Duke Energy 2008 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2008 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4 Duke Energy

in the real estate market also continued to impact Crescent

Resources. As a result, we fell short of achieving our 2008

employee incentive target of $1.27 of adjusted diluted earnings

per share (EPS).

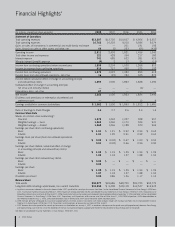

But importantly, with the combined 2008 adjusted segment

earnings before interest and taxes (EBIT) of U.S. Franchised

Electric and Gas, Commercial Power and International Energy,

and our employees’ efforts to control costs, we achieved a

total 2008 adjusted diluted EPS of $1.21.

Last year, our employees delivered on our most important

metric of all. It was our best year ever for employee safety. Our

Total Incident Case Rate, a common industry standard used to

measure safety performance, dropped to 1.15, an 8 percent

improvement over 2007. All major operational groups hit

their safety targets. Even more importantly, we had no

work-related fatalities last year, and serious injuries were down.

Our employees also delivered an excellent year from an

operations standpoint. They responded heroically in September

when the remnants of Hurricane Ike tore through our Midwest

service territory. With about 1.1 million of our 1.6 million

customers impacted, this was easily the largest storm-related

incident in our history for this region. Despite the widespread

damage to our system, we were able to safely restore service to

every customer within eight days.

Last year, our stock performance was down but we still outper-

formed the overall markets. Duke Energy’s 2008 total share-

holder return was –21.7 percent, compared to –37.0 percent

for the S&P 500 and –27.2 percent for the Philadelphia Utility

Index. While there is some consolation in out-performing the

market in 2008, our goal remains to deliver sustainable growth

over the long term.

No one knows just how long this recession will last or how

severe it will be. With double-digit national unemployment

forecast for 2009, there is a lot of belt tightening going on

in homes and businesses throughout the country. At Duke

Energy, we will continue to take the necessary steps to

maintain our strong balance sheet.

Maintaining Our Liquidity and Cash Positions

Efficient capital attraction and deployment is our lifeblood —

it is the key to our future earnings growth. Electric utilities are

one of the most capital-intensive of all U.S. industries. During

the unprecedented tightening of the credit markets in 2008,

we continued to access capital markets.

From Jan. 1, 2008, through Jan. 31, 2009, we issued about

$4.5 billion of fixed-rate debt at a weighted average rate of

6.05 percent, with an average maturity of 15.2 years. To put

this in context, it should be compared with the weighted

average cost of our total long-term debt at year-end. The 2008

year-end cost of our total portfolio was 5.65 percent with an

average maturity of 12.7 years. We also continue to maintain

investment-grade credit ratings.

We will continue to allocate cash to our growth projects as

well as to maintain and grow our dividend. We are proud that

2008 was the 82nd consecutive year that Duke Energy paid

a quarterly cash dividend on its common stock. Last year, the

Board of Directors increased the quarterly dividend payment

from 22 cents to 23 cents per share.

Investing in the Future

We have the potential to invest nearly $25 billion over the next

five years to modernize our regulated operations and to grow

our commercial businesses. About $7 billion is committed

capital, including the dollars allocated for completing our two

new advanced coal-fired plants. Roughly $13 billion is for

ongoing capital spending, such as maintenance, which has

some flexibility as to when it is spent. The remaining $5 billion

of our potential investment is discretionary growth capital. We

won’t invest these discretionary dollars unless 1) we secure

constructive regulatory treatment for projects in our regulated

businesses, or 2) our return expectations are met for projects

in our commercial businesses.

We believe we can grow earnings through more creative legisla-

tive and regulatory frameworks — such as save-a-watt approval

and cash recovery of construction work in progress. This will

allow us to recover financing, construction and energy effi-

ciency costs on a timely basis to earn fair and competitive

returns on capital over time. As a result, we remain committed

to growing adjusted diluted earnings per share at a compound

annual growth rate of 5 to 7 percent through 2013, assuming

a rebound in the economy.

An Evolving Mission

Today, the electric utility industry is at a crossroads. Energy

policies over the 20th century promoted investment in large

generating plants fueled by low-cost fossil fuels, primarily coal

and natural gas. They also fostered the development of nuclear

power. The success of this effort was essential to the United

States’ emergence as a world economic superpower.

With the mission of providing universal access to electricity

accomplished, we face new challenges. Our mission for this

century is to redefine our boundaries — to go beyond the

meter, creating new customer partnerships and providing

universal access to clean and efficient energy.

To accomplish this mission we are:

1. Promoting investment in customer programs to accelerate

the contribution of energy efficiency to meet future demand

2. Building a new fleet of efficient power plants using diverse

fuels to meet growing demand and to increase our reliability,

while retiring older higher-emitting plants to significantly

decrease our environmental impact, and

3. Pushing for the approval of legislative and regulatory policies

that will ease the transition to an industry with significantly

fewer greenhouse gas emissions.