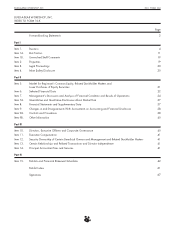

Build-A-Bear Workshop 2011 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2011 Build-A-Bear Workshop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BUILD-A-BEAR WORKSHOP, INC. 2011 FORM 10-K

co-tenants, the availability or cost of appropriate locations

within existing or new shopping malls or the desirability,

safety or success of shopping malls. In addition, customer mall

traffic may be reduced due to a loss of consumer confidence

because of the economy, terrorism or war. If we are unable to

generate sufficient guest traffic, our sales and results of

operations will be harmed. A significant decrease in shopping

mall traffic could have a material adverse effect on our

financial condition and profitability. For example, we have

experienced a decline in transactions at comparable locations

over the past several years.

If we are unable to generate interest in and demand for our

interactive retail experience, including being able to identify

and respond to consumer preferences in a timely manner,

our financial condition and profitability could be

adversely affected.

We believe that our success depends in large part upon our

ability to continue to attract guests with our interactive

shopping experience and our ability to anticipate, gauge and

respond in a timely manner to changing consumer

preferences and fashion trends. We cannot assure you that

our past success will be sustained or there will continue to be

a demand for our “make-your-own stuffed animal” interactive

experience, or for our stuffed animals, animal apparel and

accessories. A decline in demand for our interactive shopping

experience, our animals, animal apparel or accessories, or a

misjudgment of consumer preferences or fashion trends, could

have a negative impact on our business, financial condition

and results of operations. For example, in 2008 we

announced plans to close the Friends 2B Made concept. The

closure was completed by the end of the fiscal 2009 third

quarter with pre-tax charges totaling $3.9 million. In addition,

if we miscalculate the market for our merchandise or the

purchasing preferences of our guests, we may be required to

sell a significant amount of our inventory at discounted prices

or even below costs, thereby adversely affecting our financial

condition and profitability. For example, in 2007, we

wrote-off $1.6 million, net of tax, of inventory, including

excess Shrek®merchandise.

Our future growth and profitability could be adversely

affected if our marketing and online initiatives are not

effective in generating sufficient levels of brand awareness

and guest traffic.

We continue to update and evaluate our marketing initiatives,

focusing on brand awareness, new product news, timely

promotions and rapidly changing consumer preferences. We

may not be able to successfully engage children in our virtual

world website, bearville.com, and achieve high enough traffic

levels nor be able to leverage the site to drive traffic to our

stores. Our future growth and profitability will depend in large

part upon the effectiveness and efficiency of our marketing

programs and future marketing efforts that we undertake,

including our ability to:

• create greater awareness of our brand, interactive

shopping experience and products;

• identify the most effective and efficient level of spending

in each market;

• determine the appropriate creative message and media

mix for marketing expenditures;

• effectively manage marketing costs (including creative

and media) in order to maintain acceptable operating

margins and return on marketing investment;

• select the right geographic areas in which to market;

• convert consumer awareness into actual store visits and

product purchases; and

• reach a level of engagement on the virtual world Web

site with large numbers of unique visitors with frequent

visitation that drives visits to our retail stores resulting

in purchases.

Our planned marketing expenditures may not result in

increased total or comparable store sales or generate

sufficient levels of product and brand awareness. We may not

be able to manage our marketing expenditures on a cost-

effective basis.

If we are unable to increase our comparable store sales

trends, our results of operations and financial condition could

be adversely affected.

Our comparable store sales for 2011 declined 2.1%

following a 2.0% decline in 2010, a 13.4% decline in fiscal

2009, a 14.0% decline in fiscal 2008 and a 9.9% decline in

fiscal 2007. We believe that the decrease in 2011 was

primarily attributable to the underperformance of certain

licensed movie products in the fourth quarter. We believe that

global economic conditions continued to impact our

comparable store sales in 2010. We believe that the

decrease in fiscal 2009 was primarily attributable to the

continued economic recession and dramatic decrease in

consumer sentiment and the decline in North American

shopping mall traffic. We believe that the decrease in 2008

was primarily attributable to the economic recession and

decrease in consumer disposable income, a continued decline

in shopping mall customer traffic and changes in media

strategies, online entertainment, children’s media consumption

and play patterns. We believe that the decrease in 2007 was

primarily attributable to a decline in shopping mall customer

traffic and consumer spending on discretionary products,

changes in media strategies, online entertainment, children’s

media consumption and play patterns, competitive plush

animal products and lower than expected customer purchases

of select licensed movie products introduced in the fiscal

12