Comfort Inn 2011 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2011 Comfort Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

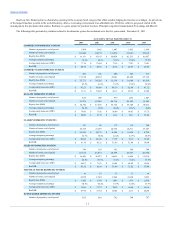

The following table presents key worldwide system size statistics as of and for the year ended December 31, 2011:

Comfort 1,953

149,752

94

6,894

76

(21)

(88)

Comfort

Suites 628

49,379

98

7,263

13

(1)

(19)

Quality 1,417

129,701

58

4,596

100

16

(88)

Ascend

Collection 63

6,120

15

1,466

22

—

(1)

Clarion 327

45,245

25

3,916

38

(3)

(28)

Sleep Inn 404

29,654

56

3,555

8

(4)

(8)

MainStay

Suites 42

3,311

31

2,445

5

—

(1)

Econo Lodge 872

52,801

33

1,992

65

1

(42)

Rodeway Inn 391

21,742

24

1,436

25

12

(35)

Suburban 62

7,285

25

2,136

4

—

(6)

Cambria

Suites 19

2,215

31

3,976

—

—

(4)

Totals 6,178

497,205

490

39,675

356

—

(320)

Brand growth is important to our business model. We have identified key market areas for hotel development based on supply/demand relationships

and our strategic objectives. Development opportunities are typically offered to: (i) existing franchisees; (ii) developers of hotels; (iii) owners of independent

hotels and motels; (iv) owners of hotels leaving other franchisors’ brands; and, (v) franchisees of non-hotel related products such as restaurants.

Our franchise sales organization is structured to support the Company’s efforts to leverage its core strengths in order to take advantage of opportunities

for further growth. The franchise sales organization employs both sales managers as well as franchise sales directors. This organization emphasizes the

benefits of affiliating with the Choice system, our commitment to improving hotel profitability, our central reservation delivery services, our training and

support systems (including our proprietary property management systems) and our Company’s track record of growth and profitability to potential

franchisees. Franchise sales directors are assigned to specific brands to leverage their brand expertise to enhance product consistency and deal flow. Our sales

managers ensure each prospective hotel is placed in the appropriate brand, facilitate teamwork and information sharing amongst the sales directors and

provide better service to our potential franchisees. The structure of this organization supports the Company’s efforts to leverage its core strengths in order to

take advantage of opportunities for further growth. Integrating our brands and strategies allow our brand teams to focus on understanding, anticipating and

meeting the unique needs of our customers.

Our objective is to continue to grow our portfolio by continuing to sell our existing brands, creating extensions of our existing brands and introducing

new brands, either organically or via acquisition, within the various lodging chain categories. Based on market conditions and other circumstances, we may

offer certain incentives to developers to increase development of our brands such as discounting various fees such as the initial franchise fee and royalty rates

as well as provide financing for property improvements and other purposes.

Because retention of existing franchisees is important to our growth strategy, we have a formal impact policy. This policy offers existing franchisees

protection from the opening of a same-brand property within a specified distance, depending upon the market in which the property is located.

Our board of directors previously authorized us to enter into programs which permit us to offer financing, investment, and guaranty support to

qualified franchisees as well as to acquire and resell real estate to incent franchise development for certain brands in strategic markets. We expect to

opportunistically deploy capital over the next several years and our annual investment in these programs will be dependent on market and other conditions.

16