Creative 2002 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2002 Creative annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

5

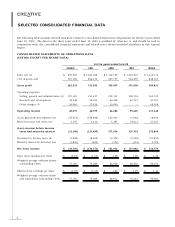

CONSOLIDATED BALANCE SHEET DATA (US$’000):

As of June 30

2002(1) 2001 2000 1999 1998(1)

Cash and cash equivalents $ 166,917 $ 168,157 $ 285,757 $ 318,990 $ 417,262

Working capital 165,945 203,180 331,414 400,998 484,792

Total assets 666,378 673,980 1,176,459 805,689 865,113

Long-term debt, net of

current maturities 16,782 22,560 27,051 28,642 32,277

Shareholders’ equity 423,952 381,886 778,638 560,261 622,314

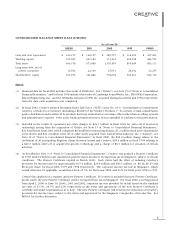

Notes:

(1) Financial data for fiscal 2002 includes the results of 3Dlabs Inc., Ltd (“3Dlabs”), see Note 15 of “Notes to Consolidated

Financial Statements,” and for fiscal 1998 includes the results of Cambridge SoundWorks, Inc., ENSONIQ Corporation,

Silicon Engineering, Inc., and the NetMedia Division of OPTi Inc. acquired during fiscal 2002 and 1998 respectively,

from the date each acquisition was completed.

(2) In fiscal 2002, Creative adopted Emerging Issues Task Force (“EITF”) Issue No. 01-9, “Accounting for Consideration

Given by a Vendor to a Customer (Including a Reseller of the Vendor’s Products.)” As a result, certain consideration

paid to distributors and resellers of its products has been reclassified as a revenue offset rather than as selling, general

and administrative expense. Prior years’ financial statements have been reclassified to conform to this presentation.

(3) Included in the results of operations are other charges of: $26.1 million in fiscal 2002 for write-off of in-process

technology arising from the acquisition of 3Dlabs, see Note 15 of “Notes to Consolidated Financial Statements;”

$22.8 million in fiscal 2001 which comprised $8.4 million restructuring charges, $3.2 million fixed assets impairment

write-downs and $11.2 million write-off of other assets acquired from Aureal Semiconductor, Inc. (“Aureal”), see

Note 12 of “Notes to Consolidated Financial Statements;” in fiscal 2000, the $20.0 million charge relates to the

settlement of all outstanding litigation claims between Aureal and Creative; $68.6 million in fiscal 1998 relating to

a $60.3 million write-off of acquired in-process technology and a charge of $8.3 million for cessation of certain

activities.

(4) As described in Note 9 of “Notes to Consolidated Financial Statements”, Creative was granted a Pioneer Certificate

in 1990 under which income classified as pioneer status income is exempt from tax in Singapore, subject to certain

conditions. The Pioneer Certificate expired in March 2000. Such status had the effect of reducing Creative’s

provision for income taxes by approximately $15.4 million, $26.4 million and $43.3 million, or $0.18, $0.29 and

$0.46 per share, for fiscal 2000, 1999 and 1998 respectively. The corporate income tax rate in Singapore, which

would otherwise be applicable, would have been 25.5% for fiscal year 2000, and 26% for fiscal years 1998 to 1999.

Creative has applied for a separate and new Pioneer Certificate. If Creative is awarded this new Pioneer Certificate,

profits under the new Pioneer Certificate will be exempted from tax in Singapore. For fiscal 2000 (covering period

from April 1, 2000 to June 30, 2000), 2001 and 2002, corporate tax was provided for in full based on the standard

tax rates of 25.5%, 24.5% and 22% respectively as the terms and agreements of the new Pioneer Certificate is

currently still under negotiation as at to date. The new Pioneer Certificate will result in the reduction of Creative’s

provision for income taxes, subject to the terms and agreement by the Singapore Comptroller of Income Tax. See

MD&A for further discussion.