Avnet 2002 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2002 Avnet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

To Our Shareholders

Dear Fellow Avnet Shareholder:

In an unprecedented industry environment, Avnet’s team was put to the test during fiscal year

2002.The previous year’s dramatic industry downturn continued to challenge all aspects of the

technology supply chain. For the first time in more than four decades, Avnet posted an operating

loss for the fiscal year. But our team’s actions, reactive and proactive, were equally unprecedented.

Operations were fine-tuned. Our cost structure and debt were reduced substantially. Our value

propositions were enhanced.The result: a lean and focused organization better positioned than

ever for growth and for leveraging profits and creating shareholder returns from that growth.

UNPRECEDENTED ENVIRONMENT

In our previous annual report, I described fiscal year 2001 as “a tale of two markets.” It was the

best of times during the first half, and the worst of times during the second half as the slowing

worldwide economy, falling demand for electronic equipment and a supply chain bloated with

excess inventory and over-capacity converged. A significant drop in revenues heralded what

would be, for Avnet and the technology industry overall, an extremely difficult period. However,

as FY’02 progressed, the story became one of stabilization in the technology market, albeit at

much lower revenue levels. At Avnet, our operating results improved continuously throughout

the fiscal year, and we returned to profitability in the fourth quarter before special charges.

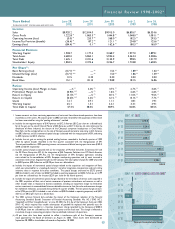

Avnet closed the year with $8.92 billion in revenues, approximately 30 percent lower than the

$12.81 billion record set in FY’01. Per share results from continuing operations fell to a loss of

$0.16 in the September quarter of 2001 before aggressive expense reductions, which started

during FY’01 and continued throughout FY’02, began to catch up with the steep revenue decline.

Subsequently, losses decreased to $0.02 per share and $0.01 per share in the December 2001

and March 2002 quarters, respectively, and Avnet ended FY’02 back in the black at $0.01 per

share before special charges.

UNPRECEDENTED ACTIONS

Although we are far from satisfied with the Company’s FY’02 financial results, rest assured

that Avnet is committed to generating acceptable levels of profitability regardless of market

conditions and revenue levels. Clearly, by the December 2001 quarter, our leadership team’s

focus on strengthening our financial position and restructuring our operations began to

curtail the losses wrought by unprecedented falling revenues. Throughout the year, the

Company attained cost savings from global economies of scale that were created during the

previous decade’s aggressive acquisition period.

STRENGTHENING AVNET’S FINANCIAL POSITION Since December 2000, Avnet’s

management team has concentrated on removing cost and working capital from our business and

generating cash. In doing so, it has created unprecedented operating leverage for our Company.

Today, our balance sheet is positioned to support growth, and our profit and loss statement,

trimmed of expenses, gives us the ability to leverage top-line growth to higher earnings levels.

2