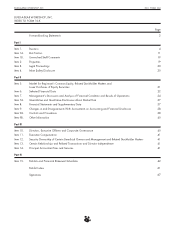

Build-A-Bear Workshop 2011 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2011 Build-A-Bear Workshop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BUILD-A-BEAR WORKSHOP, INC. 2011 FORM 10-K

All stores outside of the U.S., Canada, the United

Kingdom and Ireland are currently operated by third party

franchisees under separate master franchise agreements

covering each territory. Master franchise rights are typically

granted to a franchisee for an entire country or group of

countries for a specified term. The terms of these master

franchise agreements vary by country but typically provide

that we receive an initial, one-time development fee and

continuing royalties based on a percentage of the franchisees’

stores sales. The terms of these agreements range up to

25 years with a franchisee option to renew for an additional

term if certain conditions are met. All franchised stores have

similar signage, store layout and merchandise characteristics

to our company-owned stores. Our goal is to have well-

capitalized franchisees with expertise in retail operations or

franchising and real estate in their respective country. We

collaborate with our franchisees in the development of their

business, marketing and store growth plans. We review all

franchisees’ orders for merchandise which are made in the

same factories that produce products for our company-owned

stores and advise our franchisees concerning their operational

and business practices in an effort to ensure they are in

compliance with our standards. We expect our current

franchisees to open approximately ten to twelve new stores,

net of closures, in fiscal 2012.

SOURCING AND INVENTORY MANAGEMENT

We do not own or operate any manufacturing facilities. Our

animal skins, stuffing, clothing and accessories are produced

by factories located primarily in China. We purchased

approximately 81% of our inventory in fiscal 2011,

approximately 73% in fiscal 2010 and approximately 80% in

fiscal 2009 from three long standing vendors. After specifying

the details and requirements for our products, our vendors

contract orders with multiple manufacturing facilities in China

that are approved by us in accordance with our quality

control and labor standards. We believe that our supplier

factories are compliant with the International Council of Toy

Industries (ICTI) CARE certification.

The CARE (Caring, Awareness, Responsible, Ethical)

Process is the ICTI program to promote ethical manufacturing,

in the form of fair labor treatment, as well as employee health

and safety, in the toy industry supply chain worldwide. The

program’s initial focus is in China, where 70 percent of the

world’s toy volume is manufactured. In order to obtain this

certification, each factory completed a rigorous evaluation

performed by an accredited ICTI agent. Our vendors can be

used interchangeably as each has a sourcing network for

multiple product categories and can expand its factory

network as needed. Our relationships with our vendors

generally are on a purchase order basis and do not provide a

contractual obligation to provide adequate supply or

acceptable pricing on a long-term basis.

The average time from the beginning of production to

arrival of the products into our stores is approximately 90 to

120 days. Our weekly tracking and reporting tools give us

the capability to adjust to shifts in demand. Through an

ongoing analysis of selling trends, we regularly update our

product assortment by increasing quantities of productive

styles and eliminating less productive items. Our distribution

centers provide further logistical efficiencies for delivering

merchandise to our stores.

DISTRIBUTION AND LOGISTICS

We own our 350,000 square-foot distribution center near

Columbus, Ohio which serves the majority of our stores in the

United States and Canada. We also engage a third-party

warehouse in southern California to service our West Coast

stores. The contract has a one year term and is renewable. In

Europe, we contract with a third-party distribution center in

Selby, England under an agreement that ends in December

2014. This agreement contains clauses that allow for

termination if certain performance criteria are not met.

Transportation from the warehouses to the stores is

managed by several third-party logistics providers. In the

United States, Canada and Europe, merchandise is shipped

by a variety of distribution methods, depending on the store

and seasonal inventory demand. Key delivery methods are

direct trucks through third-party pool points, ‘LTL’ (less-than

truck load) deliveries, and direct parcel deliveries. Shipments

from our third-party distribution centers are scheduled

throughout the week in order to smooth workflow and stores

that are part of the same shipping route are grouped together

to reduce freight costs. All items in our assortment are eligible

for distribution, depending on allocation and fulfillment

requirements, and we typically distribute merchandise and

supplies to each store once a week on a regular schedule,

which allows us to consolidate shipments in order to reduce

distribution and shipping costs. Back-up supplies, such as

Cub Condo®carrying cases and stuffing for the animals, are

often stored in limited amounts at local pool points.

MANAGEMENT INFORMATION SYSTEMS AND TECHNOLOGY

Optimizing technology is a key business strategy. We are

committed to utilizing and leveraging digital advancements to

gain a competitive edge and improve guest experiences. We

regularly evaluate strategic information technology initiatives

focused on competitive differentiation, support of corporate

strategy and reinforcement of our internal support

systems. Most recently, we implemented a new e-commerce

platform which helps propel our largest store into the future.

Our information and operational systems are best in class

and incorporate a broad range of purchased and internally

developed technologies; each are built on a foundation of

sound business processes, support guest relationships,

marketing, financial, retail operations, real estate,

merchandising, e-commerce and inventory management

processes, and deliver solid business results. Our employees

can securely access these systems over a company-wide

network. Sales, daily deposit and guest information are

9