Cemex 2012 Annual Report Download

Download and view the complete annual report

Please find the complete 2012 Cemex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In a year of recovery, our considerable progress

to transform our company is underscored in this,

our 2012 annual report. We are simplifying and

delayering our corporation to create a faster,

leaner, and more agile organization, ready to

act quickly in an ever-changing market environment.

We are dramatically improving our collaboration

across functions, levels, and geographies in order

to form a more exible structure, capable of

unlocking the full potential of our company. We are

offering innovative higher quality building solutions

to meet our customers’ needs. We are enhancing our

strength and competitive advantage in

the global building materials industry, serving as

our clients’ partner of choice. We are taking decisive

steps to strengthen CEMEX,s capital structure and

regain our financial flexibility.

Table of contents

-

Page 1

... in order to form a more flexible structure, capable of unlocking the full potential of our company. We are offering innovative higher quality building solutions to meet our customers' needs. We are enhancing our strength and competitive advantage in the global building materials industry... -

Page 2

... are narrowing our managers' geographic scope, while greatly increasing their spans of control, so they enjoy the room to act swiftly and effectively, while responding more rapidly to our customers' needs. Ultimately, we are accelerating our company's agility to extract greater value from all of our... -

Page 3

... our capital structure and regain our financial flexibility. Operationally, we are dramatically improving our collaboration across functions, levels, and geographies. Commercially, we are developing innovative higher margin specialty products and services to fulfill our customers' everchanging needs... -

Page 4

... clients, expanding both the quality and scope of our commercial offerings. We are evolving from a supplier of building materials to a provider of comprehensive building solutions-collaborating with our customers to deliver integrated value-added products and services for their construction projects... -

Page 5

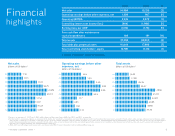

... quarters of year-over-year growth, our operating EBITDA rose 10% to US$2.6 billion in 2012, despite a 2% decline in our consolidated net sales to US$15.0 billion. This is our highest operating EBITDA generation since 2009. Improved pricing and volume in the Americas and Asia, as well as continued... -

Page 6

...until February 2014 and bolstered our liquidity. We have also increased the average life of our debt to 5.0 years, from 3.8 years at the beginning of 2012, with no significant change in annual interest expense. As I have reported in the past, transforming CEMEX is the cornerstone of our strategy to... -

Page 7

... provide training opportunities; cultivate self-employment and development of micro businesses; contribute to disaster relief; and foster local environmental awareness. I want CEMEX to be a good neighbor in all the communities in which we operate. Each of CEMEX's 44,000 employees, who live and work... -

Page 8

... statements of operations accounts, these figures result from translating the local currency amounts into US dollars at the average exchange rate for the year, which approximates a convenience translation of the Mexican peso results for 2012 and 2011 using the average exchange rates of the year of... -

Page 9

We continue to reengineer our corporate DNA, working aggressively to make CEMEX a more agile, flexible, and competitive global corporation. Through our actions, we position our company to extract more value from all of our assets; improve the way we interact with our customers to provide them with ... -

Page 10

...they are operating. Moreover, we flattened our structure in the Philippines, so our commercial and logistical managers report directly to our country president. This enables top management to get more involved in planning commercial strategies, as well as building and managing customer relationships... -

Page 11

... a 10-year strategic agreement with IBM to deliver world-class IT and back-office business process services to our company. A major milestone in our transformation process, this agreement will help to ensure our continued strength and competitive advantage in the global building materials industry... -

Page 12

... value for our customers, we continued to grow our portfolio of integrated building solutions, launched new global ready-mix concrete brands, and introduced a comprehensive pricing strategy that more fully reflects and captures the high value-creating capability of our products and services. A key... -

Page 13

... researchers design advanced building materials that fulfill our customers' increasingly demanding performance requirements. In 2012, we added Insularis to our portfolio of global ready-mix concrete brands. This new brand offers a portfolio of construction solutions and ready-mix concrete products... -

Page 14

...our approach to pricing our different products and services. The value-before-volume framework is being deployed globally and executed locally. Our highly talented commercial teams are undergoing comprehensive training to better prepare them to implement this initiative and to convey the benefits of... -

Page 15

... share offering of a 26.65% minority position in CEMEX Latam Holdings LATAM HOLDINGS Cultural Center Library, Colombia the original Financing Agreement. As a result of this milestone transaction, we not only extended the final maturity of this debt by three years, but also gained more financial... -

Page 16

... amortizations under the new Facilities Agreement until February 2017. We further increased the average life of our debt to 5.0 years, from 3.8 years at the beginning of the year, with no significant change in our annual interest expense. Double U Office Building, Germany < previous I contents... -

Page 17

... our target of a 35% alternative fuels substitution rate by 2015-by far the most ambitious short-term commitment among our global competitors. City of the Future rendering We are also committed to securing alternative renewable sources of energy by either developing projects or contracting with... -

Page 18

Development Certificates) on the Mexican stock exchange. The proceeds from this offering will be invested in a series of energy projects in Mexico, beginning with the construction of the Ventika wind-powered energy park in the northern state of Nuevo Leon. With a minority equity stake not exceeding ... -

Page 19

.... During 2012, 42,989 families benefited from Patrimonio Hoy, bringing the accumulated total to 396,845. Through such exemplary programs, we engage and develop strong long-term relationships with key members of our local communities. 97% 54% of our operations have community engagement plans An... -

Page 20

...74 (445) 50 (904) 1,117 (0.80) n.a Balance sheet information Cash and cash equivalents Net working capital12 Property, plant, and equipment, net Total assets Short-term debt and other financial obligations13 Long-term debt and other financial obligations13 Total liabilities Non-controlling interest... -

Page 21

... in producing plants, as well as, beginning in 2008, freight expenses of raw material in plants and delivery expenses of CEMEX's ready-mix concrete business. 2. For the periods ending December 31, 2002 through 2007, the expenses related to the distribution of the company's products were classified... -

Page 22

... approximate number of employees worldwide Today, we are strategically positioned in the Americas, Europe, Africa, the Middle East, and Asia. Business Strategy We seek to continue to strengthen our global leadership by growing profitably through our integrated positions along the cement value chain... -

Page 23

... in 2014 Eurobonds. We also issued US$1.5 billion of new senior secured notes due 2022. We have continued our asset sale process in order to reduce our debt and streamline our operations. During 2012, we completed the initial share offering of a 26.65% minority position in CEMEX Latam Holdings... -

Page 24

... another, we increase their diversity of experience and knowledge of our business. Foster our sustainable development At CEMEX, sustainability is incorporated in our strategy and our day-to-day operations. Our goal is to provide building solutions that meet the needs of a resource-constrained world... -

Page 25

... help in the development of our local communities, and we collaborate with governments, NGOs, and opinion leaders to anticipate and address emerging social demands. Alignment with Investor Interests Employee stock-ownership plan Chelm Cement Plant, Poland composed of qualified directors who provide... -

Page 26

Management discussion and analysis operational results and financial condition of the company Consolidated Results Net sales declined 2% to US$15.0 billion in 2012 compared with 2011. Higher sales in the U.S. and South, Central America and the Caribbean regions were more than offset by lower sales ... -

Page 27

... associated with changes in interest rates and exchange rates of debt, or both; as an alternative source of financing; and as hedges of (1) highly probable forecasted transactions and (2) CEMEX's net assets in foreign subsidiaries. Under International Financial Reporting Standards (IFRS), CEMEX is... -

Page 28

...2012, our Mexican operations' net sales decreased 3% year over year to US$3.4 billion, and operating EBITDA remained flat at US$1.2 billion. Our domestic gray cement and ready-mix concrete volumes decreased 1% and 2%, respectively, while our aggregates volumes increased 2% for the year. Construction... -

Page 29

... gray cement, ready-mix concrete, and aggregates volumes decreased 19%, 9%, and 15%, respectively, for the year. Our Spanish operations' domestic gray cement and ready-mix concrete volumes decreased 40% and 43%, respectively, for the year. The decline in sales volumes for building materials during... -

Page 30

Global capacity CEMENT PRODUCTION CEMENT CAPACITY (MILLION PLANTS METRIC TONS/YEAR) CONTROLLED CEMENT PLANTS READY-MIX MINORITY PART. PLANTS AGGREGATES QUARRIES LAND DISTRIBUTION CENTERS MARINE TERMINALS Mexico United States Northern Europe1 Mediterranean2 South, Central America and the Caribbean3 ... -

Page 31

... materials our regional domestic gray cement volumes increased 12%, while our ready-mix concrete and aggregates volumes declined 18% and 54%, respectively, for the year. In the Philippines, our operations' domestic gray cement volumes increased 15% in 2012. Sales volumes for the year benefited... -

Page 32

... New Sunward Holding B.V., Cemex Research Group AG, Cemex Shipping B.V., Cemex Asia B.V., CEMEX France Gestion (S.A.S.), CEMEX UK, and Cemex Egyptian Investments B.V. CEMEX to increase cement production capacity in the Philippines On September 17, 2012, CEMEX announced that it is planning to expand... -

Page 33

...; maximize internal efficiencies; and allow the company to better serve its customers. The 10-year services contract awarded to IBM is worth just over US$1 billion, and will include: finance and accounting and human resource back-office services, as well as IT infrastructure, application development... -

Page 34

... of the shares. Dividends US dollars per ADS 01 02 03 04 05 06 07 0.51 0.52 0.51 0.61 0.60 0.90 0.83 For the years 2008, 2009, 2010, and 2011 a recapitalization of retained earnings was approved. For more information read note 11 on page 21. Caracolito Cement Plant in Colombia < previous... -

Page 35

... the obligations under the Financing Agreement, dated August 14, 2009, as amended, and other senior secured debt having the benefit of such collateral. Mexico City International Airport Results as of 11:59 p.m., New York City Time, on March 23, 2012 APPROXIMATE AGGREGATE PRINCIPAL AMOUNT TENDERED... -

Page 36

... auditors' report 38 Consolidated statements of operations 39 Consolidated statements of comprehensive loss 40 Consolidated balance sheets 41 Consolidated statements of cash flows 42 Consolidated statements of changes in stockholders' equity 43 Notes to the consolidated financial statements 119... -

Page 37

... subsidiaries ("the Company"), which comprise the consolidated balance sheets as at December 31, 2012 and 2011, the consolidated statements of operations, comprehensive loss, changes in stockholders' equity, and cash flows for the years ended December 31, 2012, 2011 and 2010, and notes, comprising... -

Page 38

Consolidated Note 2012 Years ended December 31, 2011 2010 statements of operations CEMEX, S.A.B. de C.V. and subsidiaries (Millions of Mexican pesos, except for loss per share) Net sales Cost of sales Gross proï¬t Administrative and selling expenses Distribution expenses 3 2R $ 197,036 (... -

Page 39

... statements of comprehensive loss CEMEX, S.A.B. de C.V. and subsidiaries (Millions of Mexican pesos) Note 2012 Years ended December 31, 2011 2010 Consolidated net loss Items that will not be reclassiï¬ed subsequently to proï¬t or loss Actuarial losses Income tax recognized directly... -

Page 40

Consolidated balance sheets CEMEX, S.A.B. de C.V. and subsidiaries (Millions of Mexican pesos) Note Years ended December 31, 2012 2011 Assets Current assets Cash and cash equivalents Trade receivables less allowance for doubtful accounts Other accounts receivable Inventories, net Other current ... -

Page 41

... statements of Notes 2012 Years ended December 31, 2011 2010 Operating activities Consolidated net loss Non-cash items: Depreciation and amortization of assets Impairment losses Equity in loss of associates Other expenses (income), net Comprehensive ï¬nancing result Income taxes Changes... -

Page 42

Consolidated statements of changes in stockholders' equity CEMEX, S.A.B. de C.V. and subsidiaries (Millions of Mexican pesos) Notes Common stock Additional paid-in capital Other equity reserves Retained earnings Total controlling interest Non-controlling interest Total stockholders' equity Balance... -

Page 43

... of the United Mexican States, or Mexico, is a holding company (parent) of entities whose main activities are oriented to the construction industry, through the production, marketing, distribution and sale of cement, ready-mix concrete, aggregates and other construction materials. CEMEX, S.A.B. de... -

Page 44

... $1,558, respectively, associated with the negotiation of capital leases during the year (note 16B); In 2011, the increase in debt for $1,352 related mainly to the acquisition of Ready Mix USA LLC (note 15B); In 2011, the decrease in debt and in perpetual debentures within non-controlling interest... -

Page 45

..., the accounts of the subsidiary's statements of operations should be restated to constant amounts as of the reporting date, in which case, both the balance sheet accounts and the statements of operations accounts would be translated to pesos at the closing exchange rates of the year. < previous... -

Page 46

... programs, in which CEMEX maintains a residual interest in the trade accounts receivable sold in case of recovery failure, as well as continued involvement in such assets, do not qualify for derecognition and are maintained on the balance sheet. 2G) Inventories (note 11) Inventories are valued... -

Page 47

...instruments held for trading, as well as those investments available for sale, classified under IAS 39, are recognized at their estimated fair value, in the first case through the statements of operations as part of other financial income (expenses), net, and in the second case, changes in valuation... -

Page 48

... investments are tested for impairment upon the occurrence of factors such as the occurrence of a significant adverse event, changes in CEMEX's operating environment, changes in projected use or in technology, as well as expectations of lower operating results for each cash generating unit, in order... -

Page 49

... to, among other factors, the estimation of future prices of CEMEX's products, the development of operating expenses, local and international economic trends in the construction industry, the long-term growth expectations in the different markets, as well as the discount rates and the growth... -

Page 50

... expense of the related debt is accrued, in the case of interest rate swaps, or when the underlying products are consumed in the case of contracts on the price of raw materials and commodities. Likewise, in hedges of the net investment in foreign subsidiaries, changes in fair value are recognized in... -

Page 51

... consolidated financial statements Notes Put options granted for the purchase of non controlling interests and associates Represent agreements by means of which CEMEX commits to acquire, in case the counterparty exercises its right to sell at a future date at a predefined price formula, the shares... -

Page 52

...associated with employees' benefits for: a) defined benefit pension plans; and b) other postretirement benefits, basically comprised of health care benefits, life insurance and seniority premiums, granted by CEMEX and/or pursuant to applicable law. These costs are recognized as services are rendered... -

Page 53

... position are recognized. CEMEX's policy is to recognize interest and penalties related to unrecognized tax benefits as part of the income tax in the consolidated statements of operations. 2P) Stockholders' equity Common stock and additional paid-in capital (note 20A) These items represent the value... -

Page 54

... material in plants and delivery expenses of CEMEX's ready-mix concrete business, but excludes freight expenses of finished products between plants and points of sale and freight expenses between points of sales and the customers' facilities, which are included as part of the distribution expenses... -

Page 55

...geographic concentration within the countries in which CEMEX operates. As of and for the years ended December 31, 2012, 2011 and 2010, no single customer individually accounted for a significant amount of the reported amounts of sales or in the balances of trade receivables. In addition, there is no... -

Page 56

... to assess. CEMEX does not expect the application of IFRS 10 to have a significant impact on its consolidated financial statements. In May 2011, the IASB issued IFRS 11, Joint arrangements ("IFRS 11"), effective beginning January 1, 2013. IFRS 11 addresses inconsistencies in the reporting of joint... -

Page 57

... statements. • • 3) Revenues and construction contracts For the years ended December 31, 2012, 2011 and 2010, net sales, after sales and eliminations between related parties resulting from consolidation, were as follows: 2012 2011 2010 From the sale of goods associated to CEMEX's main... -

Page 58

..., marketing and sale of cement, ready-mix concrete, aggregates and other construction materials, the allocation of resources and the review of their performance and operating results. All regional presidents report directly to CEMEX's Chief Executive Officer. The country manager, who is one... -

Page 59

...ready-mix concrete operations in Argentina; and d) "Rest of Asia" is mainly comprised of CEMEX's operations in Thailand, Bangladesh, China and Malaysia. The segment "Others" refers to: 1) cement trade maritime operations, 2) Neoris, N.V., CEMEX's subsidiary involved in the development of information... -

Page 60

...net 2011 Net sales Operating EBITDA Financial expense Mexico $ 43,361 United States 32,759 Northern Europe United Kingdom 15,757 Germany 15,975 France 14,170 Rest of Northern Europe 14,278 Mediterranean Spain 7,142 Egypt 6,516 Rest of Mediterranean 7,762 South America and the Caribbean Colombia... -

Page 61

...fixed assets 1 Mexico $ United States Northern Europe United Kingdom Germany France Rest of Northern Europe Mediterranean Spain Egypt Rest of Mediterranean South America and the Caribbean Colombia Rest of South America and the Caribbean Asia Philippines Rest of Asia Others Total $ 2011 834 187 496... -

Page 62

to the consolidated financial statements Notes Net sales by product and geographic segment for the years ended December 31, 2012, 2011 and 2010 were as follows: 2012 Cement Concrete Aggregates Others Eliminations Net sales Mexico $ United States Northern Europe United Kingdom Germany France Rest ... -

Page 63

... statements Notes Net sales by product and geographic segment - continued 2010 Cement Concrete Aggregates Others Eliminations Net sales Mexico $ United States Northern Europe United Kingdom Germany France Rest of Northern Europe Mediterranean Spain Egypt Rest of Mediterranean South America... -

Page 64

... to the terms of the programs. The portion of the accounts receivable sold maintained as reserves amounted to $2,280 in 2012 and $3,181 in 2011. Therefore, the funded amount to CEMEX was $8,512 (US$662) in 2012 and $9,552 (US$684) in 2011. The discount granted to the acquirers of the trade accounts... -

Page 65

... Work-in-process Raw materials Materials and spare parts Inventory in transit Allowance for obsolescence $ $ 5,934 2,819 2,980 4,523 820 (591) 16,485 6,437 2,597 3,219 5,328 517 (444) 17,654 For the years ended December 31, 2012, 2011 and 2010, CEMEX recognized in the statements of operations... -

Page 66

... in the development, building and operation of the invested assets, if any. As of December 31, 2012, different projects were being considered but CEMEX did not have any investment in Blue Rock - TRG. Equity in net income (loss) of associates by geographic operating segment in 2012, 2011 and 2010 is... -

Page 67

to the consolidated financial statements Notes Combined condensed balance sheet information of CEMEX's associates as of December 31, 2012 and 2011 is set forth below: 2012 2011 Current assets Non-current assets Total assets Current liabilities Non-current liabilities Total liabilities Total net ... -

Page 68

... (2,797) 1,169 38 (15,337) (1,161) (13,727) 292,343 (71,072) 221,271 Includes corporate buildings and related land sold to financial institutions during 2012 and 2011, which were leased back, without incurring any change in the carrying amount of such assets or gain or loss on the transactions. The... -

Page 69

... events, mainly: a) the closing and/or reduction of operations of cement and ready-mix concrete plants resulting from adjusting the supply to current demand conditions; and b) the transferring of installed capacity to more efficient plants, for the years ended December 31, 2012, 2011 and 2010, CEMEX... -

Page 70

...within operating costs and expenses. Goodwill Changes in consolidated goodwill in 2012, 2011 and 2010 were as follows: 2012 2011 2010 Balance at beginning of period Business combinations Disposals and cancellations 1 Reclassiï¬cation to assets held for sale 2 Impairment losses (note 15C) 3 Foreign... -

Page 71

... the consolidated financial statements Notes Intangible assets of definite life Changes in intangible assets of definite life in 2012, 2011 and 2010 were as follows: 2012 Extraction rights Industrial property and trademarks Customer relations Mining projects 1 Others Total Balance at beginning... -

Page 72

... mainly to the measurement at fair value of CEMEX's previously held equity interest in Ready Mix USA, LLC, and was recognized within "Other expenses, net." The consolidated financial statements of CEMEX as of December 31, 2011 included the balance sheet of Ready Mix USA, LLC as of December 31, 2011... -

Page 73

... in the information technology and software development business. CEMEX is engaged in the production, marketing, distribution and sale of cement, ready-mix concrete, aggregates and other construction materials. The geographic operating segments reported by CEMEX (note 4) represent CEMEX's groups of... -

Page 74

... other factors, the estimation of future prices of CEMEX's products, the development of operating expenses, local and international economic trends in the construction industry, the long-term growth expectations in the different markets, as well as the discount rates and the long-term growth rates... -

Page 75

... products, among other factors. CEMEX has also considered recent developments in its operations in the United States, such as the 20% and 7% increase in ready-mix concrete volumes in 2012 and 2011, respectively, and the 4% and 3% increase in 2012 and 2011, respectively, of ready-mix concrete prices... -

Page 76

... 31, 2012 and 2011, CEMEX considers that its combination of discount rate and long-term growth rate applied in the base model for its group of CGUs in the United States to which goodwill has been allocated reflect the particular risk factors existing as of the date of analysis. 16) Financial... -

Page 77

... financial statements Notes 2012 Short-term Long-term 2011 Short-term Long-term Bank loans Loans in Mexico, 2013 to 2014 $ Loans in foreign countries, 2013 to 2018 Syndicated loans, 2013 to 2017 - 2 - 2 1,088 3,770 49,972 54,830 Bank loans Loans in Mexico, 2012 to 2014 Loans in foreign... -

Page 78

...during 2009, 2010, 2011 and finally on September 17, 2012 (the "Financing Agreement"), with the completion of the Exchange Offer on September 17, 2012, as further described in this note 16. On September 17, 2012, in connection with the Facilities Agreement described elsewhere in this note 16A, CEMEX... -

Page 79

... 31, 2011 and 2010, after the application of the proceeds from the refinancing transactions disclosed above and in note 16B and others, the application of the net proceeds obtained from the sale of assets, and the equity offering in 2009, the remaining debt balance under the Financing Agreement was... -

Page 80

... the United States; c) sell selected assets in Europe; and/or d) sale of other non-core assets. If during the Facilities Agreement term CEMEX pays down US$1,500 and US$2,000 of aggregate principal amount under the Facilities Agreement, the interest rate under the outstanding amount of the New Notes... -

Page 81

...; (iii) change CEMEX's business or the business of any obligor or material subsidiary (in each case, as defined in the Facilities Agreement); (iv) enter into mergers; (v) enter into agreements that restrict its subsidiaries' ability to pay dividends or repay intercompany debt; (vi) acquire assets... -

Page 82

... times for the period ending December 31, 2011. CEMEX's ability to comply with these ratios may be affected by economic conditions and volatility in foreign exchange rates, as well as by overall conditions in the financial and capital markets. For the compliance periods ended as of December 31, 2012... -

Page 83

... financial statements Notes For 2013 and going forward, CEMEX believes that it will continue to comply with its covenants under its Facilities Agreement, as it is expecting to benefit from cost savings programs implemented during 2012 and 2011, favorable market conditions in some of its key... -

Page 84

... within "Other equity reserves." IV. Liabilities secured with accounts receivable As mentioned in note 9, as of December 31, 2012 and 2011, CEMEX maintained securitization programs for the sale of trade accounts receivable established in Mexico, the United States, France and the United Kingdom, and... -

Page 85

... consolidated financial statements Notes 16C) Fair value of financial instruments Financial assets and liabilities CEMEX's carrying amounts of cash, trade accounts receivable, other accounts receivable, trade accounts payable, other accounts payable and accrued expenses, as well as short-term debt... -

Page 86

... October 2013. These contracts were intended to maintain the exposure to changes in the price of such entity. Changes in the fair value of this instrument generated losses of approximately US$7 ($100) in 2012, US$35 ($437) in 2011 and US$42 ($526) in 2010, recognized in the statements of operations... -

Page 87

.... Changes in fair value of the conversion options generated a loss in 2012 of approximately US$243 ($3,078) and a gain in 2011 of approximately US$279 ($3,482). On March 30, 2010, in connection with the offering of the 2015 Notes and to effectively increase the conversion price for CEMEX's CPOs... -

Page 88

... changes in foreign exchange rates relates primarily to its operating activities. Due to its geographic diversification, CEMEX's revenues and costs are generated and settled in various countries and in different currencies. For the year ended December 31, 2012, approximately 21% of CEMEX's net sales... -

Page 89

... through the statements of operations as part of "Other financial income (expense), net." A significant decrease in the market price of CEMEX's CPOs and third party shares would negatively affect CEMEX's liquidity and financial position. As of December 31, 2012 and 2011, the potential change in the... -

Page 90

...risks from changes in foreign currency exchange rates, price and currency controls, interest rates, inflation, governmental spending, social instability and other political, economic and/or social developments in the countries in which they operate, any one of which may materially increase CEMEX net... -

Page 91

... include items related to tax contingencies. As of December 31, 2012 and 2011, includes approximately $12,526 and $11,717, respectively, of the non-current portion of taxes payable recognized in 2009 as a result of changes to the tax consolidation regime in Mexico (note 19D). Approximately... -

Page 92

...years ended December 31, 2012, 2011 and 2010 were approximately $528, $357 and $550, respectively. CEMEX contributes periodically the amounts offered by the pension plan to the employee's individual accounts, not retaining any remaining liability as of the balance sheet date. Defined benefit pension... -

Page 93

... net periodic cost were as follows: United States 2012 United Range of rates in Kingdom other countries United States $ 1,985 1,931 1,940 1,999 2,037 11,344 Mexico Mexico 2011 United Range of rates in Kingdom other countries Discount rates Rate of return on plan assets Rate of salary increases... -

Page 94

...the consolidated financial statements Notes Significant events related to employees' pension benefits Applicable regulation in the United Kingdom requires entities to maintain plan assets at a level similar to that of the obligations. In November 2012, in order to better manage CEMEX's obligations... -

Page 95

... financial statements Notes Information related to other postretirement benefits In some countries, CEMEX has established health care benefits for retired personnel limited to a certain number of years after retirement. As of December 31, 2012 and 2011, the projected benefits obligation related... -

Page 96

... income taxes during 2012, 2011 and 2010 were as follows: 2012 2011 2010 Deferred income tax (charged) credited to the statements of operations 1 Deferred income tax (charged) credited to stockholders' equity Reclassiï¬cation to other captions in the balance sheet Change in deferred income tax for... -

Page 97

... future periods. For the years ended December 31, 2012, 2011 and 2010, CEMEX has reported pre-tax losses on a worldwide consolidated basis. Nonetheless, based on the same forecasts of future cash flows and operating results used by CEMEX's management to allocate resources and evaluate performance in... -

Page 98

... consolidated financial statements Notes 19D) Uncertain tax positions and significant tax proceedings As of December 31, 2012 and 2011, as part of short-term and long-term provisions and other liabilities (note 17), CEMEX has recognized provisions related to unrecognized tax benefits in connection... -

Page 99

... tax earnings in the controlled subsidiaries that generated the tax loss carryforwards in the past. Changes in the Parent Company's tax payable associated with the tax consolidation in Mexico in 2012, 2011 and 2010 were as follows: 2012 2011 2010 Balance at the beginning of the year Income tax... -

Page 100

... statements Notes • On November 10, 2010, the Colombian tax authority notified CEMEX Colombia of a proceeding in which the Colombian tax authority rejected certain tax losses taken by CEMEX Colombia in its 2008 year-end tax return. In addition, the Colombian tax authority assessed an increase... -

Page 101

...on September 4, 2009; and (iv) increase the variable common stock by issuing up to 1,500 million shares (500 million CPOs) which will be kept in CEMEX's treasury and used to be subscribed and paid pursuant to the terms and conditions of CEMEX's long-term compensation stock program (note 21), without... -

Page 102

... the "Fixed program" (note 21A) generated additional paid-in capital of approximately $11 in 2011 and $5 in 2010, and increased the number of shares outstanding. In addition, in connection with the long-term executive stock-based compensation programs (note 21), in 2012, 2011 and 2010, CEMEX issued... -

Page 103

...224,000 new common shares offered in such private placement that were subject to a put option granted to the initial purchasers during the 30-day period following closing of the offering. CEMEX Latam's assets include substantially all of CEMEX's cement and ready-mix assets in Colombia, Panama, Costa... -

Page 104

....48 in 2012, $11.42 in 2011 and $12.12 in 2010. In 2012, CEMEX initiated a new stock-based compensation program for a group of executives which is linked to both internal performance conditions (increase in Operating EBITDA), as well as market conditions (increase in the price of CEMEX's CPO), over... -

Page 105

... financial statements Notes Until 2005, CEMEX granted stock options to executives based on CEMEX's CPO. Options outstanding under CEMEX's programs represent liability instruments, except for those of its "Fixed program," which was designated as equity instruments (note 2S). The information related... -

Page 106

... value as of the date of the financial statements, recognizing changes in valuations in the statements of operations. Changes in the provision for executive stock option programs for the years ended December 31, 2012, 2011 and 2010 were as follows: Restricted program Variable program Special program... -

Page 107

...retained earnings declared in February 2012 and February 2011, as applicable (note 20A). According to resolution of the stockholders' meetings on February 23, 2012 and February 24, 2011. The number of CPO to be issued under the executive stock-based compensation programs, as well as the total amount... -

Page 108

...cement plants' electricity needs in Mexico during such year. This agreement is for CEMEX's own use and there is no intention of trading in energy by CEMEX. In 2007, CEMEX Ostzement GmbH ("COZ"), CEMEX's subsidiary in Germany, entered into a long-term energy supply contract with Vattenfall Europe New... -

Page 109

... services (back office) in finance, accounting and human resources; as well as IT infrastructure services, support and maintenance of IT applications in the countries in which CEMEX operates. 23D) Commitments from employee benefits In some countries, CEMEX has self-insured health care benefits plans... -

Page 110

...other sales conditions of cement, and that the producers exchanged confidential information, all of which limited competition in the Polish cement market. In January 2007, CEMEX Polska filed its response to the notification, denying that it had committed the practices listed by the Protection Office... -

Page 111

... and financial position. On January 20, 2012, the United Kingdom Competition Commission (the "UK Commission"), commenced a market investigation into the supply or acquisition of cement, ready-mix concrete and aggregates. The referral to the UK Commission was made by the Office of Fair Trading... -

Page 112

... in anti-competitive agreements and/or concerted practices. This investigation is related to unannounced previous inspections carried out by the EC in the United Kingdom and Germany in November 2008. CEMEX has received requests for information from the EC in September 2009, October 2010 and December... -

Page 113

... financial statements Notes • In October 2009, CEMEX Corp., one of CEMEX's subsidiaries in the United States, and other cement and concrete suppliers were named as defendants in several purported class action lawsuits alleging price fixing in Florida. The purported class action lawsuits... -

Page 114

... Florida operating results. In November 2008, AMEC/Zachry, the general contractor for CEMEX's expansion program in Brooksville, Florida, filed a lawsuit against CEMEX Florida in the United States, alleging delay damages and seeking an equitable adjustment to the contract and payment of change orders... -

Page 115

...statements Notes • In July 2008, Strabag SE ("Strabag"), one of the leading suppliers of building materials in Europe, entered into a Share Purchase Agreement ("SPA") to purchase CEMEX's operations in Austria and Hungary for â,¬310 (US$409 or $5,256), subject to authorization of the competition... -

Page 116

... financial statements Notes • In August 2005, a lawsuit was filed against a subsidiary of CEMEX Colombia and other members of the Asociación Colombiana de Productores de Concreto, or ASOCRETO, a union formed by all the ready-mix concrete producers in Colombia. The lawsuit claimed that CEMEX... -

Page 117

..., during 2012, 2011 and 2010, there were no loans between CEMEX and its board members or other members of its top management. For the years ended December 31, 2012, 2011 and 2010, the aggregate amount of compensation of CEMEX, S.A.B. de C.V.'s board of directors, including alternate directors, and... -

Page 118

..., Ltda. Global Cement, S.A. CEMEX El Salvador, S.A. Readymix Argentina, S.A. CEMEX Jamaica. Neoris N.V. 1 2 3 Mexico Spain United States Spain Costa Rica Nicaragua Egypt Colombia Panama Dominican Republic Puerto Rico France Philippines Philippines Thailand Malaysia United Kingdom Germany Austria... -

Page 119

Annex A Table of contents 120 Independent auditors' report 121 Statements of operations 122 Statements of comprehensive loss 123 Balance sheets 124 Statements of cash flows 125 Statements of changes in stockholders' equity 126 Notes to the financial statements < previous I contents I next > -

Page 120

... financial statements of CEMEX, S.A.B. de C.V. ("the Company"), which comprise the balance sheets as at December 31, 2012 and 2011, the statements of operations, comprehensive loss, changes in stockholders' equity, and cash flows for the years ended December 31, 2012, 2011 and 2010, and notes... -

Page 121

Statements of operations CEMEX, S.A.B. DE C.V. (Parent company-only) (Millions of Mexican pesos) Note 2012 Years ended December 31, 2011 2010 Rental income License fees Total revenues Administrative expenses Operating earnings before other expenses, net 1 Other expenses, net Operating earnings ... -

Page 122

... of comprehensive loss CEMEX, S.A.B. DE C.V. (Parent company-only) (Millions of Mexican pesos) Note 2012 Years ended December 31, 2011 2010 Net loss $ (209) (20,271) (3,674) Items that will not be reclassiï¬ed subsequently to proï¬t or loss Income tax recognized directly in other... -

Page 123

Balance Sheets CEMEX, S.A.B. DE C.V. (Parent company-only) (Millions of Mexican pesos) Note Years ended December 31, 2012 2011 Assets Current assets Cash and cash equivalents Other accounts receivable Accounts receivable from related parties Total current assets 5 6 11 $ 20 645 277 942 309,166 4,... -

Page 124

... of cash flows CEMEX, S.A.B. DE C.V. (Parent company-only) (Millions of Mexican pesos) Note 2012 Years ended December 31, 2011 2010 Operating activities Net loss Non-cash items: Depreciation of buildings Comprehensive ï¬nancing result Income taxes Changes in working capital Net cash ï¬,ow... -

Page 125

Statements of changes in stockholders' equity CEMEX, S.A.B. DE C.V. (Parent company-only) (Millions of Mexican pesos) Additional paid-in capital Other equity reserves Retained earnings Total stockholders' equity Note Common stock Balances at January 1, 2010 Total other items of comprehensive loss... -

Page 126

... 2012, 2011 and 2010 (Millions of Mexican pesos) 1) Description of business CEMEX, S.A.B. de C.V. is a Mexican holding company (parent) of entities whose main activities are oriented to the construction industry, through the production, marketing, distribution and sale of cement, ready-mix concrete... -

Page 127

... the foreign exchange rates used by CEMEX, S.A.B. de C.V. and those exchange rates published by the Mexican Central Bank. 2D) Business concentration CEMEX, S.A.B. de C.V. provides 100% of its services to the subsidiaries in the countries in which the company has operations. According to its analysis... -

Page 128

... in financial instruments held for trading, as well as those investments available for sale, classified under IAS 39, are recognized at their estimated fair value, in the first case through the statements of operations as part of other financial income, net, and in the second case, changes in... -

Page 129

... among other factors, to the estimation of future prices of CEMEX's products, the development of operating expenses, local and international economic trends in the construction industry, the long-term growth expectations in the different markets, as well as the discount rates and the growth rates in... -

Page 130

...in order to change the risk profile associated with changes in interest rates, the exchange rates of debt, or both; and as an alternative source of financing. CEMEX, S.A.B. de C.V. recognizes all derivative instruments as assets or liabilities in the balance sheet at their estimated fair values, and... -

Page 131

... all available positive and negative evidence, including factors such as market conditions, industry analysis, expansion plans, projected taxable income, carryforward periods, current tax structure, potential changes or adjustments in tax structure, tax planning strategies, future reversals... -

Page 132

... Revenue from services is recognized when services are rendered to customers, and there is no condition or uncertainty implying a reversal thereof. 2Q) Executive stock-based compensation Based on IFRS 2, Share-based payments ("IFRS 2"), stock awards based on shares of CEMEX granted to executives are... -

Page 133

Notes to the financial statements • In May 2011, the IASB issued IFRS 12, Disclosure of interests in other entities ("IFRS 12"), effective beginning January 1, 2013, which is a new and comprehensive standard on disclosure requirements for all forms of interests in other entities, including ... -

Page 134

Notes to the financial statements 6) Other accounts receivable As of December 31, 2012 and 2011, short-term accounts receivable consisted of the following: 2012 2011 Non-trade accounts receivable Other refundable taxes $ $ - 645 645 86 412 498 7) Investments in subsidiaries and associates and ... -

Page 135

... $ 54 4,100 4,154 57,251 3,266 60,517 57,305 7,366 64,671 6.6% 9.6% 1 Represents the weighted average effective interest rate. 2012 Short-term Long-term 2011 Short-term Long-term Bank loans Loans in Mexico, 2013 to 2014 $ Loans in foreign countries, 2013 to 2018 Syndicated loans, 2013 to 2014... -

Page 136

... 31, 2011 and 2010, after the application of the proceeds from the refinancing transactions disclosed above and in this note and others, the application of the net proceeds obtained from the sale of assets, and the equity offering in 2009, the remaining debt balance under the Financing Agreement was... -

Page 137

... the United States; c) sell selected assets in Europe; and/or d) sale of other non-core assets. If during the Facilities Agreement term CEMEX pays down US$1,500 and US$2,000 of aggregate principal amount under the Facilities Agreement, the interest rate under the outstanding amount of the New Notes... -

Page 138

...; (iii) change CEMEX's business or the business of any obligor or material subsidiary (in each case, as defined in the Facilities Agreement); (iv) enter into mergers; (v) enter into agreements that restrict its subsidiaries' ability to pay dividends or repay intercompany debt; (vi) acquire assets... -

Page 139

... times for the period ending December 31, 2011. CEMEX's ability to comply with these ratios may be affected by economic conditions and volatility in foreign exchange rates, as well as by overall conditions in the financial and capital markets. For the compliance periods ended as of December 31, 2012... -

Page 140

...the Facilities Agreement. That scenario will have a material adverse effect on CEMEX, S.A.B. de C.V.'s liquidity, capital resources and financial position. 10B) Other financial obligations Other financial obligations in the balance sheet of CEMEX, S.A.B. de C.V. as of December 31, 2012 and 2011, are... -

Page 141

... to the financial statements III. Mandatorily convertible securities due in 2019 In December 2009, CEMEX, S.A.B. de C.V. completed its offer to exchange CBs issued in Mexico, into mandatorily convertible securities for approximately $4,126 (US$315). Reflecting antidilution adjustments, at their... -

Page 142

..., CEMEX, S.A.B. de C.V. held interest rate swaps, as well as forward contracts and other derivative instruments on its own shares and third parties' shares, with the objective of, as the case may be: a) changing the risk profile associated with the price of raw materials and other energy projects... -

Page 143

...respectively. Changes in fair value of the conversion options generated a loss in 2012 of approximately US$243 ($3,078) and a gain in 2011 of approximately US$279 ($3,482). On March 30, 2010, in connection with the offering of the 2015 Notes and to effectively increase the conversion price for CEMEX... -

Page 144

...the fair value of future cash flows of a financial instrument will fluctuate because of changes in foreign exchange rates. The exposure of CEMEX, S.A.B. de C.V. to the risk of changes in foreign exchange rates relates primarily to its operating activities and certain financial assets and liabilities... -

Page 145

... improvements to optimize capacity utilization and maximize profitability, as well as borrowing under credit facilities, proceeds of debt and equity offerings, and proceeds from asset sales. The net cash flows provided by operating activities in 2012 and 2011, as presented in its statements of cash... -

Page 146

..., 2012 and 2011, the main accounts receivable and payable with related parties, are the following: Assets 2012 Short-term Long-term Liabilities Short-term Long-term CEMEX México, S.A. de C.V. CEMEX Research Group AG. CEMEX Latam Holdings S.A. Construction Funding Corporation CEMEX Central, S.A. de... -

Page 147

... 2012 the CEMEX, S.A.B. de C.V.'s parent company-only tax loss carryforwards by expiration date are the following: Period of occurrence of the loss Balance carryforward Expiration year 2003 2004 2005 2006 2007 and thereafter $ 654 57 403 1,187 43,940 46,241 2013 2014 2015 2016 - In November 2009... -

Page 148

... years 2012 and 2011 includes an expense of approximately $31 for both periods, related to equity issuance expenses, recognized in other equity reserves. CEMEX, S.A.B. de C.V.'s management considers that sufficient taxable income will be generated in the future to realize the tax benefits associated... -

Page 149

...effective rate shown in the statements of operations of CEMEX, S.A.B. de C.V. As of December 31, 2012, 2011 and 2010, these differences are explained as follows: 2012 % 2011 % 2010 % Tax law income tax rate Unrecognized tax beneï¬ts in the year Inï¬,ation adjustments Tax consolidation effect (note... -

Page 150

...in capital of approximately $11 in 2011 and $5 in 2010, and increased the number of shares outstanding. In addition, in connection with the cost associated with the executive long-term compensation programs in CEMEX, S.A.B. de C.V.'s CPO, CEMEX, S.A.B. de C.V. generated additional paid-in capital of... -

Page 151

... the trust. The purchase price per CPO in dollars and the corresponding number of CPOs under this transaction are subject to dividend adjustments. CEMEX recognizes a liability for the fair value of the guarantee, and changes in valuation were recorded in the statements of operations (note 10D). 14D... -

Page 152

.... 16) Subsequent events In connection with the tax proceeding related to the taxes payable in Mexico from passive income generated by foreign investments for the years 2005 and 2006 and the transitory amnesty provision both of which are described in note 15, on January 31, 2013, CEMEX, S.A.B. de... -

Page 153

...on the Mexican Stock Exchange. pp equals percentage points. Strategic capital expenditures CEMEX defines it as investments incurred with the purpose of increasing the company's profitability. These include capital expenditures on projects designed to increase profitability by expanding capacity, and... -

Page 154

... Corporate Practices Committee Dionisio Garza Medina President Bernardo Quintana Isaac Rafael Rangel Sostmann Finance Committee Rogelio Zambrano Lozano President Tomás Milmo Santos Rodolfo GarcÃa Muriel Francisco Javier Fernández Carbajal Secretary Ramiro Villarreal Morales (not a member... -

Page 155

... CEMEX Northern Europe Ignacio Madridejos joined CEMEX in 1996, and after holding management positions in the Strategic Planning area, he headed CEMEX operations in Egypt, Spain, and Western Europe. He is currently President of CEMEX Northern Europe, and is also responsible for the company's global... -

Page 156

... a successful career of more than 22 years in the building materials industry. Since then he has held several senior positions in the company's operations in Florida and the Eastern region of the United States. Before joining CEMEX, he headed the ready-mix concrete and concrete products divisions... -

Page 157

...-2542 New York office 590 Madison Ave. 41st floor New York, NY 10022 USA Phone : (212) 317-6000 Fax : (212) 317-6047 Exchange listings Bolsa Mexicana de Valores (BMV) Mexico Ticker symbol: CEMEXCPO Share series: CPO (representing two A shares and one B share) New York Stock Exchange (NYSE) United... -

Page 158

... forward-looking statements. Readers should review future reports filed by us with the SEC and the BMV and/or CNBV. This annual report also includes statistical data regarding the production, distribution, marketing and sale of cement, ready-mix concrete, clinker and aggregates. We generated some of... -

Page 159

... consolidated financial information 22 Company overview 26 Management discussion and analysis, operational results and financial condition of the company 28 Global review of operation 32 Capital market initiatives Financial statemens Terms we use Board of Directors Executive Committee Investor and... -

Page 160

www.cemex.com < previous I contents I next > 160