Dillard's 2015 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2015 Dillard's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

14

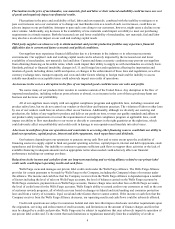

ITEM 6. SELECTED FINANCIAL DATA.

The selected financial data set forth below should be read in conjunction with our "Management's Discussion and

Analysis of Financial Condition and Results of Operations", our consolidated audited financial statements and notes thereto and

the other information contained elsewhere in this report.

(Dollars in thousands, except per share data) 2015 2014 2013 2012* 2011

Net sales . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 6,595,626 $ 6,621,054 $ 6,531,647 $ 6,593,169 $ 6,263,600

Percent change . . . . . . . . . . . . . . . . . . . . . . . — % 1% (1)% 5% 2%

Cost of sales . . . . . . . . . . . . . . . . . . . . . . . . . . 4,350,805 4,272,605 4,223,715 4,247,108 4,047,269

Percent of sales. . . . . . . . . . . . . . . . . . . . . . . 66.0 % 64.5% 64.7 % 64.4% 64.6%

Interest and debt expense, net. . . . . . . . . . . . . 60,923 61,306 64,505 69,596 72,059

Income before income taxes and income on

and equity in losses of joint ventures . . . . . . 408,784 510,768 496,224 479,750 396,669

Income taxes (benefit) . . . . . . . . . . . . . . . . . . 140,770 179,480 173,400 145,060 (62,518)

Income on and equity in losses of joint

ventures. . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,356 565 847 1,272 4,722

Net income . . . . . . . . . . . . . . . . . . . . . . . . . . . 269,370 331,853 323,671 335,962 463,909

Net income per diluted common share . . . . . . 6.91 7.79 7.10 6.87 8.52

Dividends per common share . . . . . . . . . . . . . 0.26 0.24 0.22 5.20 0.19

Book value per common share . . . . . . . . . . . . 49.98 49.02 45.33 41.24 41.50

Average number of diluted shares

outstanding . . . . . . . . . . . . . . . . . . . . . . . . . . 39,004,500 42,603,236 45,586,087 48,910,946 54,448,065

Accounts receivable . . . . . . . . . . . . . . . . . . . . 47,138 56,510 30,840 31,519 28,708

Merchandise inventories. . . . . . . . . . . . . . . . . 1,374,505 1,374,481 1,345,321 1,294,581 1,304,124

Property and equipment, net . . . . . . . . . . . . . . 1,939,832 2,029,171 2,134,200 2,287,015 2,440,266

Total assets . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,865,625 4,170,071 4,050,739 4,048,744 4,306,137

Long-term debt . . . . . . . . . . . . . . . . . . . . . . . . 614,785 614,785 614,785 614,785 614,785

Capital lease obligations . . . . . . . . . . . . . . . . . 7,269 5,919 6,759 7,524 9,153

Other liabilities . . . . . . . . . . . . . . . . . . . . . . . . 238,980 250,455 228,439 233,492 245,218

Deferred income taxes . . . . . . . . . . . . . . . . . . 258,070 278,999 314,162 317,038 376,091

Subordinated debentures. . . . . . . . . . . . . . . . . 200,000 200,000 200,000 200,000 200,000

Total stockholders' equity. . . . . . . . . . . . . . . . 1,795,305 2,019,270 1,992,197 1,970,175 2,052,019

Number of stores

Opened . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 32———

Closed. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 31624

Total—end of year . . . . . . . . . . . . . . . . . . . . 297 297 296 302 304

___________________________________

* Fiscal 2012 contains 53 weeks.

The items below are included in the Selected Financial Data.

2015

A $12.6 million pretax gain ($8.1 million after tax or $0.21 per share) primarily related to the sale of four retail store

locations.

2014

A $5.9 million pretax gain ($3.8 million after tax or $0.09 per share) related to the sale of a retail store location.