Cemex 2012 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2012 Cemex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

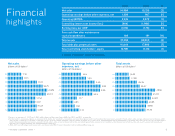

On the financial front, we continued to strengthen

our capital structure and to regain our financial flex-

ibility—both of which are critical to our company’s

future. During 2012, we successfully completed the

refinancing of our August 2009 Financing Agree-

ment with close to 93% participation. This deal, which

extended the final maturity of our Financing Agree-

ment debt from 2014 to 2017, was an important

milestone for us. It not only provided more time to

benefit from the recovery of our markets, but also

more opportunity to consolidate our transformation

efforts. Subsequently, we placed US$1.5 billion of

bonds, which demonstrated the strong support for

CEMEX in the global capital markets. We used the

proceeds from this offering to prepay principal out-

standing under our new Facilities Agreement.

In addition, we successfully placed 26.65% of the

stock of our CEMEX Latam Holdings subsidiary on

the Colombian Stock Exchange. Through this transac-

tion—from which we received approximately US$960

million to pay down debt—we enabled minority stock-

holders to share in the upside potential of a rapidly

growing region through an equity stake directly in

our operating subsidiary, which was a new approach

for CEMEX. I believe that this initiative was good for

all our shareholders since it unlocked untapped value,

broadened our investor base, and enhanced our finan-

cial flexibility.

Under our financial plan for 2012, we have substan-

tially prepaid all of our principal debt payments until

February 2014 and bolstered our liquidity. We have

also increased the average life of our debt to 5.0

years, from 3.8 years at the beginning of 2012, with

no significant change in annual interest expense.

As I have reported in the past, transforming CEMEX

is the cornerstone of our strategy to recover our track

record of industry leading, sustainable value creation.

As a result of our transformation efforts, for the year,

we produced an incremental recurring improvement in

our steady-state EBITDA of US$200 million on top of

the US$150 million we achieved in 2011, reaching a

run rate of US$400 million by the end of 2012.

However, CEMEX’s transformation is about much more

than improving our company’s cost structure. Our un-

derlying goal is to reengineer our corporate DNA. We

have been drilling deep into every aspect of our orga-

nization, seeking innovative solutions and collaborating

across functions and geographies, in order to use our

people and our assets more eciently and effectively.

One example of this new approach is our 10-year

strategic agreement with IBM to provide us with best-

in-class IT and back-oce business process services.

By partnering with one of the leaders of the global IT

industry, we are able to focus on our core business,

while responding more quickly to changing market

needs and serving our customers better. In addition,

we expect to generate savings of approximately US$1

billion during the life of the contract.

Furthermore, during 2012, we completed the global

integration of the most advanced enterprise platform

based on SAP. We achieved this deployment in record

time and cost across all of our worldwide operations.

This simpler, faster, and more flexible state-of-the-art

business platform makes our internal processes more

ecient, improves our customer service, and enhanc-

es our competitiveness.

CEMEX’s transformation

is about much more than

improving our company’s

cost structure. Our underlying

goal is to reengineer our

corporate DNA.

6

< previous I contents I next >