Creative 2000 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2000 Creative annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

14

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS

LIQU IDITY AND CAPITAL RESOURCES

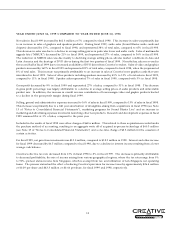

Cash and cash equivalents at June 30, 2000 were $285.8 million, a decrease of $33.2 million compared to the balance at

June 30, 1999.

Operating Activities: Net cash generated from operating activities during fiscal 2000 was $160.2 million, compared with

$124.1 million in fiscal 1999. Cash from operating activities for fiscal 2000 was primarily generated from net income of

$161.0 million, partially offset by net adjustments of $44.3 million for non-cash items including depreciation and amortization

of $35.6 million, amortization of deferred share compensation of $4.6 million, investment write off of $9.8 million, and net

gain from investments of $94.7 million. Also included in cash generated from operating activities were net increases in

accounts payable, other accrued liabilities and income taxes payable amounting to $131.2 million, decreases in other assets,

prepaids and accounts receivable of $16.0 million, offset by an increase in inventory of $82.6 million due to stockpiling to

safeguard against component shortages. In addition, $21.1 million was used to purchase marketable securities during fiscal

2000.

Cash from operating activities for fiscal 1999 was primarily generated from net income of $115.1 million, adjustments of

$22.4 million for non-cash items including depreciation and amortization of $37.3 million and realized net gain from sale

of investments of $15.0 million, and a net increase in accounts payable, other accrued liabilities and income tax payable of

$7.5 million. This was offset by increases in other assets, prepaids and accounts receivable of $17.2 million and cash used

to build the inventory position of $3.7 million.

Investing Activities: Net cash used for investing activities during fiscal 2000 was $104.3 million, compared with $38.4

million in fiscal 1999. The balance in fiscal 2000 includes the purchase of investments of $228.2 million and the acquisition

of capital and other assets amounting to $22.6 million. The cash used in investing activities was offset in part by the proceeds

from sale of quoted investments amounting to $146.5 million.

Cash used in investing activities during fiscal 1999, included capital expenditures and other assets of $16.3 million and

purchase of investments amounting to $64.6 million. The sale of investments provided $42.5 million cash in fiscal 1999.

Financing Activities: During fiscal 2000, $89.1 million was used for financing activities, compared with $184.0 million

provided in fiscal 1999. Cash used in financing included $102.2 million to purchase and retire 5.9 million of Creative’s

ordinary shares (See Note 6 of “Notes to Consolidated Financial Statements”), $20.6 million for dividend payment (See

Note 7 of “Notes to Consolidated Financial Statements”), and $5.7 million to repay long-term obligations and minority

shareholders’ loan and equity balance. The cash used in financing activities was offset by cash generated from exercises of

Creative’s stock options amounting to $16.9 million and proceeds from the issuance of preference shares to minority shareholders

by one of Creative’s subsidiaries amounting to $22.5 million.

Cash used for financing activities in fiscal 1999 included $139.0 million to purchase and retire 10 million of Creative’s

ordinary shares, $45.0 million to pay dividends, $5.2 million to reduce long-term obligations and minority shareholders’ loan

and equity balance. This was offset by a $5.2 million cash inflow from the exercise of share options.

On September 21, 2000, the U.S. Bankruptcy Court for the Northern District of California, Oakland Division approved the

sale to Creative of substantially all of the assets of Aureal Semiconductor, Inc. The sale includes settlement of all outstanding

litigation claims between Aureal and Creative. Creative will pay $28.0 million in cash, plus two new shares of Creative stock

for every 100 outstanding shares of Aureal stock, or 208,079 shares of Creative.

As of June 30, 2000, one of Creative’s subsidiaries had firm commitments for capital expenditure amounting to approximately

$17.9 million, which primarily relates to the set up of new manufacturing facilities in Malaysia.

As of June 30, 2000, in addition to cash reserves and excluding the term loan, Creative had unutilized credit facilities totaling

approximately $99.1 million for overdrafts, guarantees and letters of credit. Creative continually reviews and evaluates

investment opportunities, including potential acquisitions of, and investments in, companies that can provide Creative with

technologies, subsystems or complementary products that can be integrated into or offered with its existing product range.

Creative generally satisfies its working capital needs from internally generated cash flows. Management believes that Creative

has adequate resources to meet its projected working capital and other cash needs for at least the next twelve months.