Comfort Inn 2011 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2011 Comfort Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

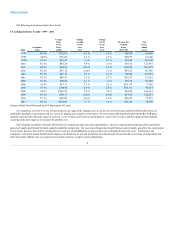

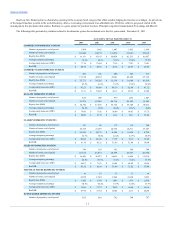

The following chart demonstrates these trends:

1997 64.5%

$75.16

6.1 %

1.9 %

$48.50

128,000

1998 64.0%

$78.62

4.6 %

2.3 %

$50.29

143,000

1999 63.3%

$81.27

3.4 %

2.7 %

$51.44

143,148

2000 63.5%

$85.24

4.9 %

3.4 %

$54.13

121,476

2001 60.1%

$84.85

(0.5)%

2.9 %

$50.99

101,279

2002 59.2%

$83.15

(2.0)%

1.6 %

$49.22

86,366

2003 59.1%

$83.19

0.1 %

2.3 %

$49.20

65,876

2004 61.3%

$86.41

3.9 %

2.7 %

$52.93

55,245

2005 63.1%

$90.84

5.1 %

3.4 %

$57.34

65,900

2006 63.4%

$97.31

7.1 %

3.2 %

$61.69

73,308

2007 63.1%

$104.04

6.9 %

2.8 %

$65.61

94,541

2008 60.3%

$106.96

2.8 %

3.8 %

$64.49

146,312

2009 54.5%

$98.17

(8.2)%

(0.4)%

$53.50

142,287

2010 57.5%

$98.06

(0.1)%

1.6 %

$56.43

73,976

2011 60.1%

$101.64

3.7 %

3.2 %

$61.06

38,409

(Source: Smith Travel Research and US Department of Labor)

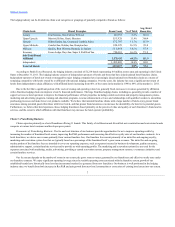

As a franchisor, we believe we are well positioned in any stage of the lodging cycle as our fee-for-service business model has historically delivered

predictable, profitable, long-term growth in a variety of lodging and economic environments. We have historically benefited from both the RevPAR gains

typically experienced in the early stages of recovery, as our revenues are based on our franchisees’ gross room revenues, and the supply growth normally

occurring in the later stages as we increase our portfolio size.

The Company’s portfolio of brands offers both new construction and conversion opportunities. Our new construction brands typically benefit from

periods of supply growth and favorable capital availability and pricing. Our conversion brands also benefit from periods of supply growth as the construction

of new hotels increases the need for existing hotels to seek new brand affiliations as their product moves through the hotel life cycle. Furthermore, the

Company's conversion brands benefit from lodging cycle downturns as our unit growth has been historically driven from the conversion of independent and

other hotel chain affiliates into our system as these hotels endeavor to improve their performance.

6