Food Lion 2002 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2002 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

40 |Delhaize Group |Annual Report 2002

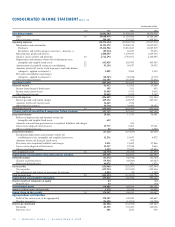

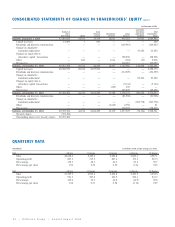

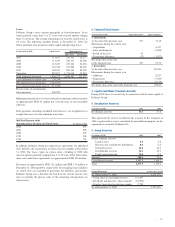

CONSOLIDATED INCOME STATEMENT (note 1, 18)

(in thousands of EUR)

Note 2002 2001 2000

Operating income 21,082,584 21,920,023 18,576,729

Sales 19 20,688,436 21,395,945 18,168,166

Other operating income 394,148 524,078 408,563

Operating expenses (20,275,394) (20,998,720) (17,837,216)

Merchandise and consumables 15,323,270 15,968,370 13,695,993

Purchases 15,412,504 15,881,843 13,605,519

Inventories and work in progress (increase –, decrease +) (89,234) 86,527 90,474

Miscellaneous goods and services 1,408,495 1,439,853 1,239,784

Salaries, social security and pensions 20 2,712,294 2,783,011 2,328,085

Depreciation and amounts written off establishment costs,

intangible and tangible fixed assets 22 632,828 629,436 465,563

Amortization of goodwill arising on consolidation 22 92,154 89,957 39,932

Amounts written off stocks, work in progress and trade debtors

(charged +, applied or released –) 3,809 2,264 3,330

Provisions for liabilities and charges

(charged +, applied or released –) (18,563) (30,226) (6,715)

Other operating expenses 121,107 116,055 71,244

Operating profit 807,190 921,303 739,513

Financial income 41,422 15,242 15,060

Income from financial fixed assets 105 161 655

Income from current assets 25,699 9,743 9,063

Other financial income 15,618 5,338 5,342

Financial expenses (496,487) (479,504) (311,284)

Interest payable and similar charges 429,132 445,295 282,132

Amounts written off current assets 12,645 1,514 -

Other financial expenses 54,710 32,695 29,152

Net financial result 23 (455,065) (464,262) (296,224)

Current profit of consolidated companies before taxation 352,125 457,041 443,289

Exceptional income 14,391 11,379 38,961

Release of depreciation and amounts written off

intangible and tangible fixed assets 632 --

Amounts released from provisions for exceptional liabilities and charges -343 -

Gains on the disposal of fixed assets 13,737 8,401 37,961

Other exceptional income 22 2,635 1,000

Exceptional expenses (27,121) (107,829) (80,260)

Exceptional depreciation and amounts written off

establishment costs, intangible and tangible fixed assets 11,531 15,947 6,872

Amounts written off financial fixed assets -475 -

Provisions for exceptional liabilities and charges 2,831 21,402 27,866

Losses on the disposal of fixed assets 11,437 12,558 2,636

Other exceptional expenses 1,322 57,447 42,886

Net exceptional result 24 (12,730) (96,450) (41,299)

Profit of the consolidated companies before taxation 339,395 360,591 401,990

Deferred taxation (33,472) (68,436) (41,784)

Transfer to deferred taxes (79,551) (69,029) (43,607)

Release of deferred taxes 46,079 593 1,823

Tax on profits (126,081) (123,397) (103,944)

Tax on profits (127,935) (123,452) (105,046)

Tax adjustments and release of provisions for taxation 1,854 55 1,102

Total income taxes 25 (159,553) (191,833) (145,728)

Profit of the consolidated companies 179,842 168,758 256,262

Share in results of companies at equity 43 -(80)

Profit/(Loss) 43 -(80)

Consolidated profit 179,885 168,758 256,182

Interest of third parties in the results 1,578 19,338 95,495

Group share in the results 26 178,307 149,420 160,687

Appropriations and transfers

Profit of the current year to be appropriated 178,307 149,420 160,687

Transfer to reserves (96,401) (14,891) (34,700)

Profit to be distributed (81,906) (134,529) (125,987)

Dividends 81,305 133,423 125,038

Directors’ fees 601 1,106 949