Foot Locker 2010 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2010 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

At January 29, 2011, the Company has foreign tax credit carryforwards totaling $9 million that expire

between 2018 and 2019. The Company also has state operating loss carryforwards with a potential tax benefit of

$16 million that expire between 2011 and 2030. The Company will have, when realized, a capital loss with a

potential benefit of $3 million arising from a note receivable. This loss will carryforward for 5 years after

realization. The Company has U.S. state and Canadian provincial credit carryforwards that total $2 million,

expiring between 2011 and 2020. The Company has international operating loss carryforwards with a potential

tax benefit of $1 million, expiring between 2011 and 2030.

The Company had $70 million of gross unrecognized tax benefits and $68 million of net unrecognized tax

benefits, as of the beginning of the year. The Company has classified certain income tax liabilities as current or

noncurrent based on management’s estimate of when these liabilities will be settled. Interest expense and

penalties related to unrecognized tax benefits are classified as income tax expense. The Company recognized

$1 million of interest expense in each of 2010, 2009, and 2008. The total amount of accrued interest and

penalties was $3 million in 2010 and $5 million in 2009.

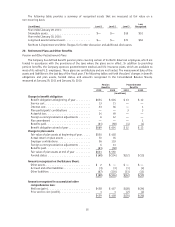

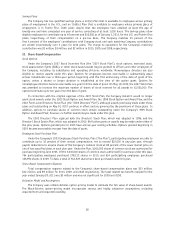

The following table summarizes the activity related to unrecognized tax benefits:

(in millions)

Balance as of January 30, 2010 ........................................ $70

Foreign currency translation adjustments ................................. 3

Increases related to current year tax positions.............................. 4

Increases related to prior period tax positions .............................. 3

Decreases related to prior period tax positions.............................. (7)

Settlements .................................................... (9)

Lapse of statute of limitations ........................................ (2)

Balance as of January 29, 2011 ........................................ $62

Of the unrecognized tax benefits, $61 million would, if recognized, affect the Company’s annual effective tax

rate. It is reasonably possible that the liability associated with the Company’s unrecognized tax benefits will

increase or decrease within the next twelve months. These changes may be the result of foreign currency

fluctuations, ongoing audits or the expiration of statutes of limitations. Settlements could increase earnings in

an amount ranging from $0 to $5 million based on current estimates. Audit outcomes and the timing of audit

settlements are subject to significant uncertainty. Although management believes that adequate provision has

been made for such issues, the ultimate resolution of these issues could have an adverse effect on the earnings of

the Company. Conversely, if these issues are resolved favorably in the future, the related provision would be

reduced, generating a positive effect on earnings. Due to the uncertainty of amounts and in accordance with its

accounting policies, the Company has not recorded any potential impact of these settlements.

18. Financial Instruments and Risk Management

The Company operates internationally and utilizes certain derivative financial instruments to mitigate its

foreign currency exposures, primarily related to third party and intercompany forecasted transactions. As a result

of the use of derivative instruments, the Company is exposed to the risk that counterparties will fail to meet their

contractual obligations. To mitigate the counterparty credit risk, the Company has a policy of entering into

contracts only with major financial institutions selected based upon their credit ratings and other financial

factors. The Company monitors the creditworthiness of counterparties throughout the duration of the derivative

instrument. Additional information is contained within Note 19, Fair Value Measurements.

51