Charles Schwab 2015 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2015 Charles Schwab annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

12 LETTER FROM THE CHIEF FINANCIAL OFFICER

or insights affect our priorities; and so on. As a result, in

any given year our nance and business leadership engage

in an extensive, ongoing process to work out the trade-offs

necessary to ensure that priorities continue to be met while

available resources are allocated effectively throughout the

rm to build a constantly improving client proposition and

long-term stockholder value. When I talk about disciplined

execution, it’s that process I’m thinking of.

The results

For 2015, we were facing an already lean operating expense

base and a set of priorities, including the launch of Intelligent

Portfolios products and some focused hiring, that we felt

shouldn’t be disrupted absent a dire revenue picture. At the

same time, we were well aware that it was far from certain

that the Fed would make any rate move before year-end, so

we couldn’t count on help from that direction.

Under those circumstances, we chose to focus on staying

within planned expense levels and held FOE growth to

4%, which enabled us to stick to our expected spending

on projects and marketing while limiting overall expense

growth to 4%. That in turn yielded a 130 basis point

difference between revenue and expense growth and

a 35.7% pre-tax prot margin. Again, not quite what we

hoped or expected starting out, but essentially consistent

with our baseline scenario and great results given the

environmental challenges we faced.

And now…

With that crucial rst Fed rate move behind us, the path

forward could be a bit brighter. As we nalized our annual

planning at the beginning of 2016, the forward rate curve

implied that, despite some global market jitters, the U.S.

economy was strong enough to support expectations for

at least one more Fed move in 2016, and we developed our

baseline scenario with that in mind. Our baseline scenario

also includes relatively at long-term rates and a 6.5%

improvement in the S&P 500 Index relative to year-end

2015, as well as a potential decline in revenue trades as

average portfolio turnover continues to slow.

Against that backdrop, we’d expect to produce another

strong year of growth in our client base, and to take

advantage of the breathing room provided by the improving

rate environment to drive harder on reinvestment for future

growth while still delivering a substantial portion of the

rate-driven revenue improvement to our owners through

increased protability. With our baseline expectations

calling for revenue growth in the mid-teens, we planned

for expense growth right around the double-digit mark to

support necessary growth in our infrastructure and allow

for increases in both project and marketing investments

while still delivering a revenue/expense growth gap of at

least 500 basis points. That would represent a pre-tax

prot margin of approximately 39%, another big step on our

journey to higher protability. And while results may vary

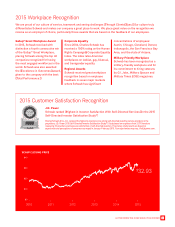

29.7%

2011

29.7%

2012

31.4%

2013

34.9%

2014

35.7%

2015

PRE-TAX PROFIT MARGIN