Dillard's 2003 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2003 Dillard's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

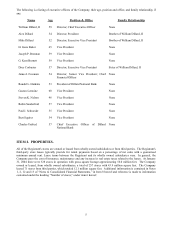

(in thousands of dollars) Number of

Locations

Impairment

Amount

Stores closed during fiscal 2003 3 $ 3,809

Stores to close during fiscal 2004 4 17,115

Store impaired based on cash flows 1 1,293

Non-operating facilities 7 16,030

Joint Venture 1 5,480

Total 16 $43,727

2002 Compared to 2001

Advertising, selling, administrative and general (“SG&A“) expenses increased to 27.3% of sales for fiscal 2002

compared to 26.9% for fiscal 2001. The percentage increase is primarily due to a lack of sales leverage as SG&A

expenses decreased $27.4 million in 2002 compared to 2001. On a dollar basis significant decreases were noted in

payroll, utilities and supplies partially offset by a $23.8 million increase in bad debt expenses, which includes an increase

in the allowance for doubtful accounts of $12.4 million during 2002 compared to 2001.

Depreciation and amortization as a percentage of sales remained flat during fiscal 2002 principally due to lower

amortization expenses during 2002 compared to 2001 as a result of the non-amortization provisions of SFAS No. 142

combined with a lack of sales leverage from the 3% decline in comparable store sales during the year.

Interest and debt expense as a percentage of sales remained flat during fiscal 2002 as a result of the Company’s

continuing focus on reducing its outstanding debt levels and the reduction in variable short-term interest rates combined

with a lack of sales leverage. The Company retired $340 million in long-term debt and issued $40 million in new

mortgage loans and $100 million in additional receivable financing during 2002.

The Company adopted the provisions of SFAS No. 145, “Rescission of FASB Statements No. 4, 44 and 64, Amendment

of FASB Statement No. 13, and Technical Corrections” (“SFAS No. 145”) as of February 1, 2003. For the year ended

February 1, 2003, as a result of adopting SFAS No. 145, the Company has reclassified $6.8 million to interest and debt

expense from extraordinary loss. This amount is comprised of a gain of $4.8 million on debt repurchased, offset by a call

premium of $11.6 million. For the year ended February 2, 2002, the Company has reclassified $9.4 million to interest

and debt expense from extraordinary gain.

The Company has reclassified $11.3 million in interest expense related to its receivable financing from other revenue to

interest expense on its consolidated statements of operations for fiscal 2001.

During fiscal 2002, the Company recorded a pretax charge of $52.2 million for asset impairment and store closing costs.

The charge includes a write down to fair value for certain under-performing properties in the amount of $55.8 million

and exit costs to close four such properties in the amount of $4.4 million, all of which were closed during fiscal 2003,

partially offset by forgiveness of a lease obligation of $8.0 million in connection with the sale of a closed owned store in

Memphis, Tennessee in satisfaction of that obligation. During fiscal 2001, the Company recorded a pretax charge of

$3.8 million for asset impairment and store closing costs. The charge includes a write down to fair value for one under-

performing store in the amount of $1.8 million and lease commitments of $2 million.

15