Cathay Pacific 2015 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2015 Cathay Pacific annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report 2015

3

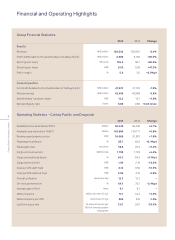

The Cathay Pacific Group reported an attributable profit of HK$6,000 million for 2015. This

compares to a profit of HK$3,150 million in 2014. Earnings per share were HK152.5 cents

compared to HK80.1 cents in the previous year.

Chairman’s Letter

The Group’s performance in 2015 was better than in 2014.

The business benefited from low fuel prices. The high

passenger load factors experienced in the first half of the

year continued in the second half. This reflected strong

economy class demand. Premium class demand was not as

strong as expected on some long-haul routes. Air cargo

demand, which came under pressure during the second

quarter of the year, remained weak in the second half. There

was an improved contribution from the Group’s subsidiary

and associated companies.

The Group’s passenger revenue in 2015 was HK$73,047

million, a decrease of 3.5% compared to 2014. Capacity

increased by 5.9%, reflecting the introduction of new routes

(to Boston, Düsseldorf, Hiroshima and Zurich) and increased

frequencies on some other routes. The load factor

increased by 2.4 percentage points, to 85.7%. Strong

competition, a significant reduction in fuel surcharges,

unfavourable foreign currency movements and the fact that

a higher proportion of passengers were connecting through

Hong Kong put downward pressure on yield, which

decreased by 11.4%, to HK59.6 cents. Economy class

demand was strong. Premium class demand improved on

regional routes but was not as strong as expected on some

long-haul routes.

The Group’s cargo revenue in 2015 was HK$23,122 million,

a decrease of 9.0% compared to the previous year. This

mainly reflected a reduction in fuel surcharges consequent

upon lower fuel prices. Capacity for Cathay Pacific and

Dragonair increased by 5.4%. The load factor decreased by

0.1 percentage point to 64.2%. Strong competition,

overcapacity, unfavourable foreign currency movements

and the reduction in fuel surcharges put pressure on yield,

which decreased by 13.2%, to HK$1.90. Demand was strong

in the first quarter of 2015, assisted by industrial action at

ports on the west coast of the United States. Overall

demand was weak for the rest of the year, particularly on

European routes.

Total fuel costs for Cathay Pacific and Dragonair (before the

effect of fuel hedging) decreased by HK$14,561 million (or

37.8%) compared to 2014, despite increases in capacity. A

40.3% decrease in average prices was partially offset by a

4.3% increase in consumption. Fuel is still the Group’s most

significant cost, accounting for 34.0% of our total operating

costs in 2015 (compared to 39.2% in 2014). Fuel hedging

losses reduced the benefit of lower fuel costs. After taking

hedging losses into account, fuel costs decreased by

HK$7,331 million (or 18.2%) compared to 2014.

The Group’s operating expenses exclusive of fuel increased

by 2.3% in 2015 compared to 2014. This was mainly due to

increased operations and a corresponding increase in the

size of the workforce. Congestion at Hong Kong

International Airport and air traffic control constraints in the

Greater China region also increased operating expenses.

Productivity improvements and favourable foreign currency

movements kept the increase in non-fuel costs below the

increase in capacity. There was a 3.1% reduction in non-fuel

costs per ATK.

The contribution from Air China (the results of which are

included in the Group’s results three months in arrear) was

significantly higher in 2015 than in 2014. The improvement

principally reflected low fuel prices and strong passenger

demand. In August 2015, devaluation of the Renminbi led to

significant foreign exchange losses for Air China. However,

the foreign exchange losses were more than offset by

savings from low fuel prices.