Food Lion 2002 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2002 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

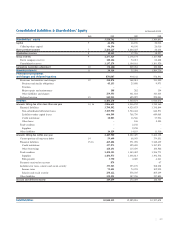

|49

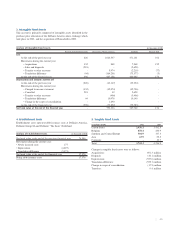

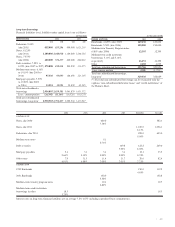

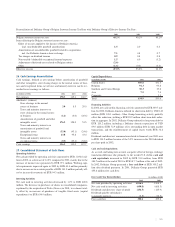

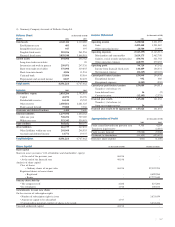

Long-term Borrowings

Financial liabilities (excl. liabilities under capital leases) are as follows:

(in thousands)

United States 2002 2001

USD EUR USD EUR

Debenture, 9.00%

(due 2031) 855,000 815,296 900,000 1,021,219

Notes, 8.125%

(due 2011) 1,100,000 1,048,918 1,100,000 1,248,156

Notes, 7.375%

(due 2006) 600,000 572,137 600,000 680,812

Debt securities, 7.55% to

8.05% (due 2007 to 2027) 270,808 258,232 293,539 333,075

Medium-term notes, 6.16%

to 14.15% (due 2003 to

2016) 97,536 93,007 108,492 123,105

Mortgages payable, 7.50%

to 10.20% (due 2003

to 2016) 33,551 31,993 39,839 42,205

Total non-subordinates

borrowings 2,956,895 2,819,583 3,041,870 3,451,572

Less : current portion (26,392) (25,166) (16,326) (18,525)

Total non-subordinated

borrowings, long-term*2,930,503 2,794,417 3,025,544 3,433,047

(in thousands of EUR)

Europe and Asia 2002 2001

Eurobonds, 4.625% (due 2009) 149,138 149,002

Eurobonds, 5.50% (due 2006) 150,000 150,000

Medium-term Treasury Program notes,

6.80% (due 2006) 12,395 12,395

Medium-term credit institution

borrowings, 3.11% and 5.14%,

respectively 16,151 14,392

Other 2,102 4,035

Total non-subordinated borrowings 329,786 329,824

Less: current portion (250) (1,735 )

Total non-subordinated borrowings,

long-term*329,536 328,089

(*) The total non-subordinated borrowings can be reconciled with the

captions “non-subordinated debenture loans” and “credit institutions” of

the Balance Sheet.

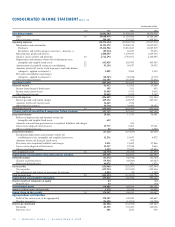

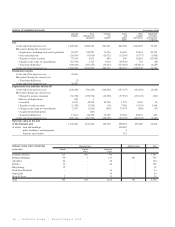

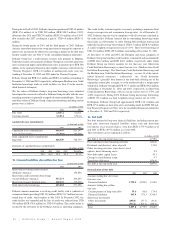

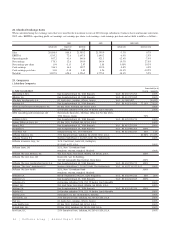

2004 2005 2006 2007 Thereafter Fair value

in millions of USD

Notes, due 2006 600.0 582.1

7.38%

Notes, due 2011 1,100.0 1,056.1

8.13%

Debentures, due 2031 855.0 693.0

9.00%

Medium term notes 5.1

8.71%

Debt securities 149.8 122.2 249.0

7.55% 8.05%

Mortgage payables 5.4 3.1 3.4 3.4 12.1 33.5

9.64% 9.10% 9.09% 9.00% 8.74%

Other notes 7.9 11.3 11.4 11.7 29.6 82.4

6.91% 6.99% 7.00% 7.01% 7.21%

in millions of EUR

1999 Eurobonds 150.0 112.5

4.63%

2001 Eurobonds 150.0 132.8

5.50%

Medium-term treasury program notes 12.4 12.7

6.80%

Medium-term credit institution

borrowings & other 18.3 18.3

3.25%

Interest rates on long-term financial liabilities are on average 7.8% (8.5% including capitalized lease commitments).