Foot Locker 2010 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2010 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

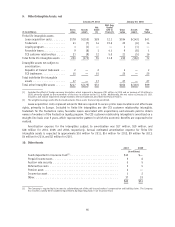

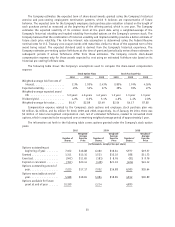

The following table provides a summary of recognized assets that are measured at fair value on a

non-recurring basis:

(in millions) Level 1 Level 2 Level 3 Loss

Recognized

Year ended January 29, 2011:

Intangible assets ......................... $— $— $15 $10

Year ended January 30, 2010:

Long-lived assets held and used ............... $— $— $71 $36

See Note 3, Impairment and Other Charges, for further discussion and additional disclosures.

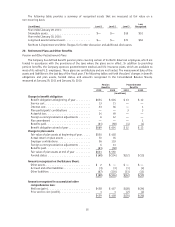

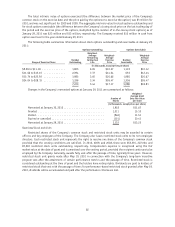

20. Retirement Plans and Other Benefits

Pension and Other Postretirement Plans

The Company has defined benefit pension plans covering certain of its North American employees, which are

funded in accordance with the provisions of the laws where the plans are in effect. In addition to providing

pension benefits, the Company sponsors postretirement medical and life insurance plans, which are available to

most of its retired U.S. employees. These plans are contributory and are not funded. The measurement date of the

assets and liabilities is the last day of the fiscal year. The following tables set forth the plans’ changes in benefit

obligations and plan assets, funded status, and amounts recognized in the Consolidated Balance Sheets,

measured at January 29, 2011 and January 30, 2010:

Pension

Benefits Postretirement

Benefits

2010 2009 2010 2009

(in millions)

Change in benefit obligation

Benefit obligation at beginning of year......... $654 $604 $13 $12

Service cost........................... 13 11 — —

Interest cost .......................... 33 36 — 1

Plan participants’ contributions ............. — — 3 3

Actuarial loss.......................... 24 49 — —

Foreign currency translation adjustments ....... 6 12 — —

Plan amendment ....................... — — — 1

Benefits paid .......................... (61) (58) (4) (4)

Benefit obligation at end of year ............. $669 $654 $12 $13

Change in plan assets

Fair value of plan assets at beginning of year ..... $550 $418

Actual return on plan assets ................ 70 76

Employer contributions ................... 36 103

Foreign currency translation adjustments ....... 6 11

Benefits paid .......................... (61) (58)

Fair value of plan assets at end of year ......... $601 $550

Funded status ......................... $(68) $(104) $(12) $(13)

Amounts recognized on the Balance Sheet:

Other assets........................... $ 2 $ — $— $—

Accrued and other liabilities................ (3) (3) (1) (2)

Other liabilities ........................ (67) (101) (11) (11)

$(68) $(104) $(12) $(13)

Amounts recognized in accumulated other

comprehensive loss:

Net loss (gain) ......................... $438 $ 457 $(28) $(34)

Prior service cost (credit).................. 1 1 (2) (2)

$439 $ 458 $(30) $(36)

55