Dillard's 2003 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2003 Dillard's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

• reinvesting operating cash flows into store growth, distribution initiatives, improving product quality in our

proprietary brands; and

• returning profits to shareholders through dividends, share repurchases and increased share price.

The consumer retail sector is extremely competitive. Many different retail establishments compete for our customers’

business. These include other department stores, specialty retailers, discounters, internet and mail order retailers. We

also attempt to enhance our income by managing our operating costs without sacrificing service to our customers.

Trends and uncertainties

The following key uncertainties have been identified by the Company whose fluctuations can have a material effect on

the operating results.

• Cash flow from operating activities are a primary source of liquidity that is adversely affected when the industry

faces market driven challenges and new and existing competitors seek areas of growth to expand their

businesses. If our customers do not purchase our merchandise offerings in sufficient quantities, we respond by

taking markdowns. If we have to reduce our prices, the cost of goods sold on our income statement will

correspondingly rise, thus reducing our income.

• Success of brand – The success of our exclusive brand merchandise is dependent upon customer fashion

preferences.

• Store growth – Our growth is dependent on a number of factors which could prevent the opening of new stores,

such as identifying suitable markets and locations.

2004 Guidance

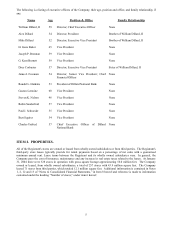

A summary of guidance on key financial measures for 2004, on a GAAP basis, is shown below. There have been no

changes in the guidance for 2004 since the Company released its fourth quarter earnings on March 10, 2004.

(In millions of dollars) 2004 2003

Estimated Actual

Depreciation and amortization $ 290 $ 291

Rental expense 64 64

Interest and debt expense 155 181

Capital expenditures 240 227

General

Net Sales. Net sales include sales of comparable stores, non-comparable stores and lease income on leased departments.

Comparable store sales include sales for those stores which were in operation for a full period in both the current month

and the corresponding month for the prior year. Non-comparable store sales include sales in the current fiscal year from

stores opened during the previous fiscal year before they are considered comparable stores, sales from new stores opened

in the current fiscal year and sales in the previous fiscal year for stores that were closed in the current fiscal year.

Service Charges, Interest and Other Income. Service Charges, Interest and Other Income include interest and service

charges, net of service charge write-offs, related to the Company’s proprietary credit card sales. Other income relates to

joint ventures accounted for by the equity method, rental income, shipping and handling fees and gains (losses) on the

sale of property and equipment and joint ventures.

Cost of Sales. Cost of sales includes the cost of merchandise sold, bankcard fees, freight to the distribution centers,

employee and promotional discounts and direct payroll for salon personnel.

Advertising, selling, administrative and general expenses. Advertising, selling, administrative and general expenses

include buying and occupancy, selling, distribution, warehousing, store management and corporate expenses, including

payroll and employee benefits, insurance, employment taxes, advertising, management information systems, legal, bad

debt costs and other corporate level expenses. Buying expenses consist of payroll, employee benefits and travel for

design, buying and merchandising personnel.

10