Foot Locker 2010 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2010 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

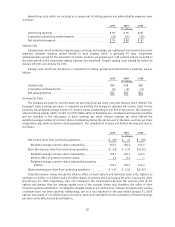

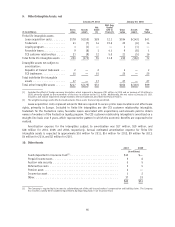

Depreciation and

Amortization Capital Expenditures Total Assets

2010 2009 2008 2010 2009 2008 2010 2009 2008

(in millions)

Athletic Stores..... $ 85 $ 90 $111 $72 $70 $122 $1,983 $1,873 $1,879

Direct-to-Customers . 9 9 6 4 5 6 290 291 297

94 99 117 76 75 128 2,273 2,164 2,176

Corporate ........ 12 13 13 21 14 18 623 652 701

Total Company..... $106 $112 $130 $97 $89 $146 $2,896 $2,816 $2,877

Sales and long-lived asset information by geographic area as of and for the fiscal years ended January 29,

2011, January 30, 2010, and January 31, 2009 are presented below. Sales are attributed to the country in which

the sales originate, which is where the legal subsidiary is domiciled. Long-lived assets reflect property and

equipment. The Company’s sales in Italy, Canada, and France represent approximately 24, 19, and 14 percent,

respectively, of the International category’s sales for the period ended January 29, 2011. No other individual

country included in the International category is significant.

2010 2009 2008

(in millions)

Sales

United States .......................................... $3,568 $3,425 $3,768

International .......................................... 1,481 1,429 1,469

Total sales ............................................ $5,049 $4,854 $5,237

2010 2009 2008

(in millions)

Long-Lived Assets

United States .......................................... $257 $266 $311

International .......................................... 129 121 121

Total long-lived assets .................................... $386 $387 $432

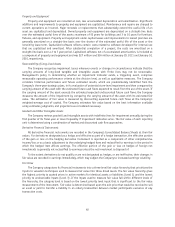

3. Impairment and Other Charges

2010 2009 2008

(in millions)

Impairment of goodwill and other intangible assets................. $10 $— $169

Impairment of assets ..................................... — 36 67

Reorganization costs ..................................... — 5 —

Store closing program .................................... — — 5

Money market impairment.................................. — — 3

Northern Group note impairment ............................. — — 15

Total impairment and other charges ........................... $10 $41 $259

Impairment of Goodwill and Other Intangible Assets

The 2010 and 2009 annual goodwill impairment tests did not result in an impairment charge as the fair

value of each reporting unit exceeded the carrying values of each respective reporting unit.

Intangible assets that are determined to have finite lives are amortized over their useful lives and are

measured for impairment only when events or circumstances indicate that the carrying value may be impaired.

Intangible assets with indefinite lives are tested for impairment if impairment indicators arise and, at a minimum,

annually. During the fourth quarter of 2010, the Company determined that a triggering event had occurred

related to its CCS intangible assets, which is part of the Direct-to-Customers segment, reflecting decreases in

projected revenues. Accordingly, a charge of $10 million was recorded to write-down the CCS tradename. The fair

value was determined using an income approach using the relief-from-royalty method.

43