Cathay Pacific 2015 Annual Report Download

Download and view the complete annual report

Please find the complete 2015 Cathay Pacific annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual

Report

2015

Cathay Pacic

Airways Limited

Stock Code: 293

Table of contents

-

Page 1

Cathay Pacific Airways Limited Stock Code: 293 Annual Report 2015 -

Page 2

Hong Kong Contents 2 Financial and Operating Highlights 3 Chairman's Letter 5 2015 in Review 16 Review of Operations 22 Financial Review 28 Directors and Officers 30 Directors' Report 37 Corporate Governance Report 49 Independent Auditor's Report 54 Consolidated Statement of Profit or Loss and ... -

Page 3

... provider of passenger, cargo and other airline-related services in Mainland China. Cathay Pacific is the majority shareholder in AHK Air Hong Kong Limited ("Air Hong Kong"), an all-cargo carrier offering scheduled services in Asia. Cathay Pacific and its subsidiaries employ more than 33,600 people... -

Page 4

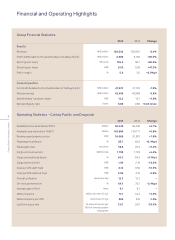

...Cathay Pacific Net borrowings Shareholders' funds per share Net debt/equity ratio HK$ million HK$ million HK$ Times 47,927 42,458 12.2 0.89 51,722 43,998 13.1 -7.3% -3.5% -6.9% 0.85 +0.04 times 2 Cathay Pacific Air ways Limited Operating Statistics - Cathay Pacific and Dragonair 2015 Available... -

Page 5

... expected on some long-haul routes. The Group's cargo revenue in 2015 was HK$23,122 million, a decrease of 9.0% compared to the previous year. This mainly reflected a reduction in fuel surcharges consequent upon lower fuel prices. Capacity for Cathay Pacific and Dragonair increased by 5.4%. The load... -

Page 6

... in aircraft, in our products and in the development of our network. Our financial position is strong. Supported by our world-class team, we remain deeply committed to strengthening the aviation hub in Hong Kong, our home city for the past 70 years. 4 Cathay Pacific Air ways Limited 2015. One... -

Page 7

... Traveller Asia-Pacific Awards; and Best Airline for Inflight Retail at the Airline Retail Conference Asia Pacific. services in our lounges outside Hong Kong from the last November 2015. It will reopen in the second quarter of aircraft had been fitted with new business and economy class seats and... -

Page 8

...in Review • Cathay Pacific service teams and individual staff members won honours at the Inflight Sales Person of the Year Awards and the Customer Service Excellence Awards organised by the Hong Kong Association for Customer Service Excellence. • We stopped flying to Moscow in June 2015. We... -

Page 9

Joy of Discovery Our modern fleet and growing network of destinations lets you live a Life Well Travelled. -

Page 10

...handled 1.7 million tonnes of cargo in 2015, an increase of 13% compared to 2014. It serves 12 airlines, including Cathay Pacific, Dragonair and Air Hong Kong. enables flights to be booked on mobile devices. We also improved the design and content of our airline websites. Fleet development • We... -

Page 11

...Governing Board in June 2015. • In March 2015, Cathay Pacific and Qatar Airways extended their codeshare arrangements so as to include Qatar Airways flights between Doha and Muscat. Environment Committee, the Airlines Advisory Group on Global Market-Based Measures, the Sustainable Aviation Fuel... -

Page 12

... bank has raised more than HK$12 million and has benefited more than 400 children. • In May 2015, a group of Cathay Pacific staff went to for Good" donations are put to good use within the local community. Sichuan province in Mainland China to see how "Change • The Cathay Pacific Volunteers... -

Page 13

...of Social Service every year citizenship. Dragonair has received the Caring Company Logo every year since 2005. Commitment to staff • At 31st December 2015, the Cathay Pacific Group employed more than 33,600 people worldwide. Around 25,800 of these staff are employed in Hong Kong. Cathay Pacific... -

Page 14

2015 in Review Fleet profile* Number at 31st December 2015 Leased Aircraft type Owned Finance Operating Total '16 Firm orders '18 and '17 beyond Total '16 Expiry of operating leases '17 '18 '19 '21 and '20 beyond Options Aircraft operated by Cathay Pacific: A330-300 A340-300 A350-900 A350-1000 747... -

Page 15

... management of operating costs. handling services to eight airlines. Four more airlines cargo terminal at Hong Kong International Airport. It has Asia Miles Limited ("AML") • AML, a wholly owned subsidiary, manages Cathay Pacific members. Group's reward programme. It has more than eight million -

Page 16

.... It provides ground services to 22 airlines, including Cathay Pacific and Dragonair. • In 2015, HAS had 47% and 20% market shares in ramp and passenger handling businesses respectively at Hong Kong International Airport. • In 2015, the number of customers for passenger • In June 2015, Air... -

Page 17

Art of Living Special attention to detail in our lounges enables you to enjoy an enhanced travel experience. -

Page 18

... long-haul routes. Load factor by region % Passenger load factor and yield % 90 100 HK cents 70 80 80 60 70 60 50 60 40 40 16 50 Cathay Pacific Air ways Limited 20 30 40 India, Middle East, Southwest Pacific and Pakistan and South Africa Sri Lanka 2011 2012 Southeast Asia 2013... -

Page 19

... Australia. • Business on the New Zealand route was steady in 2015. We increased the frequency of the Auckland service March 2015. We increased capacity by using Boeing 777-300ER aircraft on one of these flights from December 2015 to February 2016. In August 2015, Cathay Pacific and Air New... -

Page 20

...classes in 2015. Demand for travel between was strong. • We will introduce four-times-weekly services to Madrid in June 2016 and to London's Gatwick airport in September 2016. the United Kingdom and Southwest Pacific destinations North Asia • Our Mainland China routes benefited from increased... -

Page 21

Review of Operations Cargo Services Loyalty and Reward Programmes Cathay Pacific and Dragonair carried 1.8 million tonnes of cargo and mail in 2015, an increase of 4.4% compared to 2014. The cargo revenue of Cathay Pacific and Dragonair in 2015 was HK$20,079 million, a decrease of 8.9% compared ... -

Page 22

...Cathay Pacific Air ways Limited North America in April 2015. We changed routings so as to increase cargo capacity on the Chicago, Los Angeles and New York routes. We also increased the frequency of the Columbus service from three to four flights a week from October 2015. Asia Miles • Asia Miles... -

Page 23

Joy of Life The Cathay Pacific team will always ensure your journey gets off to the best possible start. -

Page 24

...150 million in 2014. The business benefited from low fuel prices. The high passenger load factors experienced in the first half of the year continued in the second half. This reflected strong economy class demand. Premium class demand was not as strong as expected on some long-haul routes. Air cargo... -

Page 25

.... Revenue passenger Cathay Pacific and Dragonair: revenue and breakeven load factor % 90 85 • The passenger load factor increased by 2.4 percentage points to 85.7%. Available seat kilometres increased by 5.9%. • Passenger yield decreased by 11.4% to HK¢59.6. • First and business class... -

Page 26

Financial Review Operating expenses Group 2015 HK$M 2014 HK$M Change Cathay Pacific and Dragonair 2015 HK$M 2014 HK$M Change Staff Inflight service and passenger expenses Landing, parking and route expenses Fuel, including hedging losses Aircraft maintenance Aircraft depreciation and operating ... -

Page 27

Financial Review Cathay Pacific and Dragonair operating results analysis 2015 HK$M 2014 HK$M Airlines' profit before taxation Taxation Airlines' profit after taxation Share of profits from subsidiaries and associates Profit attributable to the shareholders of Cathay Pacific The changes in the ... -

Page 28

... fuel price 26 Cathay Pacific Air ways Limited risk by hedging a percentage of its expected fuel Dividends • Dividends proposed for the year are HK$2,085 million, representing a dividend cover of 2.9 times. • Dividends per share increased from HK$0.36 to HK$0.53. consumption. As the Group... -

Page 29

... The net debt/equity ratio increased from 0.85 times to 0.89 times. 0 2011 2012 2013 2014 2015 0 Funds attributable to the shareholders of Cathay Pacific Net debt/equity ratio Net borrowings decreased by 7.3% to HK$47,927 million. This was in part Interest rate profile: borrowings % 100 27 80... -

Page 30

... the Swire group in 1995 and has worked with the group in Hong Kong, the United States, Singapore and Australia. YAU, Ying Wah (Algernon), aged 57, has been a Director of the Company since September 2015. He has been Chief Executive Officer of Hong Kong Dragon Airlines Limited since July 2014. He... -

Page 31

... Chartered Bank (Hong Kong) Limited. WONG, Tung Shun Peter*, aged 64, has been a Director of the Company since May 2009. He is currently Deputy Chairman and Chief Executive of The Hongkong and Shanghai Banking Corporation Limited, a Group Managing Director and a member of the Group Management Board... -

Page 32

... Pacific Airways Limited (the "Company" or "Cathay Pacific") is managed and controlled in Hong Kong. As well as operating scheduled airline services, the Company and its subsidiaries (collectively referred to as the "Group") are engaged in other related areas including airline catering, aircraft... -

Page 33

... impact on the Group is provided in the sections of this annual report headed 2015 in Review (on pages 5 to 14), Corporate Governance Report (on pages 37 to 48) and Directors' Report (on pages 30 to 35). At 31st December 2015, 3,933,844,572 shares were in issue (31st December 2014: 3,933,844,572... -

Page 34

..., aircraft leasing, frequent flyer programmes, the provision of airline catering, ground support and engineering services and other services agreed to be provided and other transactions agreed to be undertaken under the Air China Framework Agreement. 32 Cathay Pacific Air ways Limited In return... -

Page 35

.... 2% of sales were made to the Group's largest customer and 10% of purchases were made from the Group's largest supplier. No Director, any of their close associates or any shareholder who, to the knowledge of the Directors, owns more than 5% of the number of issued shares of the Company has an... -

Page 36

... as stated above, no Director or chief executive of Cathay Pacific Airways Limited had any interest or short position, whether beneficial or non-beneficial, in the shares or underlying shares (including options) and debentures of Cathay Pacific Airways Limited or any of its associated corporations... -

Page 37

... 2,949,997,987 shares of the Company, comprising: (i) 1,770,238,000 shares directly held by Swire Pacific; (ii) 1,179,759,987 shares indirectly held by Air China and its subsidiaries CNAC, Super Supreme Company Limited and Total Transform Group Limited, comprising the following shares held by their... -

Page 38

Peace of mind Our award-winning Business Class takes you to a new level of comfort and relaxation. 36 Cathay Pacific Air ways Limited -

Page 39

...14 to the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited (the "Listing Rules") throughout the year covered by the annual report with the following exceptions which it believes do not benefit shareholders: • Sections A.5.1 to A.5.4 of the CG Code in respect of... -

Page 40

... the Listing Rules. The Independent Non-Executive Directors: • provide open and objective challenge of management and Board members • raise intelligent questions and challenge constructively and with vigour 38 Cathay Pacific Air ways Limited Chairman and Chief Executive The CG Code requires... -

Page 41

Corporate Governance Report • bring outside knowledge of the businesses and markets in which the Group operates, providing informed insight and responses to management. The Company has been granted by the Stock Exchange a waiver from strict compliance with Rule 3.10A of the Listing Rules, which ... -

Page 42

... of changes in the business environment and their impact on budgets and the longer-term plan • the raising of new initiatives and ideas Meetings Attended/Held 40 Board Cathay Pacific Air ways Limited Audit Committee 2015 Remuneration Annual General Committee Meeting Executive Directors John... -

Page 43

... internal and external audit reports • feedback from external parties such as customers, others with whom the Group does business, trade associations and service providers. Directors' interests at 31st December 2015 in the shares of the Company and its associated corporations (within the meaning... -

Page 44

... allowances and, after three years' service, a bonus related to the overall profit of the Swire Pacific group. The provision of housing facilitates relocation either within Hong Kong or elsewhere in accordance with the needs of the business and as part of the training process whereby managers... -

Page 45

... statements and other related information that give a true and fair view of the Group's affairs and of its results and cash flows for the relevant periods, in accordance with Hong Kong Financial Reporting Standards and the Hong Kong Companies Ordinance • selecting appropriate accounting... -

Page 46

... set out by the Hong Kong Institute of Certified Public Accountants and comply with the CG Code. They are available on the Company's website. The Audit Committee met three times in 2015. Regular attendees at the meetings are the Finance Director, the Group Internal Audit Manager and the external... -

Page 47

... Company's compliance with the CG Code. In 2016, the Committee has reviewed, and recommended to the Board for approval, the 2015 financial statements. programme and review of progress on the 2015 • the changes in the nature and extent of significant risks since the previous review and the Group... -

Page 48

... every year with the Audit Committee. In addition to its agreed annual schedule of work, the Department conducts other special reviews as required. The Group Internal Audit Manager has direct access to the Audit Committee. Audit reports are sent to the Chief Operating Officer, the Finance Director... -

Page 49

...Rules meetings with major shareholders, investors and analysts over two-month periods immediately after the announcement of the interim and annual results and at certain other times during the year. In addition, the Finance Director attended regular meetings with analysts and investors in Hong Kong... -

Page 50

... the shares then in issue. issue, provided that the aggregate number of the shares Other information for shareholders Key shareholder dates for 2016 are set out on page 112 of this report. No amendment has been made to the Company's Articles of Association during the year. financial statements for... -

Page 51

... Shareholders of Cathay Pacific Airways Limited (incorporated in Hong Kong with limited liability) Report on the audit of the consolidated financial statements Opinion We have audited the consolidated financial statements of Cathay Pacific Airways Limited and its subsidiaries (together "the Group... -

Page 52

...indication of management bias. 50 Cathay Pacific Air ways Limited Hedge accounting Refer to notes 11, 13, 16, 19 and 29 to the consolidated financial statements and the accounting policies on page 103. The key audit matter How the matter was addressed in our audit The Group enters into derivative... -

Page 53

...and the related depreciation charge for the year ended 31st December 2015 was HK$7,565 million. Depreciation rates and the carrying value of aircraft and related equipment are reviewed annually taking into consideration factors such as changes in fleet composition, current and forecast market values... -

Page 54

... costs totalled HK$1,561 million as at 31st December 2015 and are included within other long-term payables and trade and other payables in the consolidated statement of financial position. We have identified aircraft maintenance provisions as a key audit matter because of the inherent level... -

Page 55

... and, where applicable, related safeguards. From the matters communicated with those charged with governance, we determine those matters that were of most significance in the audit of the consolidated financial statements of the current period and are therefore the key audit matters. We describe... -

Page 56

Consolidated Statement of Profit or Loss and Other Comprehensive Income for the year ended 31st December 2015 Note 2015 HK$M 2014 HK$M 2015 US$M 2014 US$M Revenue Passenger services Cargo services Total revenue Expenses Staff (18,990) (4,713) (14,675) (32,968) (7,504) (10,883) (2,310) (798)... -

Page 57

... currency. The US$ figures are shown only as supplementary information and are translated at HK$7.8. The notes on pages 58 to 99 and the principal accounting policies on pages 100 to 105 form part of these financial statements. John Slosar Director Hong Kong, 9th March 2016 Irene Lee Director -

Page 58

... intangible assets Dividends received from associates Purchases of shares in an associate Loans to associates Financing activities New financing Net cash benefit from financing arrangements Loan and finance lease repayments Security deposits placed 56 Cathay Pacific Air ways Limited Net... -

Page 59

Consolidated Statement of Changes in Equity for the year ended 31st December 2015 Attributable to the shareholders of Cathay Pacific Share capital HK$M Capital Share redemption premium reserve HK$M HK$M Investment Retained revaluation profit reserve HK$M HK$M Cash flow Capital hedge reserve reserve... -

Page 60

... Non-airline business 2015 HK$M 2014 HK$M Unallocated 2015 HK$M 2014 HK$M Total 2015 HK$M 2014 HK$M Profit or loss Sales to external customers Inter-segment sales Segment revenue Segment results Net finance charges Share of profits of associates Profit before taxation Taxation Profit for the year... -

Page 61

... to the Financial Statements Statement of Profit or Loss and Other Comprehensive Income 1. Segment information (continued) (b) Geographical information 2015 HK$M 2014 HK$M Revenue by origin of sale: North Asia - Hong Kong and Mainland China - Japan, Korea and Taiwan India, Middle East, Pakistan... -

Page 62

... 3. Net finance charges 2015 HK$M 2014 HK$M Net interest charges comprise: - interest income on related security deposits, notes and zero coupon bonds - bank loans and overdrafts - obligations under finance leases stated at amortised cost 457 (18) 439 - wholly repayable within five years 127... -

Page 63

...changes in legislation, practice and the status of negotiations (see note 28(d) to the financial statements). A reconciliation between tax charge and accounting profit at applicable tax rates is as follows: 2015 HK$M 2014 HK$M Consolidated profit before taxation Notional tax calculated at Hong Kong... -

Page 64

...to the shareholders of Cathay Pacific of HK$6,000 million (2014: HK$3,150 million) by the daily weighted average number of shares in issue throughout the year of 3,934 million (2014: 3,934 million) shares. 7. Dividends 2015 HK$M 2014 HK$M First interim dividend paid on 5th October 2015 of HK$0.26... -

Page 65

... equipment Aircraft and related equipment Owned HK$M Leased HK$M Other equipment Owned HK$M Leased HK$M Buildings Under Owned construction HK$M HK$M Total HK$M Group Cost At 1st January 2015 Exchange differences Additions Disposals Disposal of a subsidiary Reclassification to assets held for sale... -

Page 66

... leases committed at 31st December 2015 for each of 64 Cathay Pacific Air ways Limited the following periods are as follows: 2015 HK$M 2014 HK$M Aircraft and related equipment: - within one year 3,673 3,581 8,308 7,786 23,348 Buildings and other equipment: - after one year but within two years... -

Page 67

... 2014. During the year, a number of aircraft have been transferred to assets held for sale. The fair value on which the recoverable amount is based is categorised as a Level 2 measurement. 9. Intangible assets Goodwill HK$M Computer software HK$M Others HK$M Total HK$M Cost At 1st January 2015... -

Page 68

...of net assets of the associate at effective interest (2015: 20.13%; 2014: 20.13%) - goodwill - effect of cross shareholding and others Air China is a strategic partner for the Group and the national flag carrier and a leading provider of passenger, cargo and other airline-related services in... -

Page 69

... the Financial Statements Statement of Financial Position 10. Investments in associates (continued) Aggregate information of associates that are not individually material 2015 HK$M 2014 HK$M Aggregate carrying amount of individually immaterial associates Aggregate amounts of the Group's share of... -

Page 70

... Long-term loans 2015 HK$M 2014 HK$M Bank loans - secured Other loans - unsecured Amount due within one year included under current liabilities Repayable as follows: 3,609 35,602 (9,164) 26,438 4,048 33,697 (6,025) 27,672 22,213 9,780 18,181 11,468 - unsecured 68 Cathay Pacific Air ways Limited... -

Page 71

... under finance leases The Group has commitments under finance lease agreements in respect of aircraft and related equipment expiring during the years 2016 to 2025. The reconciliation of future lease payments and their carrying value under these finance leases is as follows: 2015 HK$M 2014 HK... -

Page 72

... full cost of all benefits due by SGRBS to their employee members, who are not required to contribute to the scheme. Staff employed by the Company in Hong Kong on expatriate terms before April 1993 were eligible to join another 70 Cathay Pacific Air ways Limited scheme, the Cathay Pacific Airways... -

Page 73

...: Current service cost Net interest cost Total included in staff costs Actual return on plan assets 331 39 370 64 2015 HK$M 324 15 339 325 2014 HK$M Net liabilities recognised in the statement of financial position: Present value of funded obligations Fair value of plan assets Retirement benefit... -

Page 74

... in 2016. 2015 SGRBS CPALRS 2014 SGRBS CPALRS 72 Cathay Pacific Air ways Limited The significant actuarial assumptions are: Discount rate Expected rate of future salary increases 3.22% 5.00% 3.22% 3.06% 3.27% 5.00% 3.27% 3.41% The sensitivity of the defined benefit obligations to changes in... -

Page 75

... assets to pay all employees the benefits relating to employee service in the current and prior periods. Staff employed by the Company in Hong Kong on expatriate terms are eligible to join a defined contribution retirement scheme, the CPA Provident Fund 1993. All staff employed in Hong Kong... -

Page 76

...Cathay Pacific Air ways Limited Group Unrecognised tax losses 2015 HK$M 2014 HK$M No expiry date Expiring beyond 2021 2,426 7,228 9,654 8,444 3,980 12,424 The provision in respect of certain lease arrangements equates to payments which are expected to be made during the years 2017 to 2026 (2014... -

Page 77

... from associates and other related companies 5,360 1,145 3,083 127 9,715 5,527 891 4,050 123 10,591 At 31st December 2015, total derivative financial assets of the Group which did not qualify for hedge accounting amounted to HK$1,222 million (2014: HK$1,315 million). 2015 HK$M 2014 HK$M Analysis... -

Page 78

...three months when placed Funds with investment managers - debt securities listed outside Hong Kong 7,207 7,715 4,698 7 817 203 20,647 10,211 2,176 6,780 224 1,295 412 21,098 76 Cathay Pacific Air ways Limited - bank deposits Other liquid investments - debt securities listed outside Hong Kong... -

Page 79

...Hong Kong Companies Ordinance (Cap. 622) occurred automatically on 3rd March 2014. On that date, the share premium account and any capital redemption reserve were subsumed into share capital in accordance with section 37 of Schedule 11 to the new Ordinance. These changes did not impact on the number... -

Page 80

...156 1,051 (10,128) 1,537 34,616 Share premium HK$M Retained profit HK$M Total HK$M Company At 1st January 2015 Profit for the year Other comprehensive income Total comprehensive income for the year 2014 interim dividend Cathay Pacific Air ways Limited 24 - - - - - (24) (24) - 34,952 5,579... -

Page 81

... and lease obligations which are arranged in foreign currencies such that repayments can be met by anticipated operating cash flows. The loss transferred from the cash flow hedge reserve of the Group to profit or loss items was as follows: 2015 HK$M 2014 HK$M Revenue Fuel Others Net finance charge... -

Page 82

...001 (16,241) 12,274 80 Cathay Pacific Air ways Limited 23. Disposal of a subsidiary 2015 HK$M 2014 HK$M Net liabilities disposed of: Property, plant and equipment Trade, other receivables and other assets Trade and other payables Others Total net liabilities Reversal of non-controlling interests... -

Page 83

...Executive Directors receive fees as members of the Board and its committees. Executive Directors receive salaries. For Directors employed by the Swire group, the remuneration disclosed represents the amount charged to the Company. Management bonus is related to services for 2014 and was paid in 2015... -

Page 84

... Directors' and executive officers' remuneration (continued) (b) Executive officers' remuneration disclosed as recommended by the Listing Rules is as follows: Cash Contributions to retirement schemes HK$'000 Non-cash Bonus paid into retirement Other Housing 2015 2014 schemes benefits benefits Total... -

Page 85

..., including those who have retired or resigned during the year, in each employment category whose total remuneration for the year fell into the following ranges: 2015 HK$'000 Director Flight staff Other staff Director 2014 Flight staff Other staff 0 1,501 2,001 2,501 3,001 3,501 4,001 4,501 5,001... -

Page 86

... with Directors and executive officers except for those relating to shareholdings (as disclosed in the Directors' Report and the Corporate Governance Report). Remuneration of Directors and executive officers is disclosed in note 25 to the financial statements. 84 Cathay Pacific Air ways Limited -

Page 87

... the financial statements. (b) Guarantees in respect of lease obligations, bank loans and other liabilities outstanding at the year end: 2015 HK$M 2014 HK$M Associates Related parties Staff 4,776 1,186 200 6,162 3,112 1,032 200 4,344 Related parties are companies under control of a company which... -

Page 88

... matter in July 2014 by paying the plaintiffs US$7.5 million (approximately HK$58.1 million at the exchange rate current at date 86 Cathay Pacific Air ways Limited of payment). The settlement, which was approved by the Court in May 2015, resolves claims by all putative class members who chose not... -

Page 89

... business, the Group is exposed to fluctuations in foreign exchange rates, interest rates and jet fuel prices. These exposures are managed, sometimes with the use of derivative financial instruments, by the Treasury Department of Cathay Pacific in accordance with the policies approved by the Finance... -

Page 90

...$M Total HK$M Group Bank and other loans Obligations under finance leases Other long-term payables Trade and other payables Derivative financial liabilities, net Total (c) Market risk (i) Foreign currency risk The Group's revenue streams are denominated in a number of foreign currencies resulting... -

Page 91

Notes to the Financial Statements Supplementary Information 29. Financial risk management (continued) At the reporting date, the exposure to foreign currency risk was as follows: 2015 USD HK$M EUR HK$M AUD HK$M SGD HK$M RMB HK$M JPY HK$M Group Loans due from associates Trade debtors, other ... -

Page 92

...281 912 90 Cathay Pacific Air ways Limited Net increase/(decrease) in profit or loss HK$M Net increase/(decrease) in other equity components HK$M United States dollars Euros New Taiwan dollars Singapore dollars Renminbi Japanese yen Net increase (ii) Interest rate risk 1,247 2 (5) (3) (173) 25... -

Page 93

Notes to the Financial Statements Supplementary Information 29. Financial risk management (continued) 2015 HK$M 2014 HK$M Variable rate instruments Loans due from associates Liquid funds Long-term loans Obligations under finance leases Interest rate and currency swaps Net exposure Sensitivity ... -

Page 94

... to the Financial Statements Supplementary Information 29. Financial risk management (continued) (d) Hedge accounting The carrying values of financial assets/(liabilities) designated as cash flow hedges at 31st December 2015 were as follows: 2015 HK$M 2014 HK$M Foreign currency risk - long-term... -

Page 95

...rates, exchange rates and fuel price. Level 3 includes financial instruments with fair values measured using discounted cash flow valuation techniques in which any significant input is not based on observable market data. 2015 Level 1 HK$M Level 2 HK$M Level 3 HK$M Total HK$M Level 1 HK$M 2014 Level... -

Page 96

...reasonable change Positive/(negative) impact on valuation (HK$M) Unobservable inputs Unlisted investments Discount rate 2015: 10.0% (2014: 8.0%) The higher the discount rate, the lower the fair value 2015: +/- 0.5% (2014: +/- 0.5%) 2015: (11)/11 (2014: (76)/100) The movement during the year in... -

Page 97

... position financial position HK$M HK$M Financial instruments not offset in the statement of financial position HK$M Gross amounts of recognised financial assets/liabilities HK$M Net amount HK$M Group Derivative financial assets Related pledged security deposits Obligations under finance leases... -

Page 98

... Supplementary Information 31. Company-level statement of financial position Note 2015 HK$M 2014 HK$M 2015 US$M 2014 US$M ASSETS AND LIABILITIES Non-current assets and liabilities Property, plant and equipment Intangible assets Investments in subsidiaries Investments in associates Other long-term... -

Page 99

... with Customers" is relevant to the Group and becomes effective for accounting periods beginning on or after 1st January 2018. The standard deals with revenue recognition and establishes principles for reporting information to users of financial statements about the nature, amount, timing and... -

Page 100

... Airline Training Property Limited Asia Miles Limited Cathay Holidays Limited Cathay Pacific Aero Limited Cathay Pacific Aircraft Acquisition Limited Cathay Pacific Aircraft Lease Finance Limited Cathay Pacific Aircraft Services Limited Cathay Pacific Catering Services (H.K.) Limited Hong Kong Hong... -

Page 101

...of issued capital owned Principal activities Air China Cargo Co., Ltd. Air China Limited Cebu Pacific Catering Services Inc. Ground Support Engineering Limited HAECO ITM Limited LSG Lufthansa Service Hong Kong Limited Shanghai International Airport Services Co., Limited People's Republic of China... -

Page 102

...to cashgenerating units and is tested annually for impairment. On disposal of a subsidiary or associate, goodwill is included in the calculation of any gain or loss. 100 Cathay Pacific Air ways Limited The preparation of the financial statements in conformity with HKFRS requires management to make... -

Page 103

... of financial position, investments in associates are stated at cost less any impairment loss recognised and loans to those companies. (b) unrealised exchange differences on net investments in foreign subsidiaries and associates (including intra-Group balances of an equity nature) and related long... -

Page 104

... based on the interest rates implicit in the leases. designated as available-for-sale financial assets, these investments are stated at fair value. Fair value is based on quoted market prices at the end of the reporting period without any deduction for transaction costs. Fair values for the... -

Page 105

... purchase or sale of the assets occurs. 10. Derivative financial instruments Derivative financial instruments are used solely to manage exposures to fluctuations in foreign exchange rates, interest rates and jet fuel prices in accordance with the Group's risk management policies. The Group does not... -

Page 106

...the accounting policy 5. 18. Loyalty programme The Company operates a customer loyalty programme called Asia Miles (the "programme"). As members accumulate miles by travelling on Cathay Pacific or Dragonair flights, or when the Company sells miles to participating partners in the programme, revenue... -

Page 107

... received and the revenue deferred, and is recognised when the service is performed. 19. Related parties Related parties are individuals and companies, including subsidiary, fellow subsidiary, jointly controlled and associated companies and key management (including close members of their families... -

Page 108

... of Cathay Pacific Non-controlling interests Total equity Per share Shareholders' funds EBITDA Earnings/(loss) HK$ HK$ HK cents HK$ 111,158 27,947 (63,105) 20,647 (42,458) (23,961) (15,838) (8,781) 48,067 47,927 140 48,067 12.18 4.45 152.5 0.53 Dividend Ratios Profit/(loss) margin Return on... -

Page 109

Statistics 2013 2012 2011 2010 2009 2008 2007 2006 71,826 23,663 4,995 100,484 (96,724) 3,760 - - (1,019) 838 3,579 (675) 2,904 (284) 2,620 (551) 2,069 ... -

Page 110

... factor Cargo and mail carried Cargo and mail revenue tonne kilometres Cargo and mail load factor Excess baggage carried Kilometres flown Block hours Aircraft departures Length of scheduled routes network Number of destinations at year end Staff number at year end ATK per staff On-time performance... -

Page 111

Statistics 2013 2012 2011 2010 2009 2008 2007 2006 26,259 18,696 127,215 29,920 104,571 77.5 82.2 1,539 8,750 61.8 2,599 512 735 160 ... -

Page 112

... 2006 Productivity * Cost per ATK (with fuel) ATK per HK$'000 staff cost Aircraft utilisation Share prices High Low Year-end Price ratios (Note) Price/earnings Market capitalisation/ funds attributable to the shareholders of Cathay Pacific Price/cash flows Times HK$ Unit Hours per day HK... -

Page 113

... Cathay Pacific Weighted average number of shares (by days) in issue for the year Profit/(loss) attributable to the shareholders of Cathay Pacific Revenue Passenger/Cargo = and mail load factor Net debt/ equity ratio = Net borrowings Funds attributable to the shareholders of Cathay Pacific Revenue... -

Page 114

... in Hong Kong with limited liability. Investor relations For further information about Cathay Pacific Airways Limited, please contact: Corporate Communication Department Cathay Pacific Airways Limited 7th Floor, North Tower Cathay Pacific City Hong Kong International Airport Hong Kong Email: ir... -

Page 115

113 A n n u a l R e p o r t 2 015 DESIGN: FORMAT LIMITED www.format.com.hk Printed in Hong Kong © Cathay Pacific Airways Limited -

Page 116

www.cathaypacific.com