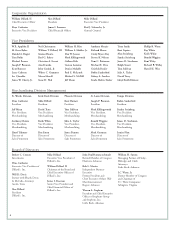

Dillard's 2003 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2003 Dillard's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

1

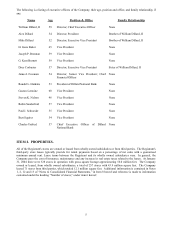

To Our Shareholders

William Dillard, II

Chairman of the Board and Chief

Executive Officer

Alex Dillard

President

Alex Dillard

We were disappointed with our results for 2003. We reduced

our operating expenses by $66 million, our depreciation and

rental expense by almost $15 million and our interest expense

by $8.7 million. However, we also experienced a 4% sales

decline and a 160 basis point reduction in gross margin. This

resulted in a large profit decline in 2003.

To improve our sales and margins, we have introduced sev-

eral new brands that we believe will broaden Dillard’s appeal

to the customer seeking better and more upscale merchandise.

We plan to continue the review of our merchandise offering to

add other appropriate brands and to reduce or eliminate

brands that are not performing with satisfactory sales and

gross margins.

We remain committed to differentiating Dillard’s from our

competition. In 2003, we increased the storewide penetration

of our exclusive brands from 18.2% of sales to 20.9%. We

intend to continue to expand the exclusive brand merchandise

offering where appropriate.

Furthermore, we will fine-tune our merchandise mix by

store location to meet the differing needs of the local demo-

graphic in our ongoing effort to set ourselves apart as the

favorite hometown store with a national appeal.

We plan to continue our review of expenses and, where

possible, eliminate or reduce those that do not negatively

impact our customer service. We have continued to invest in

the development of our associates to better service the cus-

tomer and we believe this is another way to distinguish

Dillard’s from the competition.

We were pleased with the improvement in our balance

sheet. We strengthened our financial position in 2003 by com-

mitting available cash resources to paying $261 million in debt,

capping a five-year debt reduction of approximately $1.4 bil-

lion. We reinforced our liquidity by amending and extending

our revolving line of credit to $1 billion with a maturity of

December 2008. We remain financially flexible and firmly com-

mitted to further strengthening our overall financial position.

During the year, we further improved our base of store

locations. We entered the quad-city area of Iowa for the first

time with the opening of our Davenport store in July. We

opened new Dillard’s stores in the established markets of

Cleveland, Ohio, Richmond, Virginia (2) and Houston,

Texas. In Richmond and Houston, we repositioned the

Dillard’s franchise by opening new locations and closing less-

promising ones. During 2003, we closed nine under-perform-

ing locations in our continuing effort to prune our store base.

Our store ownership percentage is 78% - one of the highest

ownership percentages in our market sector.

This is an exciting time to be in fashion apparel and home

retailing and we continue to position ourselves to capitalize on

the needs of confident customers who are focused on fashion,

service and value. We will build on the strength of the

Dillard’s franchise and proudly continue our 65-year legacy of

distinctive merchandising and service. Our team remains com-

mitted to this plan and we thank you, our shareholders, for

your continued support.

William Dillard, II