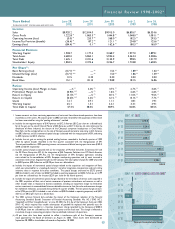

Avnet 2002 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2002 Avnet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

IT capability is an important competitive advantage for our Company, just as research and

development are for a products-based company, fostering growth while maximizing profitability.

By integrating acquisitions such as Kent Electronics Corporation, which closed just before FY’02

began, Avnet gained specialist product divisions and removed redundant infrastructure, resulting

in permanent cost reductions that allowed us to leverage savings in the face of falling revenues.

UNPRECEDENTED OPPORTUNITY

Through the 1980s, Avnet focused heavily on organic growth, adding new customers and

suppliers, growing revenues and capturing market share. During the ‘90s, the Company focused

more on mergers and acquisitions, growing earnings and leveraging the economies of scale we

had built.Today, we possess a new code.With a fervent commitment to value-based management,

we have aligned our culture, goals, structure and compensation to accomplish a single overarching

goal: consistently increase shareholder value.

Avnet’s primary financial objective is, quite simply, to create shareholder value. Improving return

on capital employed (ROCE), accelerating earnings growth and improving earnings growth stability

will lead us to this overarching goal.

Our commitment to shareholder value creation does not stop with the executive team.

At Avnet, we are forging a culture driven by value. Each operating group president is measured

on ROCE and earnings growth. Every executive leading a specialized business unit is measured

and paid on return on working capital and earnings growth.The compensation of all employees

with variable pay plans is aligned with the fundamental goal of delivering shareholder value.

Creating Value for the Technology Supply Chain

Members of the Avnet Executive

Board average

more than 20 years of

industry experience. There

is no more knowledgeable team

in the business.

management strength

5