Eversource 2002 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2002 Eversource annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

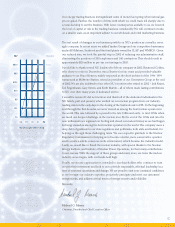

S&P

BBB+

BBB

BBB-

BB+

BB

BB-

B+

Moody’s

Baa1

Baa2

Baa3

Ba1

Ba2

Ba3

B1

98 99 00 01 02

NU Unsecured Debt Rating

Our energy trading business lost significant sums of money last spring when natural gas

prices spiked. Further, the number of firms with which we could trade fell sharply due to

several deciding to exit the business. With fewer counterparties available to us, we lowered

the level of capital at risk in the trading business considerably. We will continue to trade,

on a smaller scale, as an important adjunct to our wholesale and retail marketing business.

The net result of changes in our business portfolio is NU’s position as a smaller, more

agile company. In recent years we added Yankee Energy and our competitive businesses,

and sold Millstone, Seabrook and the fossil plants owned by CL&P and WMECO. Given

our reduced size, we took the painful step in 2002 of reducing our administrative staff,

eliminating the positions of 200 employees and 100 contractors. This should result in

approximately $20 million in pre-tax cost savings in 2003.

I would like to thank several NU leaders who left our company in 2002. Raymond Golden,

who chose to retire in December, was a Trustee for four years and provided valuable

guidance to us. Bruce Kenyon, widely respected as the chief architect of the 1996-1999

turnaround at Millstone Station, retired as president of our Generation Group at the end

of 2002. We are also indebted to four other NU executives who retired in 2002 – Jack Keane,

Ted Feigenbaum, Gary Simon, and Keith Marvin – all of whom made lasting contributions

to NU over their many years of dedicated service.

I would be remiss if I did not mention and thank all of the dedicated individuals in the

NU family, past and present, who worked on our nuclear program from our industry-

leading vision in the early days to the closing of the Seabrook sale to FPL. In the beginning

and through the first decades, we were viewed as among the best nuclear operators in

the world. This was followed by a period in the late 1980s and early- to mid-1990s when

we faced our deepest challenge in the nuclear area. By the end of the 1990s and into the

new millennium we regained our footing and closed our nuclear history as we had begun

by being viewed as among the best nuclear operators in the world. The company owes a

deep debt of gratitude to our state regulators and politicians, both state and federal, for

helping us through these challenging times. We owe a specific gratitude to the Nuclear

Regulatory Commission for helping us to become a better, more conservative operator

and to create a safety-conscious work environment, which became the industry model.

Lastly, we would like to thank the nuclear industry, with special thanks to the Nuclear

Energy Institute, and Institute of Nuclear Power Operations, for their many contributions

to our success. With the support of these groups and many more, we leave the nuclear

industry as we began, with our heads held high.

Finally, my sincere appreciation is extended to our shareholders who continue to trust

us with their investment and look to us to provide responsible, effectual leadership in a

time of economic uncertainty and change. We are proud to earn your continued confidence

as we leverage our industry expertise, proactively anticipate and meet our customers’

energy needs, and address critical issues of energy security and reliability.

Sincerely,

Michael G. Morris

Chairman, President and Chief Executive Officer

7