Bank of Montreal 1998 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 1998 Bank of Montreal annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BMO AT A GLANCE

BANK OF MONTREAL GROUP OF COMPANIES

■Grew the mortgage portfolio by 15% to $35 billion.

■Announced agreements with The Great Atlantic and Pacific

Company of Canada Limited (A&P) and Canada Safeway

Limited

to open in-store branches.

■

Opened 10 in-store locations in fiscal 1998.

■

Implemented the Private Client Service Promise, providing

one-stop banking and uniformity of services.

■Redesigned commercial credit approval system to provide

sales and service capabilities.

■Improve technology and access channels to

enter new markets and reduce operating costs.

■Retain and grow customer relationships through

improved knowledge management.

■Elevate workforce competencies in the area of

customer service and sales management.

■Redesign key processes to deliver improved

customer service.

■Loan growth of 22% and growth in fee revenue of 39%.

■Double-digit growth in retail deposits – twice the market rate

of growth.

■Retail market share in Chicagoland has tripled from 2.7%

in 1994 to 8.2%.

■Consistently high customer satisfaction scores.

■Expanded trust services in Florida to full range of banking

services.

■Continue to expand our Midwest mid-market

corporate franchise.

■Develop retail franchise to become a dominant

force in the Chicago area.

■Grow wealth management business in the

Midwest, Arizona, Florida and nationwide.

■Continue structural cost reductions through

standardized processes and continued

integration

of North American operations.

■mbanx achieved a 95% customer satisfaction rating and added

over 50,000 clients for a total of 151,700.

■New Client Contact Centre strategy ensures the highest quality

of service across different channels.

■Enhanced MasterCard®*web site allows customers to check

balances and review transactions.

■Cebra’s Internet-based tendering service MERXTM*had strong

growth and currently has 200,000 government tender

documents on its web site.

■

Formed an alliance between our North American Cash

ManagementGroupandCheckFree

®1Corporation for automated

clearing house processing, creating greater economies of scale.

■Develop a deeper knowledge and understanding

of our customers.

■Continually look for innovative applications

of technology.

■Create customer-focused solutions through the

leveraging of technology and client information.

■Create value through strategic alliances as

a means of delivering the best customer

service possible.

■Maintained leading market share position in M&A advisory

business, block trading of Canadian equities and top

research ranking.

■Launched Nesbitt Burns Quadrant ProgramTM1 allowing

clients to custom tailor their portfolios.

■

Introduced Nesbitt Burns Mutual Fund Mosaic

TM1

,amutualfund

system that determines

optimal asset mix.

■Rolled out investore®Mobile, a money management store

on wheels.

■Participated in a significant number of large Corporate

Banking transactions.

■Solidify leading market share for specific

investment and corporate banking activities

in Canada.

■

Align all functions to better meet customer needs.

■Expand Global Corporate Bank.

■Integrate and expand all wealth management

products, services and channels.

■Develop enhanced derivative core competencies.

■Continue to grow the Merchant Bank.

■Consolidated enterprise-wide credit, market, operational and

liquidity risk management to optimize our risk and return profile.

■Finalized the segregation of the management of assets

originated from our Global Corporate Banking Group to Asset

Portfolio Management.

■Completed a US$3 billion collateralized loan obligation.

■Collateralized Bond Obligation Group ranks among the largest

high-yield managers in Canada.

■Integrated Trade Finance with Global Financial Institutions

and Governments.

■

Establish a “best in class” Risk Management Group.

■

Asset Portfolio Management Group to pro-actively

manage corporate assets, using state-of-the-art

portfolio management methodology.

■Continue to grow collateralized bond obligation

portfolio during fiscal 1999.

■Provide value-added sales and distribution

services for Global Financial Institutions and

Government clients and grow Trade Finance

businesses with North American importers

and exporters.

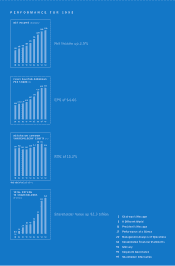

HIGHLIGHTS STRATEGYVOLUME

*GROWTH

9897969594

63.4

58.7

55.3

52.4

48.9

9897969594

31.1

25.8

23.0

20.5

16.9

9897969594

10.2

7. 7

6.0

5.1

4.5

9897969594

95.4

80.6

53.6

45.6

32.7

9897969594

Note: including guarantees and standby

letters of credit

40.3

30.0

22.9

22.0

19.4

BANK OF MONTREAL IS A HIGHLY DIVERSIFIED FINANCIAL SERVICES

INSTITUTION OFFERING A FULL RANGE OF PRODUCTS AND SERVICES

IN ALL THREE NAFTA COUNTRIES. THESE ARE THE OPERATING DIVISIONS

THAT MAKE UP THE BANK OF MONTREAL GROUP OF COMPANIES:

*Average assets ($ billions)