principal investing businesses, see " - Risk Management." GOLDMAN SACHS 2003 ANNUAL REPORT 39 -

Page 42

... Asset Management Securities Services Total (1) $ - 125 117 $ - 123 117 2,384 - 2,374 - 419 (2) 117 $3,162 128 117 $2,859 Primarily related to our combinations with SLK and The Hull Group. (2) Primarily related to our combination with The Ayco Company, L.P. (Ayco). 40 GOLDMAN SACHS 2003... -

Page 43

... CARRYING VALUE Customer lists NYSE specialist rights Option and exchange-traded fund (ETF) specialist rights Other Total (1) Includes $ 880 (1) 636 130 174 (2) $1,820 8 - 21 24 - 26 2 - 24 4-9 $ 765 666 291 258 $1,980 primarily our clearance and execution and Nasdaq customer lists acquired in... -

Page 44

... 2001, primarily reï¬,ecting a difï¬cult economic and business environment, characterized by continued weakness in equity markets and generally lower levels of corporate activity. Net revenues in Asset Management and Securities Services increased 4% compared with 2001, primarily reï¬,ecting higher... -

Page 45

.... Substantially all of the costs of these employees are reimbursed to Goldman Sachs by the real estate investment funds to which these companies provide property management and loan services. 1,037 employees associated with our combination with Ayco, a provider of fee-based ï¬nancial counseling in... -

Page 46

... Trading and Principal Investments segment; and • reclassifying the matched book businesses from the Securities Services component of the Asset Management and Securities Services segment to the FICC component of the Trading and Principal Investments segment. 44 GOLDMAN SACHS 2003 ANNUAL REPORT -

Page 47

... other factors, the overall performance of Goldman Sachs, continued strong relative performance in the business (as evidenced by our high rankings and market share), as well as the somewhat improved business environment at the end of 2003. Operating expenses also increased due to intangible asset... -

Page 48

...equities - We make markets in, act as a specialist for, and trade equities and equity-related products, structure and enter into equity derivative transactions, and engage in proprietary trading. We also execute and clear customer transactions on major stock, options and futures exchanges worldwide... -

Page 49

... principal strategies business includes equity arbitrage, as well as other proprietary trading in convertible bonds and derivatives. The equities product groups include primarily customer-driven activities in our shares, convertible bonds and derivatives businesses. GOLDMAN SACHS 2003 ANNUAL REPORT... -

Page 50

... generates revenues in the form of management and incentive fees. • securities services - Securities Services includes prime brokerage, ï¬nancing services and securities lending, all of which generate revenues primarily in the form of interest rate spreads or fees. vides investment advisory and... -

Page 51

... program of diversiï¬cation among its asset managers and $4 billion in inï¬,ows acquired from Ayco. Securities Services net revenues of $1.01 billion for 2003 increased 17% compared with 2002, primarily reï¬,ecting higher customer balances in our securities lending and margin lending businesses... -

Page 52

... senior and subordinated debt, limited and general partnership interests, and preferred and common stock; entering into interest rate, foreign currency, equity, commodity and credit derivatives; and providing guarantees, indemniï¬cations, letters of credit, representations and warranties. Our... -

Page 53

....2 million as of November 2002. Tangible book value per share is computed by dividing tangible shareholders' equity by the number of common shares outstanding, including restricted stock units granted to employees with no future service requirements. (5) (6) GOLDMAN SACHS 2003 ANNUAL REPORT 51 -

Page 54

... short-term borrowings. Dominion Bond Rating Service Limited Fitch Moody's Investors Service Standard & Poor's R-1 (middle) F1+ P-1 A-1 A (high) AAAa3 A+ As of November 2003, collateral of $220 million would have been callable in the event of a one-level reduction in our long-term credit ratings... -

Page 55

Management's Discussion and Analysis Contractual Obligations and Contingent Commitments Goldman Sachs has contractual obligations to make future payments under long-term debt and long-term noncancelable lease agreements and has contingent commitments under a variety of commercial arrangements. ... -

Page 56

... Board of Trade, the NYSE, the National Association of Securities Dealers, Inc. and the National Futures Association. Goldman Sachs International, a registered U.K. broker-dealer, is subject to regulation by the Financial Services Authority. Goldman Sachs (Japan) Ltd., a Tokyo-based broker-dealer... -

Page 57

... to hedge our exposures. Market risk limits are monitored on a daily basis by the Finance Division, and are reviewed regularly by the appropriate risk committee. Limit violations are reported to the appropriate risk committee and the appropriate business unit managers. Selected business unit... -

Page 58

...: • risk limits based on a summary measure of market VaR by signiï¬cant amounts. Shortfalls can also accumulate over a longer time horizon such as a number of consecutive trading days. The VaR numbers below are shown separately for interest rate, equity, currency and commodity products, as... -

Page 59

Management's Discussion and Analysis The following tables set forth the daily VaR for substantially all of our trading positions: AVERAGE DAILY VaR(1) (IN MILLIONS) RISK CATEGORIES 2003 YEAR ENDED NOVEMBER 2002 2001 Interest rates Equity prices Currency rates Commodity prices Diversiï¬cation ... -

Page 60

... marked-to-market on a daily basis and changes are recorded in net revenues. The following chart sets forth the frequency distribution for substantially all of our daily trading net revenues for the year ended November 2003: DAILY TRADING NET REVENUES ($ IN MILLIONS) 80 80 NUMBER OF DAYS NUMBER OF... -

Page 61

Management's Discussion and Analysis As part of our overall risk control process, daily trading net revenues are compared with VaR calculated as of the end of the prior business day. Trading losses incurred on a single day did not exceed our 95% one-day VaR during 2003. nontrading risk The market ... -

Page 62

... received under agreements entitling Goldman Sachs to require additional collateral upon speciï¬ed increases in exposure or the occurrence of adverse credit events. Where we have obtained collateral from a counterparty under a master trading agreement that covers multiple products and transactions... -

Page 63

...an internal liquidity model together with a qualitative assessment of the condition of the ï¬nancial markets and of Goldman Sachs. Our liquidity model identiï¬es and estimates cash and collateral outï¬,ows over a short-term horizon in a liquidity crisis, including, but not limited to: • upcoming... -

Page 64

...changes to our credit risk, market risk or excess liquidity position because they are generally in highly liquid assets that are typically ï¬nanced on a secured basis. funding of assets with longer term liabilities - We seek to maintain total capital (long-term borrowings plus shareholders' equity... -

Page 65

... asset managers. We believe that our relationships with our creditors are critical to our liquidity. We access funding in a variety of markets in the United States, Europe and Asia. We make extensive use of the repurchase agreement and securities lending markets, arrange for letters of credit to... -

Page 66

...capitalize on opportunities in our trading and principal investing businesses, including the purchase of investments that could be difï¬cult to fund in periods of market stress. We also increased our Global Core Excess liquidity, made leasehold 64 GOLDMAN SACHS 2003 ANNUAL REPORT improvements, and... -

Page 67

... the intrinsicvalue-based method prescribed by Accounting Principles Board Opinion No. 25, "Accounting for Stock Issued to Employees." Therefore, no compensation expense was, or will be, recognized for those stock options that had no intrinsic value on the date of grant. Adoption of SFAS No. 123 did... -

Page 68

... during interim periods. The statement does not change the measurement or recognition of the plans. Interim period disclosure is generally effective for our second quarter of 2004. Required annual disclosure is effective for our ï¬scal year ending 2004. 66 GOLDMAN SACHS 2003 ANNUAL REPORT -

Page 69

Report of Independent Auditors To the Board of Directors and Shareholders of The Goldman Sachs Group, Inc.: In our opinion, the accompanying consolidated statements of ï¬nancial condition and the related consolidated statements of earnings, changes in shareholders' equity, cash ï¬,ows and ... -

Page 70

... Asset management and securities services Interest income Total revenues Interest expense Cost of power generation Revenues, net of interest expense and cost of power generation Operating expenses Compensation and beneï¬ts Amortization of employee initial public offering and acquisition awards... -

Page 71

... fair value Other assets Total assets Liabilities and shareholders' equity Short-term borrowings, including the current portion of long-term borrowings Payables to brokers, dealers and clearing organizations Payables to customers and counterparties Securities loaned Securities sold under agreements... -

Page 72

...Changes in Shareholders' Equity YEAR ENDED NOVEMBER (IN MILLIONS, EXCEPT PER SHARE AMOUNTS) 2003 2002 2001 Common stock, par value $0.01 per share Balance, beginning of year Issued Balance, end of year Restricted stock units and employee... ï¬nancial statements. 70 GOLDMAN SACHS 2003 ANNUAL REPORT -

Page 73

... Property, leasehold improvements and equipment Business combinations, net of cash acquired Other investments Net cash used for investing activities Cash ï¬,ows from ï¬nancing activities Short-term borrowings, net Issuance of long-term borrowings Repayment of long-term borrowings, including the... -

Page 74

... tax Comprehensive income $3,005 128 $3,133 $2,114 46 $2,160 $2,310 (38) $2,272 The accompanying notes are an integral part of these consolidated ï¬nancial statements. 72 GOLDMAN SACHS 2003 ANNUAL REPORT -

Page 75

...nancing services and securities lending services to mutual funds, pension funds, hedge funds, foundations, endowments and high-net-worth individuals. The ï¬rm made certain changes to its segment reporting structure in 2003. These changes included reclassifying GOLDMAN SACHS 2003 ANNUAL REPORT 73 -

Page 76

.... The ï¬rm also has formed numerous nonconsolidated merchant banking funds with third-party investors that are typically organized as limited partnerships. The ï¬rm acts as general partner for these funds and does not hold a majority of the economic interests in any fund. Where the ï¬rm holds... -

Page 77

... as similar market transactions, changes in ï¬nancial ratios and changes in the credit ratings of the underlying companies). Cash trading instruments owned by the ï¬rm (long positions) are marked to bid prices and instruments sold but not yet purchased (short positions) are marked to offer prices... -

Page 78

... and Contracts Involved in Energy Trading and Risk Management Activities." Following day one, the ï¬rm adjusts the inputs to valuation models only to the extent that changes in such inputs can be veriï¬ed by similar market transactions, third-party pricing services and/or broker quotes or can be... -

Page 79

...Trading and principal investments" in the consolidated statements of earnings. Cash and Cash Equivalents The ï¬rm deï¬nes cash equivalents as highly liquid overnight deposits held in the ordinary course of business. Goodwill Goodwill is the cost of acquired companies in excess of the fair value... -

Page 80

... SHARE AMOUNTS) 2003 2002 2001 Net earnings, as reported Add: Stock-based employee compensation expense, net of related tax effects, included in reported net earnings Deduct: Stock-based employee compensation expense, net of related tax effects, determined under the fair-value method for all awards... -

Page 81

... of both liabilities and equity and imposes certain Assets and liabilities denominated in non-U.S. currencies are translated at rates of exchange prevailing on the date of the consolidated statement of ï¬nancial condition, and revenues and expenses are translated at average rates of exchange for... -

Page 82

...,205 661 $ - 22,272 738 4,607 401 940 70 146 6,902 14,398 - 38,921 980 $83,473 Equities and convertible debentures State, municipal and provincial obligations Derivative contracts Physical commodities Total 35,006 459 45,733 356 $160,719 $102,699 $129,775 80 GOLDMAN SACHS 2003 ANNUAL REPORT -

Page 83

... of risk management. Risk exposures are managed through diversiï¬cation, by controlling position sizes and by establishing hedges in related securities or derivatives. For example, the ï¬rm may hedge a portfolio of common stock by taking an offsetting position in a related equity-index futures... -

Page 84

...Fair value of retained interests Weighted average life (years) Annual constant prepayment rate Impact of 10% adverse change Impact of 20% adverse change Annual credit losses(1) Impact of 10% adverse change (2) Impact of 20% adverse change (2) Annual discount rate Impact of 10% adverse change Impact... -

Page 85

... The ï¬rm's variable interests in these VIEs include senior and subordinated debt; limited and general partnership interests; preferred and common stock; interest rate, foreign currency, equity, commodity and credit derivatives; guarantees; and residual interests in mortgage-backed and asset-backed... -

Page 86

...% to 8.88% and from 1.20% to 8.88%, respectively. Floating interest rates generally are based on LIBOR, the U.S. Treasury bill rate or the federal funds rate. Certain equity-linked and indexed instruments are included in ï¬,oating rate obligations. SHORT-TERM BORROWINGS The ï¬rm obtains unsecured... -

Page 87

... and related hedges approximates fair value. The effective weighted average interest rates for long-term borrowings, after hedging activities, are set forth below: AS OF NOVEMBER 2003 ($ IN MILLIONS) AMOUNT RATE AMOUNT 2002 RATE Fixed rate obligations Floating rate obligations Total $ 1,517... -

Page 88

... its capacity as an agency lender, occasionally indemniï¬es securities lending customers against losses incurred in the event that borrowers do not return securities and the collateral held is insufï¬cient to cover the market value of the securities borrowed. In relation to certain asset sales and... -

Page 89

...: MAXIMUM PAYOUT/NOTIONAL AMOUNT BY PERIOD OF EXPIRATION (3) CARRYING VALUE (1) (IN MILLIONS) 2004 20052006 20072008 2009THEREAFTER TOTAL Derivatives Securities lending indemniï¬cations (2) Guarantees of the collection of contractual cash ï¬,ows Fund-related commitments Letters of credit and... -

Page 90

... adjusted to exclude goodwill amortization expense: YEAR ENDED NOVEMBER (IN MILLIONS, EXCEPT PER SHARE AMOUNTS) 2001 Net earnings, as reported Net earnings, as adjusted EPS, as reported Basic Diluted EPS, as adjusted Basic Diluted $2,310 2,404 $ 4.53 4.26 $ 4.72 4.44 88 GOLDMAN SACHS 2003 ANNUAL... -

Page 91

... the ï¬rm's clearance and execution and Nasdaq customer lists acquired in the ï¬rm's combination with SLK and ï¬nancial counseling customer lists acquired in the ï¬rm's combination with The Ayco Company, L.P. Includes primarily technology-related assets acquired in the ï¬rm's combination... -

Page 92

...Net deferred tax assets (2) 1,420 Prepaid assets and deposits 376 Total (1) The ï¬rm sponsors various pension plans and certain other postretirement beneï¬t plans, primarily healthcare and life insurance, which cover most employees worldwide. The ï¬rm also provides certain beneï¬ts to former or... -

Page 93

... POSTRETIREMENT U.S. PENSION 2002 NON-U.S. PENSION POSTRETIREMENT (IN MILLIONS) Beneï¬t obligation Balance, beginning of year Business combination Service cost Interest cost Plan amendments Actuarial loss/(gain) Beneï¬ts paid Effect of foreign exchange rates Balance, end of year Fair value of... -

Page 94

...pension expense/(income) and postretirement expense are set forth below: YEAR ENDED NOVEMBER (IN MILLIONS) 2003 2002 2001 U.S. pension Service cost Interest cost Expected return on plan assets Net amortization Total Non-U.S. pension Service...business combination. 92 GOLDMAN SACHS 2003 ANNUAL REPORT -

Page 95

... care are exercised in the execution of the investment program. The plans employ a total return on investment approach, whereby a mix, which is broadly similar to the actual asset allocation as of November 2003, of equity securities, debt securities and other assets is targeted to maximize the long... -

Page 96

... employees subsequent to year end as part of year-end compensation. Total employee stock compensation expense, net of forfeitures, was $711 million, $645 million and $798 million 94 for the years ended November 2003, November 2002 and November 2001, respectively. GOLDMAN SACHS 2003 ANNUAL REPORT -

Page 97

... public offering generally vest as outlined in the applicable stock option agreement and ï¬rst become exercisable on the third anniversary of the grant date. All employee stock option agreements provide that vesting is accelerated in certain circumstances, such as upon The activity related to... -

Page 98

... option, respectively. Fair value was estimated as of the grant date based on a binomial option-pricing model using the following weighted average assumptions: YEAR ENDED NOVEMBER 2003 2002 2001 Risk-free interest rate Expected volatility Dividend yield Expected life 3.4% 35.0 1.0 5 years 3.5% 35... -

Page 99

... and $1.24 billion, respectively. GSI, a registered U.K. broker-dealer, is subject to the capital requirements of the Financial Services Authority, and GSJL, a Tokyo-based broker-dealer, is subject to the capital requirements of the Financial Services Agency. As of November 2003 and November 2002... -

Page 100

... the following from Asset Management and Securities Services to Trading and Principal Investments: • equity commissions and clearing and execution fees; • merchant banking overrides; and • the matched book businesses. The ï¬rm allocates revenues and expenses among the three segments... -

Page 101

... Asset Management and Securities Services Total depreciation and amortization (3) $180 584 117 $881 $140 473 131 $744 $172 577 124 $873 Includes the following expenses that have not been allocated to the ï¬rm's segments: (i) the amortization of employee initial public offering awards of... -

Page 102

...to the highly integrated nature of international ï¬nancial markets, the ï¬rm manages its businesses based on the proï¬tability of the enterprise as a whole. Accordingly, management believes that proï¬tability by geographic region is not necessarily meaningful. The ï¬rm's revenues, expenses and... -

Page 103

...opinion of management, necessary for a fair statement of the results. These adjustments are of a normal recurring nature. 2003 FISCAL QUARTER (IN MILLIONS, EXCEPT PER SHARE DATA) FIRST SECOND THIRD FOURTH Total revenues Interest expense Cost of power generation Revenues, net of interest expense and... -

Page 104

... 92.75 $77.00 77.00 75.05 63.27 As of February 2, 2004, there were approximately 6,038 holders of record of the ï¬rm's common stock. On February 2, 2004, the last reported sales price for the ï¬rm's common stock on the New York Stock Exchange was $99.81 per share. 102 GOLDMAN SACHS 2003 ANNUAL... -

Page 105

...per share 0.74 Book value per share (3) 43.60 Average common shares outstanding Basic 488.4 Diluted 511.9 Selected data (UNAUDITED) Employees United States International Total employees (4) Assets under management (IN Asset class Money markets Fixed income and currency Equity Alternative investments... -

Page 106

... Nora Johnson John F.W. Rogers Eric S. Schwartz Michael S. Sherwood David M. Solomon David A. Viniar John S. Weinberg Peter A. Weinberg Jon Winkelried Gregory K. Palm Esta E. Stecher General Counsels Alan M. Cohen Global Head of Compliance John F.W. Rogers Secretary to the Board Managing Directors... -

Page 107

... John F.W. Rogers Michael D. Ryan J. Michael Sanders Victor R. Simone, Jr. Dinakar Singh* Michael M. Smith Jonathan S. Sobel Judah C. Sommer Mark J. Tracey Michael A. Troy Barry S. Turkanis Kaysie P. Uniacke Hugo H. Van Vredenburch Haruko Watanuki Todd A. Williams Zi Wang Xu Paolo Zannoni Yoel Zaoui... -

Page 108

... Joseph Longo Peter B. MacDonald Mark G. Machin John V. Mallory Blake W. Mather John J. McCabe Lynn M. McCormick James A. McNamara Robert A. McTamaney Sharon I. Meers Michael A. Mendelson Luciana D. Miranda Douglas D. Mofï¬tt R. Scott Morris *Partnership Committee Members 106 GOLDMAN SACHS 2003... -

Page 109

...Peter Labbat Eric S. Lane Gary R. Lapidus ...John E. Waldron Robert P. Wall Steven A. Wallace Michael W. Warren Christopher S. Wendel Richard T. Wertz David D. Wildermuth Kevin L. Willens Jon A. Woodruff William M. Wicker Steven D. Pruett *Partnership Committee Members GOLDMAN SACHS 2003 ANNUAL REPORT... -

Page 110

... R. Garcia Hywel D. George Justin G. Gmelich Eldridge F. Gray Michael J. Grimaldi Benoit Herault Axel Hoerger Simon N. Holden Shin Horie Adrian ... Edward J. Guay Kevin J. Guidotti Vishal Gupta Vladimir M. Gutin Elizabeth M. Hammack Taizo Hasebe Kuniyoshi Hayashi 108 GOLDMAN SACHS 2003 ANNUAL REPORT -

Page 111

... H. Linden Cody J Smith Mary C. Henry Peter T. Cirenza Shirley Fung Andrew J. Melnick Robert K. Steel Chairman of the securities businesses Peter D. Sutherland S.C. Chairman of Goldman Sachs International John L. Thornton Senior Advisor Senior Directors John C. Whitehead H. Frederick Krimendahl... -

Page 112

... Hong Kong Houston Johannesburg London Los Angeles Madrid Melbourne* Mexico City Miami Milan Montreal Moscow New York Paris Philadelphia Princeton Salt Lake City San Francisco São Paulo Seattle Seoul Shanghai Singapore Stockholm Sydney* Taipei Tampa Tokyo Toronto Washington, D.C. Zurich *Goldman... -

Page 113

... be fair competitors and must never denigrate other ï¬rms. 14. Integrity and honesty are at the heart of our business. We expect our people to maintain high ethical standards in everything they do, both in their work for the ï¬rm and in their personal lives. GOLDMAN SACHS 2003 ANNUAL REPORT 111 -

Page 114

... of The Goldman Sachs Group, Inc. regarding lost or stolen stock certiï¬cates, dividends, changes of address and other issues related to registered share ownership should be addressed to: Mellon Investor Services LLC Overpeck Centre 85 Challenger Road Ridgeï¬eld Park, New Jersey 07660 1-800... -

Page 115

... may refer to The Goldman Sachs Group, Inc. and/or its subsidiaries and affiliates worldwide, or to one or more of them, depending on the context in each instance. Except where otherwise noted, all marks indicated by ®, ™, or SM are trademarks or service marks of Goldman, Sachs & Co. 4350-03-102 -

Page 116

www.gs.com