Comfort Inn 2011 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2011 Comfort Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

complexity.

Leveraging Size, Scale and Distribution . We continually focus on identifying methods for utilizing the significant number of hotels in our system to

reduce costs and increase returns for our franchisees. For example, we create relationships with qualified vendors to: (i) make low-cost products available to

our franchisees; (ii) streamline the purchasing process; and (iii) maintain brand standards and consistency. We plan to expand this business and identify new

methods for decreasing hotel-operating costs by increasing penetration within our existing franchise system and enhancing our existing vendor relationships

and/or creating new vendor relationships. We believe our efforts to leverage the Company’s size, scale and distribution benefit the Company by enhancing

brand quality and consistency, improving our franchisees returns and satisfaction, and creating procurement services revenues.

Total revenues from our domestic operations comprised 91% and 92% for our total revenues in 2011 and 2010, respectively. As a result, our description

of the franchise system is primarily focused on the domestic operations.

Our standard domestic franchise agreements grant franchisees the non-exclusive right to use certain of our trademarks and receive other benefits of our

franchise system to facilitate the operation of their franchised hotel at a specified location. The majority of our standard domestic franchise agreements are 20

years in duration (excluding contracts for MainStay Suites, Suburban Extended Stay Hotel branded hotels and beginning in 2008 Comfort Inn branded hotels

which run for 10 years), with certain rights for each of the franchisor and franchisee to terminate their franchise agreement, such as upon designated

anniversaries of the agreement, before the 20 th (or 10th, as applicable) year.

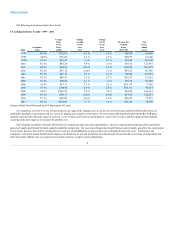

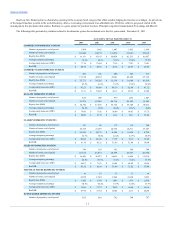

Our franchises operate domestically under one of eleven Choice brand names: Comfort Inn, Comfort Suites, Cambria Suites, Quality, Clarion, Ascend

Collection, Sleep Inn, Econo Lodge, Rodeway Inn, MainStay Suites and Suburban Extended Stay Hotel. The following table presents key statistics related to

our domestic franchise system over the five years ended December 31, 2011.

Number of properties, end of period 4,445

4,716

4,906

4,993

5,001

Number of rooms, end of period 354,139

373,884

388,594

393,535

392,826

Royalty fees ($000) $212,519

$220,411

$196,406

$ 206,049

$220,047

Average royalty rate(1)

4.14%

4.20%

4.25%

4.29%

4.32%

Average occupancy percentage(1)

57.9%

55.3%

49.4%

51.3%

53.5%

Average daily room rate (ADR)(1)

$72.07

$74.11

$71.24

$70.50

$71.83

Revenue per available room (RevPAR)(1),(2)

$ 41.75

$40.98

$ 35.18

$ 36.18

$38.44

____________________________

(1) Amounts exclude results from Cambria Suites properties open during all periods presented and Ascend Collection properties open during 2008.

(2) The Company calculates RevPAR based on information as reported to the Company by its franchisees.

According to Smith Travel Research, the total rooms open and operating in the United States at December 31, 2011 totaled approximately 4.9 million

rooms of which 8.1% were affiliated with the Choice Brands. Choice branded system-wide United States market share as of December 31, 2011 has increased

52 basis points over the past 5 years representing a cumulative annual growth rate of 3.0% compared to the total industry domestic growth rate of 1.6%.

Currently, no individual franchisee or international master franchisee accounts for more than 3% of the Company's total revenues.

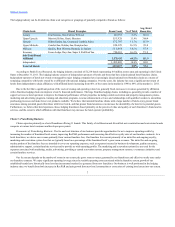

Our brands offer consumers and developers a wide range of choices from economy hotels to lower upscale, full service properties. Our brands are as

follows:

Cambria Suites: Cambria Suites is a new construction select service hotel chain with an upscale image and distinctive styling. Cambria offers well-

appointed suites that emulate the “best of a modern home.” In-room amenities include luxury

9