Dillard's 2003 Annual Report Download

Download and view the complete annual report

Please find the complete 2003 Dillard's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Dillard’s

2003 Annual Report

Table of contents

-

Page 1

2003 Annual Report Dillard's -

Page 2

... customer service. Dillard's stores offer a broad selection of merchandise, including products sourced and marketed under Dillard's exclusive brand names. The Company comprises 328 stores, spanning 29 states, all operating with one name - Dillard's. Financial Highlights (in thousands of dollars... -

Page 3

... our 65-year legacy of distinctive merchandising and service. Our team remains committed to this plan and we thank you, our shareholders, for your continued support. William Dillard, II Chairman of the Board and Chief Executive Officer Alex Dillard President Alex Dillard William Dillard, II 1 -

Page 4

..., Hosiery or Accessories, women shop at our stores because they already know what to expect. And their expectations are rising. New fashions, new styles, and a whole vocabulary of new, and exclusive, brand names have become associated with Dillard's...names such as Preston & York, Antonio Melani... -

Page 5

... sportswear, the American male (and the women who shop for them) return to the trusted exclusive brands in Dillard's men's department: including Roundtree & Yorke, Daniel Cremieux, Murano and Turnbury. Roundtree & Yorke Children's Wear Copper Key Class Club Moms all across the country apply... -

Page 6

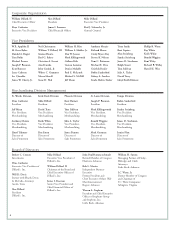

... Attorneys Austin, Texas Alex Dillard President Dillard's, Inc. Mike Dillard Executive Vice President of Dillard's, Inc. William Dillard, II Chairman of the Board and Chief Executive Officer of Dillard's, Inc. James I. Freeman Senior Vice President and Chief Financial Officer of Dillard's, Inc. John... -

Page 7

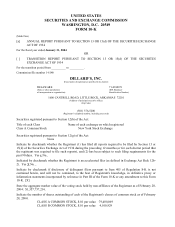

...LITTLE ROCK, ARKANSAS 72201 (Address of principal executive office) (Zip Code) (501) 376-5200 (Registrant's telephone number, including area code) Securities registered pursuant to Section 12(b) of the Act: Title of each Class Class A Common Stock Name of each exchange on which registered New York... -

Page 8

DOCUMENTS INCORPORATED BY REFERENCE Portions of the Proxy Statement for the Annual Meeting of Stockholders to be held May 15, 2004 (the "Proxy Statement") are incorporated by reference into Part III. 2 -

Page 9

... of the Registrant. Executive Compensation. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters. Certain Relationships and Related Transactions. Principal Accountant Fees and Services. PART IV 15. Exhibits, Financial Statement Schedules, and Reports on Form... -

Page 10

... "Net sales," "Net income," "Total assets" and "Number of employees-average," under item 6 hereof. The Company's annual report on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K are available free of charge on the Dillard's, Inc. Web site: www.dillards.com The information... -

Page 11

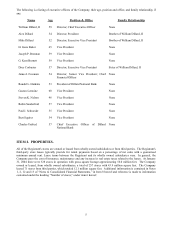

... Position & Office Director; Chief Executive Officer Director; President Director; Executive Vice President Vice President Vice President Vice President Director; Executive Vice President Director; Senior Vice President; Chief Financial Officer President of Dillard National Bank Vice President Vice... -

Page 12

... LEGAL PROCEEDINGS. From time to time, we are involved in litigation relating to claims arising out of our operations in the normal course of business. Such issues may relate to litigation with customers, employment related lawsuits, class action lawsuits, purported class action lawsuits and actions... -

Page 13

... (4) Capitalized lease obligations Deferred income taxes Guaranteed Preferred Beneficial Interests in the Company's Subordinated Debentures Stockholders' equity Number of employees - average Gross square footage (in thousands) Number of stores Opened Acquired Closed Total - end of year 2003 $7,598... -

Page 14

... to the Company's sale of its interest in FlatIron Crossing, a Broomfield, Colorado shopping center (see Note 1 of the Notes to Consolidated Financial Statements). a pretax asset impairment and store closing charge of $52.2 million ($33.4 million after tax or $0.39 per diluted share) related to... -

Page 15

...ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS. EXECUTIVE OVERVIEW Dillard's, Inc. ("the Company" or "we") operates 328 retail department stores in 29 states. Our stores are located in suburban shopping malls and offer a broad selection of fashion apparel and home furnishings. We offer an... -

Page 16

...expenses. Advertising, selling, administrative and general expenses include buying and occupancy, selling, distribution, warehousing, store management and corporate expenses, including payroll and employee benefits, insurance, employment taxes, advertising, management information systems, legal, bad... -

Page 17

.... The Company identified its reporting units under SFAS No. 142 at the store unit level. The fair value of these reporting units was estimated using the expected discounted future cash flows and market values of related businesses, where appropriate. The cumulative effect of the accounting change as... -

Page 18

...tax laws, new store locations or tax planning, the Company's effective tax rate and tax balances could be affected. As such these estimates may require adjustment in the future as additional facts become known or as circumstances change. Discount rate. The discount rate that the Company utilizes for... -

Page 19

... change by category in the Company's sales for the past two years is as follows: % Change 03-02 02-01 -1.1 -2.5 -4.8 -2.8 -8.9 -1.9 -5.8 -5.9 -0.8 -0.8 -4.3 -3.6 Cosmetics Women's and Juniors' Clothing Children's Clothing Men's Clothing and Accessories Shoes, Accessories and Lingerie Home Sales... -

Page 20

... The Company has continued to build penetration and recognition of its private brand merchandise as a means for increased control over merchandise mix and better gross margin performance with the goal of replacing underperforming branded vendors with Dillard's private brands. Inventory in comparable... -

Page 21

... with the sale of a closed owned store in Memphis, Tennessee in satisfaction of that obligation. During fiscal 2001, the Company recorded a pretax charge of $3.8 million for asset impairment and store closing costs. The charge includes a write down to fair value for one underperforming store in the... -

Page 22

... Service charge income Other Total Average accounts receivable * percent change greater than 100% 2003 Compared to 2002 Included in other income in fiscal 2003 is a gain of $15.6 million relating the sale of the Company's interest in Sunrise Mall and its associated center in Brownsville, Texas... -

Page 23

... finance charges paid on Company receivables and cash distributions from joint ventures. Operating cash outflows include payments to vendors for inventory, services and supplies, payments to employees, and payments of interest and taxes. Net cash flows from operations were $432 million for 2003... -

Page 24

... 2003, the Company repurchased approximately $18.9 million of Class A Common Stock, representing 1.5 million shares at an average price of $12.99 per share. Approximately $56 million in share repurchase authorization remained under this open-ended plan at January 31, 2004. Guaranteed Beneficial... -

Page 25

... required debt repayments and stock repurchases, if any, from cash flows generated from operations. As part of its overall funding strategy and for peak working capital requirements, the Company expects to obtain funds through its credit card receivable financing facilities and its revolving... -

Page 26

... forward-looking statements. Statements made regarding the Company's merchandise strategies, funding of cyclical working capital needs, store opening schedule and estimates of depreciation and amortization, rental expense, interest and debt expense and capital expenditures for fiscal year 2004 are... -

Page 27

... Company's customers; the impact of competitive pressures in the department store industry and other retail channels including specialty, off-price, discount, internet, and mail-order retailers; trends in personal bankruptcies and charge-off trends in the credit card receivables portfolio; changes... -

Page 28

..., CEO and senior financial officers. The current version of such Code of Conduct is available free of charge on Dillard's, Inc. Web site, www.dillards.com , and are available in print to any shareholder who requests copies by contacting Julie J. Bull, Director of Investor Relations, at the Company... -

Page 29

... Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized. Dillard's, Inc. Registrant Date: April 8, 2004 /s/ James I. Freeman James I. Freeman, Senior Vice President and Chief Financial Officer (Principal Financial and Accounting Officer) 23 -

Page 30

... of the Board and Chief Executive Officer (Principal Executive Officer) /s/ Mike Dillard Mike Dillard Executive Vice President and Director /s/ Alex Dillard Alex Dillard President and Director /s/ James I. Freeman James I. Freeman Senior Vice President and Chief Financial Officer and Director... -

Page 31

... information; and (b) any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. Date: April 8, 2004 /s/ William Dillard, II William Dillard, II Chairman of the Board and Chief Executive... -

Page 32

...information; and (b) any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. Date: April 8, 2004 /s/ James I. Freeman James I. Freeman Senior Vice-President and Chief Financial Officer... -

Page 33

INDEX OF FINANCIAL STATEMENTS AND FINANCIAL STATEMENT SCHEDULES DILLARD'S, INC. AND SUBSIDIARIES Year Ended January 31, 2004 Page Independent Auditors' Report Consolidated Balance Sheets - January 31, 2004 and February 1, 2003. Consolidated Statements of Operations - Fiscal years ended January 31, ... -

Page 34

...1, 2003, and the related consolidated statements of operations, stockholders' equity and comprehensive loss and cash flows for each of the three fiscal years in the period ended January 31, 2004. Our audits also included the financial statement schedule of Dillard's, Inc. and subsidiaries, listed in... -

Page 35

... Balance Sheets Dollars in Thousands Assets Current Assets: Cash and cash equivalents Accounts receivable (net of allowance for doubtful accounts of $40,967 and $49,755) Merchandise inventories Other current assets Total current assets Property and Equipment: Land and land improvements Buildings... -

Page 36

Consolidated Statements of Operations Dollars in Thousands, Except Per Share Data January 31, 2004 Net Sales Service Charges, Interest and Other Income Costs and Expenses: Cost of sales Advertising, selling, administrative and general expenses Depreciation and amortization Rentals Interest and debt ... -

Page 37

...413 shares under stock option, employee savings and stock bonus plans 2 Purchase of 1,456,076 shares of treasury stock __ Cash dividends declared: Common stock, $.16 per share - Balance, January 31, 2004 $1,129 See notes to consolidated financial statements. Common Stock Class A Class B $ 1,116 $40... -

Page 38

... stock Proceeds from receivable financing, net Proceeds from long-term borrowings Net cash used in financing activities Increase (decrease) in Cash and Cash Equivalents Cash and Cash Equivalents, Beginning of Year Cash and Cash Equivalents, End of Year See notes to consolidated financial statements... -

Page 39

... recent economic events, additional analyses are required to appropriately estimate losses inherent in the portfolio. The Company's current credit processing system charges off an account automatically when a customer has failed to make a required payment in each of the six billing cycles following... -

Page 40

...of $64.3 million pertaining to the Company's sale of its interest in FlatIron Crossing, a Broomfield, Colorado shopping center, for the year ended February 1, 2003. The gains on the sale were recorded in Service Charges, Interest and Other Income. Vendor Allowances - The Company receives concessions... -

Page 41

... $0.85 0.79 Segment Reporting - The Company operates in a single operating segment - the operation of retail department stores. Revenues from external customers are derived from merchandise sales and service charges and interest on the Company's proprietary credit card. The Company does not rely on... -

Page 42

...a Customer (Including a Reseller) for Cash Consideration Received from a Vendor". EITF Issue No. 02-16 addresses the accounting treatment for vendor allowances and stipulates that cash consideration received from a vendor should be presumed to be a reduction of the prices of the vendors' product and... -

Page 43

.... The fair value of these reporting units was estimated using the expected discounted future cash flows and market values of related businesses, where appropriate. Related to the 1998 acquisition of Mercantile Stores Company Inc., the Company had $570 million in goodwill recorded in its consolidated... -

Page 44

... not include a $28.4 million interest payment made on February 3, 2003 that would have been due on the last day of the Company's fiscal year had the date fallen on a business day. The Company has reclassified $11.3 million in interest expense related to its receivable financing from other revenue to... -

Page 45

... the following: (in thousands of dollars) Trade accounts payable Accrued expenses: Taxes, other than income Salaries, wages, and employee benefits Liability to customers Interest Rent Other January 31, 2004 $457,485 76,263 44,661 47,340 39,789 9,949 4,367 $679,854 February 1, 2003 $431,752 66,894 53... -

Page 46

... are used to purchase Class A Common Stock of the Company for the account of the employee. The terms of the plan provide a six-year graduated-vesting schedule for the Company contribution portion of the plan. The Company incurred expense of $18 million, $18 million and $19 million for fiscal 2003... -

Page 47

... amounts recognized in the consolidated balance sheets are as follows: (in thousands of dollars) Change in projected benefit obligation: PBO at beginning of year Service cost Interest cost Plan amendments Actuarial loss (gain) Benefits paid PBO at end of year ABO at end of year January 31, 2004 $64... -

Page 48

... of its Class A Common Stock. During fiscal 2003, the Company repurchased approximately $18.9 million of Class A Common Stock, representing 1.5 million shares at an average price of $12.99 per share. Approximately $56 million in share repurchase authorization remained under this open-ended plan at... -

Page 49

... with Accounting Principles Board Opinion No. 25, "Accounting for Stock Issued to Employees," the Company uses the intrinsic value method of accounting for stock options. No compensation cost has been recognized in the consolidated statements of operations for the Company's stock option plans. F-17 -

Page 50

... legal proceedings, in the form of lawsuits and claims, which occur in the normal course of business are pending against the Company and its subsidiaries. In the opinion of management, disposition of these matters is not expected to materially affect the Company's financial position, cash flows... -

Page 51

... on market prices or dealer quotes (for publicly traded unsecured notes) and on discounted future cash flows using current interest rates for financial instruments with similar characteristics and maturity (for bank notes and mortgage notes). The fair value of the Company's cash and cash equivalents... -

Page 52

... items: First Quarter 2003 • • a pretax gain of $15.6 million ($10.0 million after tax or $0.12 per diluted share) pertaining to the Company's sale of its interest in Sunrise Mall and its associated center in Brownsville, Texas. a pretax gain of $12.3 million ($7.9 million after tax or $0.09... -

Page 53

... the Company's sale of its interest in FlatIron Crossing, a Broomfield, Colorado shopping center (see Note 1 of the Notes to the Consolidated Financial Statements). a pretax asset impairment and store closing charge of $53.1 million ($34.0 million after tax or $0.40 per fully diluted share) related... -

Page 54

... E Column F Description Balance at Beginning of Period Additions Charged to Charged to Costs and Other Expenses Accounts Deductions (1) Balance at End of Period Allowance for losses on accounts receivable: Year Ended January 31, 2004 Year Ended February 1, 2003 Year Ended February 2, 2002 $49... -

Page 55

... and Nonqualified Stock Option Plan (Exhibit 10 (b) to Form 10-K for the fiscal year ended January 30, 1999 in 1-6140). Amended and Restated Corporate Officers Non-Qualified Pension Plan (Exhibit 10 to Form 10-Q for the quarter ended May 2, 2003 in 1-6140). Senior Management Cash Bonus Plan (Exhibit... -

Page 56

...Certification of Chief Financial Officer Pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 (18 U.S.C. 1350). 31(b) 32(a) 32(b) * Incorporated by reference as indicated. ** A management contract or compensatory plan or arrangement required to be filed as an exhibit to this report pursuant... -

Page 57

3 -

Page 58

... Rock, Arkansas 72201 Mailing Address Post Office Box 486 Little Rock, Arkansas 72203 Telephone: 501-376-5200 Fax: 501-376-5917 Listing New York Stock Exchange, Ticker Symbol "DDS" Store Openings - 2003 Store Name Great Northern Mall NorthPark Mall Stony Point Fashion Park Short Pump Town Center... -

Page 59

Dillard's, Inc. 1600 Cantrell Road Little Rock, Arkansas 72201 www.dillards.com