Bank of Montreal 1997 Annual Report Download

Download and view the complete annual report

Please find the complete 1997 Bank of Montreal annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Building

Shareholder

Value

Bank of Montreal Group of Companies 180th Annual Report 1997

Table of contents

-

Page 1

Building Shareholder Value Bank of Montreal Group of Companies 180th Annual Report 1997 -

Page 2

... Burns Equity Partners Inc. is a merchant bank created by Bank of Montreal and Nesbitt Burns to make direct equity investments in growing North American companies, both public and private. It manages a $300 million capital program through offices in Toronto and Chicago. First Canadian® Mutual Funds... -

Page 3

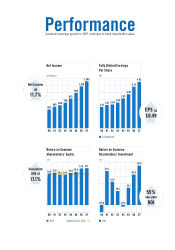

...62 4.13 3.38 2.97 2.10 2.31 2.36 2.55 Net Income up 1,168 986 825 595 522 640 709 11.7% EPS up $0.49 90 91 92 93 94 95 96 97 As Reported 90 91 92 93 94 95 96 97 Return on Common Shareholders' Equity (%) Return on Common Shareholders' Investment (%) 55.0 Consistent ROE at 17.0 17.1 15.4 14... -

Page 4

... to assure that shareholders are well informed. Fiscal 1997 saw the Bank of Montreal Group of Companies report record earnings for the eighth consecutive year, 11.7% above the level in 1996. Return on equity (ROE) was 17.1%. Your Bank is the only major bank in Canada and the United States to have... -

Page 5

...discussion paper, Policy Alternatives for Canadian Financial Services, and I encourage our Canadian shareholders to obtain a copy and take part in the debate on the issues that will decisively shape the future of the Bank.* As you read this report  our accounting to you of the initiatives we have... -

Page 6

... can beneï¬t from Bank of Montreal's uniï¬ed continental capabilities. In 1997, Bank of Montreal, Harris and Bancomer pooled their resources to create a single point of access for cash management services across North America. This initiative saves time, reduces costs and 4 Bank o f M ontr eal... -

Page 7

...and balance information across North America. A natural outgrowth of Bank of Montreal's North American infrastructure, the cash management project is the latest example of our commitment to provide our customers with an integrated array of high-value products and services in all the markets we serve... -

Page 8

... why Bank of Montreal is re-inventing retail banking  the delivery system that serves six million customers in Canada. Our new approach at the Personal and Commercial Financial Services group (PCFS) will offer a more targeted line of products and services and a multiple access-point distribution... -

Page 9

...with the appropriate products and services offered by any of the Bank of Montreal Group of Companies. With its interactive touchscreen computers, unique design and vibrant colours, Investore invites and encourages customers to browse in the resource centre, surf the Internet or attend daily in-house... -

Page 10

... Burns employs equity capital of more than $560 million and total regulatory capital of $958 million. Nesbitt Burns' investment research continues to receive the highest ranking among Canadian-based brokerage ï¬rms, and its team of 40 research analysts covers more than 450 North American stocks... -

Page 11

... for shareholder value Corporate Governance Bank of Montreal is an acknowl- Regulation for Growth As we approach the next century, the North American banking industry is confronting not one, but four, powerful drivers of change: information and technology, globalization, demographics and financial... -

Page 12

...customers. Often, those solutions can be found in alliances or strategic partnerships that pool ï¬nancial, technical and human resources, effectively combining the strength and expertise of each partner. Partners Symcor  state-of-the-art paper processing Even as the advent of electronic banking... -

Page 13

... card market, Bank of Montreal and Harris Bank have announced a strategic alliance with two major American ï¬nancial services ï¬rms, First Annapolis Consulting, Inc. and BankBoston Corporation. With the combined resources of its parent companies, Partners First will possess the economies of scale... -

Page 14

..., technology  and its employees  the Bank of Montreal Group of Companies have created a platform for continuous learning and continued proï¬tability. In both Canada and the United States, we are committed to becoming the learning bank. We have developed the new capabilities, programs and... -

Page 15

... and change; marketing, sales and service; lending, corporate ï¬nance and capital markets; and technology. A range of approaches are employed to meet the Bank's learning needs. This year, for example, two programs in support of building the core competencies of the Operations Group were designed in... -

Page 16

... strong results admittedly owe a good deal to the robust North American economy, to the bull market in shares, and to higher valuations for Canadian banks in general. But they also owe a good deal to a particularly powerful performance by the Bank of Montreal Group of Companies. You will ï¬nd more... -

Page 17

...Electronic Financial Services (EFS), as well as creating Global Treasury Group (GTG) in 1997. EFS takes responsibility for mbanx, our one-year-old virtual banking division; cash management services; telephone banking and other electronic delivery channels; credit card operations; Institutional Trust... -

Page 18

... loan categories accounted for the increase in total assets. (Details: Page 50.) Short- and Long-term Gain In summary, the most striking feature of 1997 for the Bank of Montreal Group of Companies is not so much a new record for earnings, or the 17.1% achieved in our return on shareholders' equity... -

Page 19

... income growth from our fee-related businesses. Cash Resources ($ millions) Securities Cash and Securities-to-Total Assets (%) More information can be found on page 50. The selection of the 23 largest banks is based on the size of their 1996 common shareholders' equity: Bank of Montreal, The Bank... -

Page 20

... Financial Performance Five-Year Return on Common Shareholders' Investment (%) • Our performance was slightly below the Canadian peer group average of 27.3%, and below the North American peer group average of 29.0%. Canadian Peer Group: Below Average North American Peer Group: Below Average... -

Page 21

... Group Comparison 1997 Bank of Six Bank of Montreal Bank Montreal Performance Rank Average Performance 1996 Five-Year Average Six Bank Rank Average Six Bank of Bank Montreal Rank Average Performance Primary Financial Performance Measures (%) Five-year return on common shareholders' investment... -

Page 22

... accelerated depreciation related to technology changes and costs associated with improving the efficiency of our credit process. 93 94 95 96 97 Net Income by Operating Group ($ millions) PCFS Harris GTG I&CB EFS More information can be found on page 30. Operating Group Review 112 153... -

Page 23

... diversified by customer, type, currency and geography. 35,409 30.3 93 41,194 35.1 35.8 35.6 74,034 53,336 60,796 Cash Resources ($ millions) Securities Cash and Securities-to-Total Assets (%) More information can be found on page 50. 29.8 94 95 96 97 Credit Rating • Credit rating composite... -

Page 24

... on the size of their 1996 common shareholders' equity: Bank of Montreal, The Bank of Nova Scotia, Canadian Imperial Bank of Commerce, Royal Bank of Canada, The TorontoDominion Bank, Banc One Corp., BankAmerica Corporation, Bankers Trust New York Corporation, The Bank of New York Company, Inc., The... -

Page 25

... 93 94 95 96 97 Canadian Peer Group: Below Average North American Peer Group: Below Average Cash and Securities-to-Total Assets (%) 35.1 30.3 29.8 35.8 35.6 • Relative to the Canadian and North American peer groups at 25.4% and 30.0%, respectively, our liquidity ratio placed us in the top... -

Page 26

...Services Global Treasury Group Harris Regional Banking Investment and Corporate Banking 21 22 23 24 28 30 31 33 37 39 Financial Condition Risk Management Overview Asset Quality Management Capital Management Liquidity Management Economic Outlook Supplemental Information 41 45 48 50 51 52 Electronic... -

Page 27

... to analyze shareholder value in the short term. In both measurements, ROI is calculated as the annualized total return earned on an investment in Bank of Montreal common shares made at the beginning of each period. Total return includes the effect of the change in share price and the reinvestment... -

Page 28

... in Investment and Corporate Banking 93 94 95 96 97 and Global Treasury, both of which beneï¬ted from buoyant capital markets. Cash collections on impaired loans and earnings on bonds and equities of lesser developed countries also contributed to Global Treasury's revenue growth. The Canadian and... -

Page 29

...free" Measure: investment, plus an appropriate risk premium. Currently, Return on common shareholders' this rate is set by the Board of Directors at the beginning of equity (ROE) is calculated as net income, less preferred dividends, as each ï¬scal year, using as a basis the projected average yield... -

Page 30

... growth of 4.1% due to business volume growth and a 19.7% increase in other income due to capital market fees resulting from stronger equity markets, increased new issue activity and increased secondary trading volumes. Total Revenue ($ millions) For the year ended October 31 Revenue Growth (%) 15... -

Page 31

... in trading volumes Total Bank margin (basis points) †Note: For more information see Table 5 on page 54. and reverse repos . The asset growth in Personal and Commercial Financial Services of 6.3% was principally driven by the 12.8% increase in residential mortgages. Asset growth in Electronic... -

Page 32

... income. The increase in mutual fund revenues mainly resulted from growth in assets under management which grew 51.1% from $34,978 million to $52,869 million in 1997. Other fees and commissions include revenue from insurance-related activities, foreign exchange revenue other than trading, investment... -

Page 33

... To* Employees 34% Suppliers 24% Loan Losses 4% Net Income Before Government Taxes and Levies 38% Government 48% Shareholders 52% Dividends * Note: Investment Revenue represents capital market fees, investment management and custodial fees and mutual fund revenues; Canadian Retail Service Charges... -

Page 34

... Management deposits insured by the Savings Association Insurance Fund (SAIF). This charge related to Harris Bank's acquisition of Household and contributed 0.7% to overall expense growth. Productivity Initiatives Symcor Strategic Sourcing PCFS Transformation Co-sourcing of document processing... -

Page 35

...of point-of-sale transactions and investments in technology. The increase in other expenses largely reï¬,ects third-party payments as a result of the managed futures product. In 1996, the increase in salary and employee beneï¬ts was directly related to revenue generation in Investment and Corporate... -

Page 36

... driven by strong capital markets in the low interest rate environment. Global Treasury's net income increased $85 million as a result of new business and product development as well as cash collections due to the improved North American economy. Harris Regional Banking's net income growth was 21... -

Page 37

...in meeting customer needs through a series of diverse initiatives which include: recruiting Trust & Investment Services Managers, establishing a Bank of Montreal MBA program at Dalhousie University for a select group of high potential future leaders, and enhancing the skill set of Financial Services... -

Page 38

...a result of price floors. Second, PCFS experienced a higher rate of growth in their lowerearning assets, namely mortgages, than other asset categories. Expense growth of 3.5% reflects several key investment and capacity creation initiatives such as branch rationalization, organizational streamlining... -

Page 39

... Nesbitt Burns expertise in raising public funding. • Established Bank of Montreal Ireland (BMI) as a fully licensed bank to source and build foreign currency assets. The three main lines of business are treasury, loans/investments and managed futures. • Launched an International Money Market... -

Page 40

... of strategic initiatives such as Global Distribution, Project Finance, Derivatives and Managed Futures. GTG has also experienced signiï¬cant revenue growth from cash collections ($79 million) due to the improved North American economy. Earnings from equities and bonds of lesser developed countries... -

Page 41

... Strategic Investing for the Modern Banking Environment Group Description Electronic Financial Services (EFS), a new operating group in 1997, is made up of diverse North American businesses which share a mandate to develop new technologies and channels of distribution and leverage information... -

Page 42

... credit card and corporate electronic ï¬nancial services lines of business. Non-interest expenses increased 28.4% reï¬,ecting investments in technology and increases in personnel in mbanx and telephone banking. Credit card balances and mortgages contributed to the 25.4% increase in average assets... -

Page 43

... and private banking expand corporate banking and trust businesses reduce fixed cost structure • Doubled loan syndication fees in 1997. • Working with our Electronic Financial Services organization, cash management revenues grew at a double-digit rate  twice the national average  and... -

Page 44

... effect to the current year's organization structure. (a) The decrease in assets under administration at October 31, 1996 reflects the sale of Harris' securities custody and related trustee services business for large institutions in January 1996. (b) As at October 31. NA - Not available. 38 Bank... -

Page 45

..., government, institutional and private clients. Asset Management Services offers a full range of mutual funds, discount brokerage service (InvestorLine), trust products and investment management services to private and institutional clients in North America. The Merchant Bank is a private equity... -

Page 46

... management account programs and Nesbitt Burns Pathfinder®, a comprehensive investment and retirement planning program. In addition, we offer investment products and services through Harris Trust in the United States, and through Bank of Montreal Private Client Services, Jones Heward, The Trust... -

Page 47

...and communicates policy on all risk management issues. The head of Risk Management Policy submits policy for ï¬nal approval to the Risk Review Committee of the Board of Directors, which oversees all risk management processes and receives regular reports on risk activities. All corporate policies on... -

Page 48

... rates, and equity and commodity prices. Interest rate risk is the risk that net interest income and/or shareholders' equity will decrease because of an adverse movement in interest rates. Foreign exchange risk is the potential for losses resulting from adverse currency movements in relation to open... -

Page 49

... the allowance. Off-balance sheet credit risks are included in credit risk management processes and measurement. Position Risk We use a variety of techniques to monitor, manage and control interest rate, foreign exchange, commodity and equity risk including gap reporting, stress testing, simulation... -

Page 50

... We offer derivative products to customers for their own risk management and investment purposes. These contracts can either be exchange traded (such as futures and some types of options) or over-the-counter transactions including interest rate and cross-currency swaps, forward rate agreements (FRAs... -

Page 51

...in effectively managing risk. We seek to employ the best available technologies and methods to manage credit risk. Management has supplemented traditional controls on risk concentrations with quantitative tools that help measure and price credit risks, mainly those in the corporate and institutional... -

Page 52

... portfolio largely accounts for our losses from that activity By Market following the general business cycle. However, both in Individuals 41.2 43.5 the United States and to a lesser extent in Canada, there Commercial, corporate & institutional 58.6 56.3 has been a measurable increase in personal... -

Page 53

...the secondary Net write-offs as a % of average loans and acceptances 0.2 0.3 0.6 1.3 1.1 market for loan assets assists (a) Write-offs on designated lesser developed countries include losses on sales of performing assets that were charged directly against us in managing our loans the allowance (1997... -

Page 54

... means we will: • exceed minimum regulatory requirements at all times; • cover the economic risks generated by our portfolio of businesses; • meet the expectations of the market and our regulators; and • return unneeded capital to the shareholders. Process Overview We need to maintain suf... -

Page 55

... ratio of total capital to riskCanadian Basis weighted assets, and the assets to capital multiple, which Tier 1 is deï¬ned by OSFI to be the multiple of adjusted assets (as Common shareholders' equity 7,629 6,729 6,174 5,678 4,834 at assets including guarantees and letters of credit) to total Non... -

Page 56

...broadly diversiï¬ed by Banks Businesses/Governments customer, type and currency. Individuals Our wholesale funding activities are performed by professional teams situated in several key ï¬nancial markets worldwide, and are subject to stringent liability diversiï¬cation policies, the objectives of... -

Page 57

... the United States is occurring at a time when the economy is thought to be operating beyond its capacity limits. For example, since the spring of this year the unemployment rate has generally remained below 5%. The high level of resource utilization is expected to prompt a 50-basis-point tightening... -

Page 58

... threshold (%) Return on average total equity (%) Cash ROE (%) (e) * Return on average assets (%) Return on average assets available to common shareholders (%) *Reclassified to conform with the current year's presentation. (a) Restated to reflect the effect of the two-for-one stock distribution... -

Page 59

... Capital market fees Card services Investment management and custodial fees Mutual fund revenues Trading revenue Other fees and commissions Revenue from insurance-related activities Gain/(loss) on disposal of premises and equipment Foreign exchange revenue other than trading Investment securities... -

Page 60

...* Average interest yield (%) Interest income For the year ended October 31 Assets Canadian Dollars Deposits with other banks Securities Loans Residential mortgages Non-residential mortgages Consumer instalment and other personal loans Credit card loans Loans to businesses and governments (a) Total... -

Page 61

... banks Securities Loans Residential mortgages Non-residential mortgages Consumer instalment and other personal loans Credit card loans Loans to businesses and governments (a) Total loans Change in U.S. dollar and other currencies interest income Total All Currencies Change in total interest income... -

Page 62

... based upon historical account balance behaviour. Assets Fixed term assets such as residential mortgages and consumer loans are reported based upon the scheduled repayments and estimated prepayments based on historical behaviour. Trading assets are reported in the 0-3 month category. Fixed rate, non... -

Page 63

... Investment and Corporate Banking (%) (a) The non-recurring item in 1996 is the Harris Savings Association Insurance Fund (SAIF) charge, in 1995 is the business process improvement initiative charge and in 1994 is the Harris special charge. (b) Includes the SAIF charge. (c) Government levies... -

Page 64

... for credit losses Transfer of allowance Recoveries Write-offs (e) Other, including foreign exchange ACL, end of year Allocation of Write-offs by Market Individuals Commercial, corporate and institutional Designated lesser developed countries (LDC) Allocation of Recoveries by Market Individuals... -

Page 65

.../Energy Service industries Retail trade Wholesale trade Agriculture Transportation/Utilities Communications Other Total commercial, corporate and institutional Net charge to earnings for general provision Designated lesser developed countries Total provision for credit losses (PCL) Bank o f M ontr... -

Page 66

...0 0 1993 0 0 0 0 0 0 Individuals Residential mortgages Cards Personal loans Total individuals Diversified commercial (b) General allowance Designated lesser developed countries (LDC) Specific allowance Country risk allowance Off-balance sheet Allowance for credit losses (ACL) 0 0 1 895 0 0 2 737... -

Page 67

... Net Impaired Loans by Industry Financial institutions Commercial mortgages Construction (non-real estate) Commercial real estate Manufacturing Mining/Energy Service industries Retail trade Wholesale trade Agriculture Transportation/Utilities Communications Other (d) (f) Total diversified commercial... -

Page 68

...79,312 Assets Cash resources Securities Loans (net) Acceptances Other assets Total assets Liabilities and Shareholders' Equity Deposits Other liabilities Subordinated debt Share capital Preferred Common Retained earnings Total liabilities and shareholders' equity Average Balances Loans (d) Assets... -

Page 69

...As at October 31 Balance Balance sheet items Cash resources Securities Mortgages Other loans and acceptances Other assets Total balance sheet items Off-balance sheet items Guarantees and standby letters of credit Securities lending Documentary and commercial letters of credit Commitments to extend... -

Page 70

... three months ended Balance Sheet Data Total assets Cash resources Securities Loans (net) Acceptances Other assets Deposits Total capital funds Common equity Average assets (a) Net Income Statement Interest, dividend and fee income Loans Securities Deposits with banks Total interest income Interest... -

Page 71

...Tier 1 capital ratio (h) Cash and securities-to-total assets (i) Credit rating (j) Other Financial Ratios (%) Return on average total equity (k) Return on common shareholders' investment (l) Return on average assets Return on average assets available to common shareholders Net income growth Cash ROE... -

Page 72

... of Income Consolidated Statement of Changes in Shareholders' Equity Consolidated Statement of Changes in Financial Position Notes to Consolidated Financial Statements Statement of Management's Responsibility for Financial Information Shareholders' Auditors' Report Bank Owned Corporations 67... -

Page 73

...Assets Cash Resources (note 2) Securities (notes 3 & 5) Investment (market value $19,023 in 1997 and $17,556 in 1996) Trading Loan substitutes Loans (notes 4, 5 & 16) Residential mortgages Consumer instalment and other personal loans Credit card loans Loans to businesses and governments Securities... -

Page 74

... for Credit Losses Other Income Deposit and payment service charges Lending fees Capital market fees Card services Investment management and custodial fees Mutual fund revenues Trading revenues Other fees and commissions Net Interest and Other Income Non-Interest Expense Salaries and employee... -

Page 75

... Shares (note 12) Balance at beginning of year Issued under the Shareholder Dividend Reinvestment and Share Purchase Plan Issued under the Stock Option Plan Issued on the exchange of shares of Bank of Montreal Securities Canada Limited Purchased for cancellation Stock options granted on acquisition... -

Page 76

...by Financing Activities Cash Flows Used in Investing Activities Interest-bearing deposits with banks Net purchases (sales) of investment securities Net increase in loans Proceeds from sale of credit card receivables Net increase (decrease) in securities purchased under resale agreements Premises and... -

Page 77

... of Presentation and shareholders' equity related to foreign currency transactions are translated into Canadian dollars at the exchange rate in effect at the balance sheet date. The income and expense amounts related to these transactions are translated using the average exchange rate for the year... -

Page 78

... with our accounting policy for loans which is described in note 4. Trading securities are securities that we purchase for resale over a short period of time. We report these securities at their market value and record the mark-to-market adjustments and any gains and losses on the sale of these... -

Page 79

... Net purchases (sales) of investment securities $ 45,803 (26,161) (18,327) $ 1,315 1996 $ 86,356 (68,316) (20,738) $ (2,698) Interest income and gains and losses from securities are: 1997 1996 1995 Reported in: Interest, dividend and fee income Investment securities Associated corporation Trading... -

Page 80

... for credit losses are reviewed by the Risk Management Policy unit at Head Office, which is independent from the credit function. An independent corporate audit group also reviews loans on a sample basis throughout the year to assess the need for specific allowances. We use a variety of methods to... -

Page 81

... Superintendent of Financial Institutions Canada that have restructured or experienced difficulties in servicing all or part of their external debt to commercial banks. These loans and securities are reviewed quarterly by our account managers, credit personnel and the Risk Management Policy unit to... -

Page 82

... some time. Changes in Accounting Policies Effective in 1997, Canadian generally accepted accounting principles require that unrealized gains and losses on derivative financial instruments be reported on a gross rather than net basis. We have adopted this new accounting standard in the current year... -

Page 83

... yet purchased Securities sold under repurchase agreements $ 5,594 10,304 21,389 $ 37,287 Accounts payable, accrued expenses and other items Liabilities of subsidiaries, other than deposits Accrued interest payable Unrealized losses and amounts payable on derivative contracts Deferred loan fees Non... -

Page 84

... stock exchanges. This program was established to cancel some of our common shares and help minimize the potentially dilutive effects that may arise from common shares that could be issued under our Stock Option Plan and acquisitions of The Nesbitt Thomson Corporation Limited, Burns Fry Limited... -

Page 85

... Shareholder Dividend Reinvestment and Share Purchase Plan, 7,402,920 common shares in respect of the exchange of Class B, C, E and F shares of Bank of Montreal Securities Canada Limited, 1,000,000 common shares in respect of the exchange of Class D shares of The Nesbitt Burns Corporation Limited... -

Page 86

...We have a number of pension plans which provide benefits to our employees in North America and other parts of the world. The principal pension plan covers Canadian employees. Our plans generally provide retirement benefits based on the employees' years of service and average earnings at the time of... -

Page 87

... Weighted average discount rate for projected benefit obligation Weighted average rate of compensation increase Weighted average expected long-term rate of return on pension plan assets The cost of post-retirement life insurance, health and dental care beneï¬ts reported in employee benefits... -

Page 88

... $151 for 1995. (c) Legal Proceedings Nesbitt Burns Inc., an indirect subsidiary of the Bank of Montreal, has been named as a defendant in several class and individual actions in Canada and a class action in the United States of America brought on behalf of shareholders of Bre-X Minerals Ltd. ("Bre... -

Page 89

... and related credit exposure: Notional amount: represents the amount to which a rate or price is applied in order to calculate the exchange of cash ï¬,ows. Replacement cost: represents the cost of replacing, at current market rates, all contracts which have a positive fair value, in effect the... -

Page 90

...-the-counter Exchange traded Total Commodity Contracts Equity Contracts Over-the-counter Exchange traded Total Equity Contracts Total Included in the notional amounts above is $11,051 related to the Managed Futures Certificates of Deposit Program. Risk exposures represented by the assets in this... -

Page 91

... or six-month London Interbank Offered Rate. Basis swaps are floating interest rate swaps in which amounts paid and received are based on different indices or pricing periods. Other swaps are contracts where the fixed side is denominated in a source currency other than Canadian $ or U.S. $. Bank... -

Page 92

... calculated as: • Instruments are marked to market using quoted market rates and/or zero coupon valuation techniques. • Zero coupon curves are created using generally accepted mathematical processes from underlying instruments such as cash, bonds, futures and off-balance sheet prices observable... -

Page 93

... Institutions Canada. As a result of listing our common shares on the New York Stock Exchange we are "Accounting for Transfers and Servicing of Financial Assets required by the United States Securities and Exchange Commission and Extinguishments of Liabilities", which must be adopted to report... -

Page 94

... generally accepted in the United States. The ï¬nancial statements also comply with the provisions of the Bank Act and related regulations, including the accounting requirements of the Superintendent of Financial Institutions Canada, as well as the requirements of the Securities and Exchange... -

Page 95

..., U.S.A. Harris Futures Corporation Wilmington, U.S.A. Nesbitt Burns Securities Inc. and subsidiary Chicago, U.S.A. BMO Ireland Finance Company Dublin, Ireland BMO Nesbitt Burns Equity Partners Inc. Toronto, Canada Cebra Inc. Toronto, Canada The Trust Company of Bank of Montreal Toronto, Canada 100... -

Page 96

... what a bank earns on assets such as loans and securities and what it pays on liabilities such as deposits and subordinated debentures. Notional Amount The amount to which a rate or price is applied in order to calculate the exchange of cash ï¬,ows. Off-Balance Sheet Financial Instrument An asset or... -

Page 97

For Bank of Montreal, the relationship with its investors is a long-term constructive partnership. This philosophy and approach have for many years guided our efforts to develop open, effective, accountable corporate governance practices, and have earned the Bank a long-standing reputation as a ... -

Page 98

...condition; marketing and customer satisfaction; human resources management; technology and infrastructure management; community service and Bank reputation; and strategic positioning. The Board Governance and Administration Committee conducts an independent performance evaluation of the Chairman and... -

Page 99

...inquiries, as well as an Investor Relations group dealing with institutional investors and ï¬nancial analysts. Conclusion Bank of Montreal believes corporate governance is a core contract between the Bank and its shareholders, implemented through the Board of Directors. Its rigorous implementation... -

Page 100

... The Human Resources and Management Compensation Committee deals with issues related to the Bank's human resources, including annual reviews of the Bank's human resources inventory and compensation and beneï¬ts policy changes. The committee, in addition, reviews and approves executive compensation... -

Page 101

... R. Beatty, O.B.E. Toronto, Ont. Chairman and Chief Executive Ofï¬cer Old Canada Investment Corporation Limited Peter J.G. Bentley, O.C., LL.D. Vancouver, B.C. Chairman, President and Chief Executive Officer Canfor Corporation Louis A. Desrochers, M.C., c.r. Edmonton, Alta. Senior Partner McCuaig... -

Page 102

... Chairman) Canada Chairman, Centre for International Studies University of Toronto Matthew W. Barrett, O.C. Canada Chairman of the Board and Chief Executive Ofï¬cer Bank of Montreal Ambassador Richard R. Burt United States Chairman International Equity Partners Sir Michael Butler United Kingdom... -

Page 103

... In addition, The Trust Company of Bank of Montreal and Bank of Montreal Trust Company serve as transfer agents and registrars for common shares in London, England and New York, respectively. Canada United States Other countries 90.6% 9.2% 0.2% 100.0% Registered shareholdings by geographic region... -

Page 104