Cathay Pacific 2009 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2009 Cathay Pacific annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Chairman’s Letter

The main story of 2009 was the impact on our

business of one of the most severe economic

downturns in recent memory. The global slump

resulted in extremely challenging business conditions

for the Cathay Pacific Group and commercial aviation in

general. While there was some pick-up in both our

passenger and cargo businesses towards the end of

the year as the recession began to ease, overall we

saw a deep downturn in our key markets which in turn

led to sharply reduced revenues.

We took a number of measures to help us address

the steep downturn in business, including reducing

capacity in both Cathay Pacific and Dragonair, reducing

operating costs and capital expenditure, introducing an

unpaid leave scheme for staff, parking a number of

aircraft, working to get concessions from suppliers

and requesting a deferral of new deliveries from

aircraft manufacturers.

Fuel prices in the first half of the year were significantly

lower than the record highs of mid-2008. However,

they started to rise again in the middle of 2009,

reaching uncomfortably high levels. This rise was

reflected in mark to market gains of HK$2,018 million

recorded in 2009 in respect of fuel hedging contracts

for the period 2010-2011. These gains reversed a large

part of the substantial losses recorded in 2008 in

respect of fuel hedging contracts. We expect the

results of fuel hedging to be less volatile in future.

Cathay Pacific and Dragonair between them carried

24.6 million passengers in 2009 – a fall of 1.6% on the

previous year. Our capacity fell by 3.7% compared to

2008 as we reduced frequencies and (in the case of

Dragonair) temporarily suspended operations to six

destinations. This in turn supported the load factor,

which at 80.5% rose by 1.7 percentage points

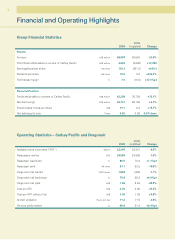

The Cathay Pacific Group recorded an attributable profit of HK$4,694 million for

2009. This compares to a loss of HK$8,696 million the previous year. Turnover for

the year fell by 22.6% to HK$66,978 million. Earnings per share rose by HK340.3

cents to HK119.3 cents.

compared to 2008. Our passenger revenue fell by

20.8% to HK$45,920 million, reflecting substantial

reductions in premium traffic and in economy class

yields, though economy class passenger numbers held

up well. The strong US dollar in the first half of the year

also contributed to the 19.5% fall in passenger yield for

the year.

Cargo revenue for the Cathay Pacific Group fell by

29.9% to HK$17,255 million in 2009, while the amount

of freight carried for Cathay Pacific and Dragonair

dropped by 7.1% to 1,527,948 tonnes. We reduced

cargo capacity by 13.1% in response to the weakness

in demand. This was reflected in a load factor of 70.8%

(compared with 65.9% in 2008). Our cargo business

was exceptionally weak in the first half of the year,

with a significant decline in tonnage and yield in all key

markets. The latter half of the year was stronger with

yield increasing in October, albeit from a very low

base, and rising consistently for the remainder of

the year. Our cargo yield for the year fell by 26.8%

to HK$1.86.

Despite 2009 being a very difficult year for the

Cathay Pacific Group, we worked hard to keep the

fundamentals of our business intact. Though we cut

capacity and parked a number of passenger and cargo

aircraft, we have kept our network substantially intact.

We also went to great efforts to ensure that the quality

of our product and service was not diminished and that

the passenger experience was not compromised. We

continued with the rollout of our innovative three-class

cabin designs for our medium- and long-haul fleet, with

all aircraft fitted with the cabins by November. New

aircraft continued to arrive, improving the overall

efficiency of our fleets, while the remaining older, fuel-

inefficient Boeing 747-200F “Classics” were retired.

Cathay Pacific Airways Limited Annual Report 2009 3