Atmos Energy 2014 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2014 Atmos Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

19

e eects of colder weather increased the throughput

for all three operating segments and added about $17.1

million, or 17 cents per diluted share, to scal 2014 consol-

idated net income.

Atmos Pipeline–Texas (APT), our intrastate natural gas

transmission and storage system, transported 714 billion

cubic feet of gas during scal 2014. APT’s system overlays

the prolic Barnett Shale natural gas basin and reaches other

producing and shale-gas areas. Its pipelines span across Texas

with connections to the state’s three major natural gas hubs

at Waha, Katy and Carthage.

APT has been adding capabilities to transport reliable

and aordable gas supplies to serve primarily our Mid-

Tex Division and other local gas distribution customers in

Texas. ese investments also help APT transport natural

gas reliably to new and existing electric power plants and

industrial facilities.

Higher natural gas consumption during scal 2014 also

created more volatility in wholesale gas prices.

Our nonregulated segment was able to take great advan-

tage of the market opportunities caused by the wider spreads

in gas prices. Atmos Energy Marketing—which buys, sells

and arranges transportation for large volumes of natural gas

at competitive prices to major customers in some 20 states

and to our own system—nearly tripled its year-over-year

contributions to scal 2014 consolidated earnings.

Because we assume a return to normal weather in scal

2015, we do not anticipate our nonregulated segment

repeating these results.

FINANCING

To raise additional capital, we sold 9.2 million shares of

our common stock in February 2014 at $44.00 a share. We

used the $390.2 million of net proceeds from the oering to

fund infrastructure improvements, to repay short-term debt

under our commercial paper program and to support other

corporate needs.

In October 2014, we replaced $500 million of maturing

4.95 percent senior notes with $500 million of 4.125 percent

senior notes due October 2044. e issuance will reduce our

weighted average cost of long-term debt and will save about

$8 million annually in interest expense.

We also have taken advantage of historically low interest

rates to lock in Treasury yield components of interest rates

for two planned future renancings for retiring debt. For

our $250 million of 6.35 percent 10-year senior notes

maturing in June 2017, the Treasury component of the

future issue will eectively be xed at 3.367 percent. e

Treasury component for renancing our $450 million of

8.50 percent 10-year senior notes that mature in March 2019

will eectively be xed at 3.857 percent. e renancings

will lower our weighted average cost of debt and will extend

weighted average maturities.

At the end of the scal year on September 30, 2014, our

balance sheet was strong with a debt-to-total-capitalization

ratio of 46.2 percent. We had nearly $1.2 billion in available

liquidity to meet our expected nancial requirements.

Rating agencies have recognized the strengths of our bal-

ance sheet, constructive regulatory outcomes and peer-lead-

ing growth in earnings per share. Our corporate credit

ratings were upgraded during the scal year by Moody’s

Investors Service from Baa1 to A2 and by Standard & Poor’s

from BBB+ to A-.

OUTLOOK

We have issued Atmos Energy’s scal 2015 earnings

guidance to be between $2.90 and $3.05 per diluted share,

excluding net unrealized margins.

Our capital expenditures for scal 2015 through scal

2018 are projected to be between $900 million and $1.1

billion annually. We expect to nance this growth through

$800 million to $1.0 billion of incremental nancing.

In turn, we forecast that the value of our rate base will

increase at a compounded annual growth rate from scal

2012 to scal 2018 of between 9 percent and 10 percent,

with a total value by the end of scal 2018 of between $7.2

billion and $7.4 billion.

Earnings growth of 6 percent to 8 percent, combined

with a dividend yield in the range of 3 percent, should

provide our shareholders an attractive total annual return

between 9 percent and 11 percent.

Signicantly, the approximately $4 billion we plan to

invest in infrastructure improvements during the next four

scal years should have little eect on our customers’ total

bills. With delivered natural gas prices forecast to remain

stable in the range of $5 to $6 per 1,000 cubic feet and

assuming normal weather, our average residential customer’s

monthly bill should remain well below $60.

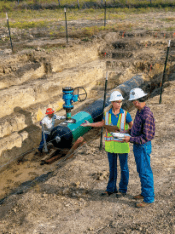

AMERICA’S SAFEST GAS COMPANY

In this annual report, we discuss the signicant level of

capital expenditures we are making in all the states we serve

to modernize and expand our natural gas transmission and

delivery system. We are a leader in our industry in pursuing

these improvements and are proud of the exceptional eorts

by our employees to achieve these results.

Our goal is to be the safest natural gas company in

America. It is a continuing journey toward that goal, but we

are fully committed and well on our way to achieving that

distinction. It is a goal that will protect and benet our

customers, communities, employees and investors for

decades to come.

Kim R. Cocklin

President and Chief Executive Ocer

November 24, 2014