Foot Locker 2010 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2010 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

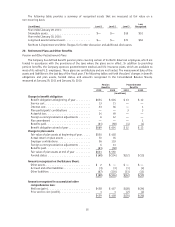

14. Leases

The Company is obligated under operating leases for almost all of its store properties. Some of the store

leases contain renewal options with varying terms and conditions. Management expects that in the normal

course of business, expiring leases will generally be renewed or, upon making a decision to relocate, replaced by

leases on other premises. Operating lease periods generally range from 5 to 10 years. Certain leases provide for

additional rent payments based on a percentage of store sales. Most of the Company’s leases require the payment

of certain executory costs such as insurance, maintenance, and other costs in addition to the future minimum

lease payments. These costs, including the amortization of lease rights, totaled $131 million, $138 million, and

$147 million in 2010, 2009, and 2008, respectively. Included in the amounts below, are non-store expenses that

totaled $15 million in 2010, 2009, and 2008.

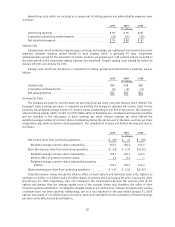

2010 2009 2008

(in millions)

Minimum rent ................................... $507 $514 $527

Contingent rent based on sales........................ 16 14 14

Sublease income ................................. (1) (2) (2)

$522 $526 $539

Future minimum lease payments under non-cancelable operating leases, net of future non-cancelable

operating sublease payments, are:

(in millions)

2011....................................................... $ 481

2012....................................................... 425

2013....................................................... 356

2014....................................................... 303

2015....................................................... 257

Thereafter ................................................... 596

Total operating lease commitments ................................... $2,418

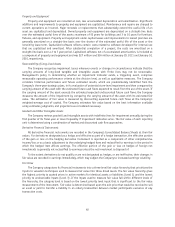

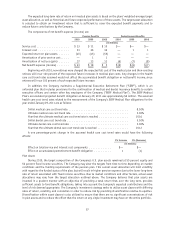

15. Other Liabilities

2010 2009

(in millions)

Straight-line rent liability ................................... $100 $101

Pension benefits ......................................... 67 101

Income taxes ........................................... 28 29

Workers’ compensation and general liability reserves ................. 11 12

Postretirement benefits .................................... 11 11

Reserve for discontinued operations ............................ 8 8

Fair value of derivatives .................................... — 24

Other................................................. 20 11

$245 $297

16. Discontinued Operations

In 1997, the Company exited its Domestic General Merchandise segment. In 1998, the Company exited both

its International General Merchandise and Specialty Footwear segments. In 2001, the Company discontinued its

Northern Group segment. The remaining reserve balances at January 29, 2011 primarily represent lease

obligations, of which $1 million is expected to be utilized within twelve months and the remaining $8 million

thereafter. The balance at January 30, 2010 totaled $10 million, of which $2 million was classified as current and

$8 million was classified as non current. The majority of the reserve balance relates to the Domestic General

Merchandise segment as the leases extend many years.

48