Food Lion 2006 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2006 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DELHAIZE GROUP / ANNUAL REPORT 2006 41

On December 31, 2006, Delhaize Group had fi nance lease

obligations outstanding of EUR 636.5 million compared with

EUR 689.3 million at the end of 2005. The average interest

rate on fi nancial lease obligations was 11.7%.

At the end of 2006, Delhaize Group’s net debt amounted to

EUR 2.6 billion, a decrease of EUR 308.4 million or -10.5%

mainly due to the weakening of the U.S. dollar between

the two balance sheet dates (currency translation effect

of EUR 242.6 million) and the continued generation of free

cash fl ow. The net debt to equity ratio continued to improve,

decreasing from 81.8% at the end of 2005 to 74.0% at the end

of 2006.

At the end of 2006, Delhaize Group had total annual minimum

operating lease commitments for 2007 of approximately

EUR 227.9 million, including approximately EUR 21.0 million

related to closed stores.. These leases generally have terms

that range between three and 27 years with renewal options

ranging within similar ranges.

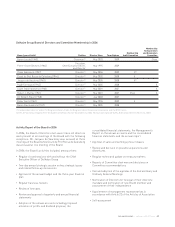

RECONCILIATION

FROM IFRS TO US GAAP

Delhaize Group prepares its fi nancial statements under

IFRS and also prepares a reconciliation of its net income

and shareholders’ equity to US GAAP in accordance with its

obligations as a foreign company listed on the New York Stock

Exchange (see p. 103).

Under US GAAP, Delhaize Group’s 2006 net income was

EUR 374.9 million (EUR 363.7 million in 2005) compared

to EUR 351.9 million under IFRS. The most signifi cant

reconciling items affecting net income were related to goodwill

adjustments, accounting differences for the convertible bond,

share-based compensation, closed store provisions, defi ned

benefi t plans, impairment charges and disposal of a foreign

operation.

At the end of 2006, Delhaize Group shareholders’ equity under

US GAAP was EUR 3.6 billion (EUR 3.7 billion at the end of

2005) compared to EUR 3.5 billion under IFRS.

RECENT EVENTS

In March 2007, Delhaize Group reached a binding agreement

to sell Di, its Belgian beauty and body care business, to Parma

Gestion, a subsidiary of Distripar, which is owned by CNP/

NPM. The agreement foresees the sale of the operations of

Di for consideration, subject to contractual adjustments, of

EUR 33.4 million in cash, which will produce a small gain.

The impact of the divestiture on the ongoing profi tability

of Delhaize Belgium will be minor. In 2006, the Di network

consisted of 90 company-operated and 42 franchised stores,

which contributed EUR 95.5 million to Delhaize Group’s net

sales and other revenues.

In March 2007, Delhaize Group announced it is planning to

implement cross-guarantees between Delhaize Group SA and

Delhaize America. The cross-guarantees of the companies’

fi nancial debt obligations will support the continued integration

of Delhaize group and increase its fi nancial fl exibility. The

implementation of cross-guarantees must not negatively

impact the credit ratings and outlook of Delhaize America and

is conditional on obtaining a credit rating for Delhaize Group

SA from Moody’s and Standard & Poor’s at least as strong

as the current credit rating and outlook of Delhaize America.

Delhaize America currently has the only credit rating within

Delhaize Group.

RISK FACTORS

The following discussion refl ects business risks that are

evaluated by our management and our Board of Directors.

This section should be read carefully in relation to our

prospects and the forward-looking statements contained

in this annual report. Any of the following risks could have

a material adverse effect on our fi nancial condition, results

of operations or liquidity and lead to impairment losses on

goodwill, intangible assets and other assets. There may be

additional risks of which the Group is unaware. There may

also be risks Delhaize Group now believes to be immaterial,

but which could turn out to have a material adverse effect.

NET DEBT

(IN BILLIONS OF EUR)

3.0 2.6 2.9 2.6

2006

2005

2004

2003

NET DEBT TO EQUITY

108% 91% 82% 74%

2006

2005

2004

2003