Creative 2002 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2002 Creative annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

7

CRITICAL ACCOUNTING POLICIES AND ESTIMATES

GENERAL

Management’s Discussion and Analysis of Financial Condition and Results of Operations are based upon Creative’s

Consolidated Condensed Financial Statements, which have been prepared in accordance with accounting principles

generally accepted in the United States of America. The preparation of these financial statements requires management

to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenues and expenses, and

related disclosure of contingent assets and liabilities. Management bases its estimates on historical experience and on

various other assumptions that are believed to be reasonable under the circumstances, the results of which form the basis

for making judgements about the carrying values of assets and liabilities that are not readily apparent from other sources.

Actual results may differ from these estimates under different assumptions or conditions.

Management believes the following critical accounting policies affect its more significant estimates and assumptions used

in the preparation of its consolidated financial statements:

Revenue recognition;

Allowances for doubtful accounts, returns and discounts;

Valuation of inventories;

Valuation of investments;

Valuation of goodwill and other intangible assets;

Restructuring costs and accruals for excess facilities;

Assessment of the probability of the outcome of current litigation; and

Accounting for income taxes.

REVENUE RECOGNITION

Revenue from product sales is recognised when persuasive evidence of an arrangement exists, delivery has occurred, price

is fixed or determinable, and collectibility is probable. Allowances are provided for estimated returns, discounts and

warranties. Management analyzes historical returns, current economic trends and changes in customer demand and

acceptance of its products when evaluating the adequacy of the sales returns allowance. Such allowances are adjusted

periodically to reflect actual and anticipated experience. When recognizing revenue, Creative records estimated reductions

to revenue for customer and distributor programs and incentive offerings, including price protection, promotions, other

volume-based incentives and rebates. Creative may take action to increase customer incentive offerings possibly resulting

in an incremental reduction of revenue at the time the incentive is offered. Significant management judgement and

estimates must be used in connection with establishing these allowances in any accounting period. If market conditions

were to decline, Creative may take action to increase customer incentive offerings, possibly resulting in an incremental

reduction of revenue at the time the incentive is offered.

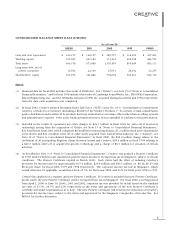

ALLOWANCES FOR DOUBTFUL ACCOUNTS, RETURNS AND DISCOUNTS

Creative establishes allowances for doubtful accounts, returns and discounts for specifically identified doubtful accounts,

returns and discounts based on credit profiles of its customers, current economic trends, contractual terms and conditions

and historical payment, return and discount experience. Management performs ongoing credit evaluations of customers’

financial condition and uses letters of credit in certain circumstances. Credit insurance coverage is obtained when

coverage is available. However, Creative often is not able to procure credit insurance coverage for all customers as insurers

have excluded certain customers and geographic markets. In the event actual returns, discounts and bad debts differ from

these estimates, or Creative adjust these estimates in future periods, its operating results and financial position could be

adversely affected.