Atmos Energy 2014 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2014 Atmos Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

17

To Our Shareholders

Three years ago, we made a sea change in Atmos Energy’s core growth

strategy, and today it is benefiting our investors, customers and communities.

Our strategy had been to grow through

acquisitions of strategically situated natural gas

distribution assets.

As our founding chairman, Charles K.

Vaughan, noted last year on Atmos Energy’s

30th anniversary, had he and the board of

directors not staked out that strategy—one com-

pletely counterintuitive to the rest of the utility

industry at the time—Atmos Energy would not

have survived. e company was a regional gas

utility in West Texas with little or no customer

growth to sustain it.

By diversifying and growing through 10

major acquisitions over two decades, Charlie

and his successor, Bob Best, built one of the

largest and best-managed natural gas utility sys-

tems in the United States. Atmos Energy not only has remained independent,

but also has prospered beyond all expectations. It has expanded into many

states, and its regulated distribution and pipeline operations have produced

steady growth in earnings and dividends.

Today Atmos Energy has amassed such a sound portfolio of integrated assets

that investing in our own operations yields much better returns than acquir-

ing more distribution assets. Our six regulated distribution divisions and our

Texas regulated intrastate pipeline produce stable and predictable results for

our investors, our customers and the communities we serve. Our nonregulated

business also adds value to our portfolio of assets.

Although we do not rule out acquisitions, we are dedicated to growth for the

foreseeable future from investing principally in our regulated assets.

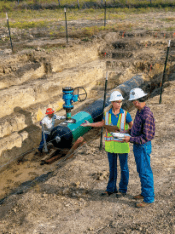

A CLEAR FOCUS

Even more importantly, our growth strategy is designed to advance our goal

of becoming the nation’s safest natural gas utility.

Fortunately, the states we serve began recognizing the need to modernize

infrastructure before the rest of the nation. Legislatures and regulatory author-

ities in our states have promulgated or approved rate design that encourages

investments to replace or fortify infrastructure and signicantly reduces the lag

time in recovering those investments.

Today we are recovering and earning on approximately 91 percent of our

infrastructure investments within six months aer a test year ends and on 96

percent of our investments within 12 months.

is balanced regulatory treatment resulted in our capital spending in

scal 2014 of $835.3 million. Our projected capital investments in scal 2015

should be between $900 million and $1.0 billion.

is signicant level of capital spending will further our journey toward be-

coming the country’s safest utility and will increase our future shareholder value.

Kim R. Cocklin

President and

Chief Executive Ocer

FISCAL 2014 HIGHLIGHTS

$2.96

earnings per diluted share, a

12% increase over fiscal 2013

$1.48

per share annual dividend

15.5%

total shareholder return

$835.3

million in capital expenditures

$134.0

million annual approved operating

income increase from rate activities

6.2%

reduced weighted average cost

of long-term debt

CREDIT UPGRADES

Standard & Poor’s: A-

Moody’s Investor Service: A2