Food Lion 2006 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2006 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

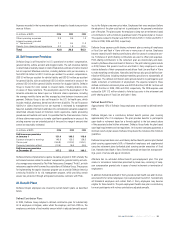

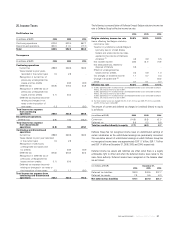

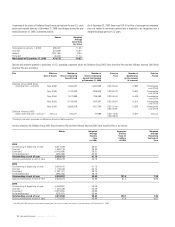

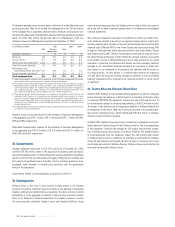

Restricted stock unit awards granted to associates of U.S. operating companies

under the Delhaize America 2002 Restricted Stock Unit Plan are as follows:

Effective Number of Number of Number of

Date of Grants Shares Underlying Shares Underlying Beneficiaries

Award Issued Awards Outstanding (at the moment

at December 31, 2006 of issuance)

May 2006 155,305 152,108 217

May 2005 145,868 132,524 204

May 2004 179,567 112,910 193

May 2003 249,247 98,501 185

May 2002 120,906 17,598 140

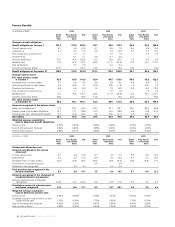

Activity related to the restricted stock plans is as follows:

Shares

2004

Outstanding at beginning of year 388,562

Granted 179,567

Released from restriction (63,230)

Forfeited/expired (3,827)

Outstanding at end of year 501,072

2005

Outstanding at beginning of year 501,072

Granted 145,868

Released from restriction (137,570)

Forfeited/expired (13,478)

Outstanding at end of year 495,892

2006

Outstanding at beginning of year 495,892

Granted 155,305

Released from restriction (126,004)

Forfeited/expired (9,872)

Outstanding at end of year 515,321

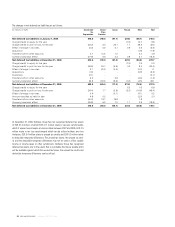

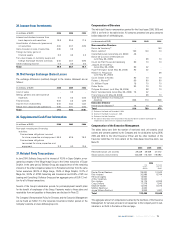

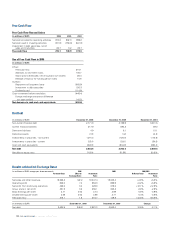

The weighted average fair value at date of grant for restricted stock unit awards

granted during 2006, 2005 and 2004 was USD 63.04, USD 60.76 and USD 46.40

based on the share price at the grant date, respectively.

The weighted average share price at the date of exercise was USD 73.78,

USD 64.26 and USD 55.99 at 2006, 2005 and 2004, respectively. The total intrin-

sic value of option exercices during the years ended 2006, 2005 and 2004, was

USD 60.0 million, USD 29.5 million and USD 30.5 million, respectively.

The weighted average fair value of options granted was USD 14.36, USD 18.28

and USD 15.33 per option for 2006, 2005 and 2004, respectively. The fair value

of options at date of grant was estimated using the Black-Scholes-Merton model

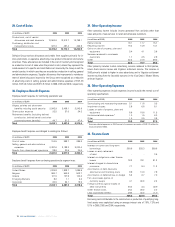

with the following weighted average assumptions:

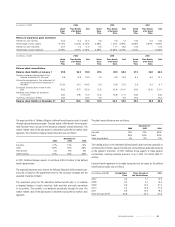

2006 2005 2004

Expected dividend yield (%) 2.5 2.3 2.6

Expected volatility (%) 27.2 39.7 41.0

Risk-free interest rate (%) 5.0 3.7 3.9

Expected term (years) 4.0 4.1 4.7

Expected volatility was determined by calculating the historical volatility of the

Group’s share price over the expected option term. Expected volatility in 2006

excludes a period of abnormal volatility that is not representative of future

expected stock price behaviour and is not expected to recur during the expected

contractual term of the options. The expected term of options is based on histori-

cal ten-year option activity.

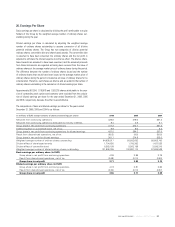

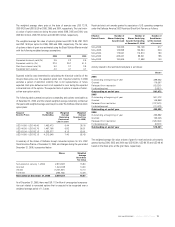

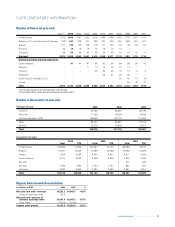

The following table summarizes options outstanding and options exercisable as

of December 31, 2006, and the related weighted average remaining contractual

life (years) and weighted average exercise price under the Delhaize America stock

option plans:

Range of Number Weighted Weighted

Exercise Prices Outstanding Average Average

Remaining Exercise Price

Contractual (in USD)

Life (in years)

USD 16.80 - USD 46.40 1,493,473 6.44 38.76

USD 46.56 - USD 60.76 1,497,798 6.83 56.21

USD 63.04 - USD 83.12 1,322,277 9.12 63.61

USD 16.80 - USD 83.12 4,313,548 7.40 52.43

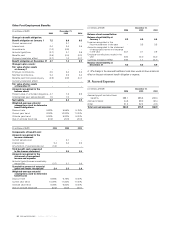

A summary of the status of Delhaize Group’s nonvested options for U.S. 2002

Stock Incentive Plan as of December 31, 2006, and changes during the year ended

December 31, 2006, is presented below.

Shares Weighted

Average

Grant-Date

Fair Value

Nonvested at January 1, 2006 2,815,587 15.80

Granted 1,324,338 14.36

Vested (1,247,461) 13.10

Forfeited (295,163) 13.05

Nonvested at December 31, 2006 2,597,301 16.67

As of December 31, 2006, there was EUR 11.8 million of unrecognized compensa-

tion cost related to nonvested options that is expected to be recognized over a

weighted average period of 1.2 years.

/ ANNUAL REPORT 2006 93