Dillard's 2003 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2003 Dillard's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Results of Operations

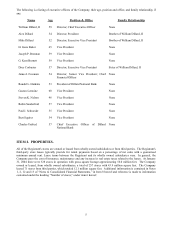

The following table sets forth the results of operations, expressed as a percentage of net sales, for the periods indicated:

(in millions of dollars) For the years ended

January 31, 2004 February 1, 2003 February 2, 2002

% of % of % of

Amount Net Sales Amount Net Sales Amount Net Sales

Net sales $7,598.9 100.0 % $7,911.0 100.0 % $8,154.9 100.0 %

Cost of sales 5,170.2 68.0 5,254.1 66.4 5,507.7 67.5

Gross profit 2,428.7 32.0 2,656.9 33.6 2,647.2 32.5

Advertising, selling, administrative

and general expenses 2,097.9 27.6 2164.0 27.3 2,191.4 26.9

Depreciation and amortization 290.7 3.8 301.4 3.8 310.7 3.8

Rentals 64.1 0.8 68.1 0.9 72.8 0.9

Interest and debt expense 181.1 2.4 189.8 2.4 192.3 2.4

Asset impairment and store closing

charges 43.7 0.6 52.2

0.7 3.8 -

Total operating expenses 2,677.5 35.2 2,775.5 35.1 2,771.0 34.0

Service charges, interest and other

income 264.8 3.4 322.9

4.1 244.8 3.0

Income before income taxes 16.0 0.2 204.3 2.6 121.0 1.5

Income taxes 6.7 0.1 72.4 0.9 49.2 0.6

Income before cumulative effect

of accounting change 9.3 0.1 131.9 1.7 71.8 0.9

Cumulative effect of accounting change - - (530.3) (6.7) - -

Net income (loss) $ 9.3 0.1 % $(398.4) (5.0) % $ 71.8 0.9 %

Sales

The percent change by category in the Company’s sales for the past two years is as follows:

% Change

03-02 02-01

Cosmetics -1.1 -2.5

Women’s and Juniors’ Clothing -4.8 -2.8

Children’s Clothing -8.9 -1.9

Men’s Clothing and Accessories -5.8 -5.9

Shoes, Accessories and Lingerie -0.8 -0.8

Home -4.3 -3.6

Sales decreased 4% for the 52-week period ended January 31, 2004 compared to the 52-week period ended February 1,

2003 on both a total and comparable store basis. Sales declined in all merchandising categories with the largest declines

in children’s, men’s clothing and accessories and women’s and juniors’ clothing. Sales in the home categories were in

line with the average sales performance while sales in accessories, shoes, lingerie and cosmetics were strongest and

exceeded the Company’s average sales performance for the period. Dillard’s management reiterates their strong belief

that merchandise differentiation by the Company is crucial to its future success in the marketplace. The Company

continues to work diligently to build penetration and recognition of its exclusive brand merchandise as a means to

provide superior price and value choices to its customers. During the fiscal years 2003, 2002 and 2001, sales of private

brand merchandise as a percent of total sales were 20.9%, 18.2% and 15.4%, respectively.

Sales decreased 3% for the 52-week period ended February 1, 2003 compared to the 52-week period ended February 2,

2002 on both a total and comparable store basis. The sales decrease for 2002 is due to lower levels of comparable store

sales particularly in the latter half of fiscal 2002 due to a notably weak retail environment. Sales declined in all

merchandising categories with the largest declines in men’s clothing and accessories and home, which decreased 6% and

4%, respectively.

13