Creative 2002 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2002 Creative annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

12

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS

YEAR ENDED JUNE 30, 2002 COMPARED TO YEAR ENDED JUNE 30, 2001

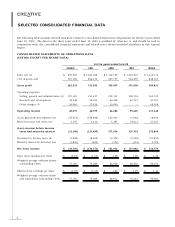

Net sales for the year ended June 30, 2002 decreased by 34% compared to the year ended June 30, 2001. The substantially

lower revenues in fiscal year 2002, was a result of the strategic shift by Creative to focus on its core products and to de-

emphasize lower margin products and the difficult global economic climate. Audio product sales (Sound Blaster audio

cards and chipsets) for fiscal year 2002 decreased by 30% compared to fiscal year 2001, but as a percentage of total sales,

increased from 41% in fiscal 2001 to 44% in fiscal 2002. Sales of speakers increased by 10% and represented 21% of

sales in fiscal 2002 compared with 12% of sales in fiscal 2001. The improvement in speaker sales was primarily a result

of the introduction of new models of multi-media speakers. Sales of personal digital entertainment (“PDE”) products

which includes digital audio players and digital cameras, decreased by 31% and represented 9% of sales in fiscal 2002

and fiscal 2001. Sales of multimedia upgrade kits (“MMUK”) which includes data storage, decreased by 84% in fiscal 2002

compared to fiscal 2001 and comprised 5% of sales compared to 22% of sales in the prior fiscal year. The reduction in

MMUK sales in fiscal 2002 is in line with Creative’s current business strategy of de-emphasizing lower margin products.

Similarly, in line with this current strategy, sales of graphics and video products decreased by 36% and represented 6%

of sales in both fiscal years 2002 and 2001. Sales of other products, which includes accessories, music products,

communication products and other miscellaneous items, increased by 4% and represented 15% of sales in fiscal 2002

compared to 10% of sales in the prior fiscal year. This increase in other product sales was primarily due to an increase

in sales of communication products.

Gross profit in fiscal 2002 increased to 33% of net sales, compared to 27% in fiscal 2001. This improvement in gross profit

was primarily a result of the strategic shift in business, with emphasis on Creative’s core audio products, speakers and

PDE products.

Selling, general and administrative (“SG&A”) expenses in fiscal 2002 declined by 26% due to management’s cost cutting

efforts to correspond to the revised revenue expectations. As a percentage of sales, SG&A expenses were 21% of sales

for fiscal 2002 and 19% for fiscal 2001. Research and development expenses were 5% of sales in fiscal 2002 and 4%

of sales in fiscal 2001.

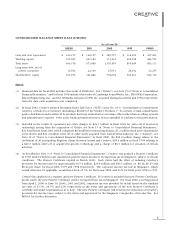

Other charges of $26.1 million in fiscal 2002 relates to the write off of acquired in-process technology arising from the

acquisition of 3Dlabs and represented 3% of sales in fiscal 2002 compared to 2% of sales in fiscal 2001. The write off of

acquired in-process technology is in accordance with the prevailing accounting standards. See Note 15 of “Notes to

Consolidated Financial Statements.”

Net investment loss of $45.4 million in fiscal year 2002 comprised $49.3 million in write-downs of investments, offset

partially by a $3.9 million net gain from sales of investments and marketable securities. Net investment loss of $148.5

million in fiscal 2001 included $200.3 million in write-downs of investments, offset partially by a $51.8 million net gain

from sales of investments and marketable securities. Net interest and other income increased by $2.7 million to $5.1

million in fiscal 2002 compared to $2.4 million in the prior fiscal year. This increase was primarily due to an exchange

gain of $3.9 million in fiscal 2002 versus an exchange loss of $3.7 million in fiscal 2001, offset partially by lower interest

income resulting from lower interest rates and lower average cash balances.

Creative’s provision for income taxes for fiscal 2002 remained flat at 1% of sales compared to the prior fiscal year. The

provision for income taxes as a percentage of income before taxes and minority interest excluding net loss or gain from

investments declined from 31% in fiscal 2001 to 17% in fiscal 2002. This reduction was primarily due to changes in the

mix of taxable income arising from various geographical regions and utilization of non Singapore net operating losses.