Assurant 2014 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2014 Assurant annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ASSURANT, INC. – 2014 Form 10-K6

PART I

ITEM 1 Business

Assurant Specialty Property

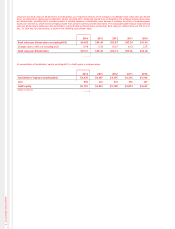

For the Years Ended

December 31, 2014

December 31, 2013

Net earned premiums by major product grouping:

Homeowners (lender-placed and voluntary) $ 1,743,965 $ 1,678,172

Manufactured housing (lender-placed and voluntary) 237,576 226,058

Other(1) 524,556 475,814

TOTAL $ 2,506,097 $ 2,380,044

Fees and other income $ 301,048 $ 133,135

Segment net income $ 341,757 $ 423,586

Loss ratio(2) 43.3% 37.4%

Expense ratio(3) 46.5% 42.5%

Combined ratio(4) 85.2% 77.9%

Equity(5) $ 1,264,216 $ 1,303,579

(1) Other primarily includes multi-family housing, lender-placed flood, and miscellaneous insurance products.

(2) The loss ratio is equal to policyholder benefits divided by net earned premiums.

(3) The expense ratio is equal to selling, underwriting and general expenses divided by net earned premiums and fees and other income.

(4) The combined ratio is equal to total benefits, losses and expenses divided by net earned premiums and fees and other income.

(5) Equity excludes accumulated other comprehensive income.

Products and Services

Assurant Specialty Property targets profi table growth in

lender-placed homeowners insurance, and adjacent niches

with similar characteristics, such as multi-family housing

insurance, lender-placed fl ood insurance and other property

risk management services.

Lender-placed and voluntary homeowners

insurance

The largest product line within Assurant Specialty Property

is homeowners insurance, consisting principally of fi re and

dwelling hazard insurance offered through our lender-placed

program. The lender-placed program provides collateral

protection to lenders, mortgage servicers and investors in

mortgaged properties in the event that a homeowner does not

maintain insurance on a mortgaged dwelling. Lender-placed

insurance coverage is not limited to the outstanding loan

balance; it provides structural coverage, similar to that of a

standard homeowners policy. The amount of coverage is based

on the last known insurance coverage under the prior policy

for the property, and provides replacement cost coverage on

the property and thus ensures that a home can be repaired or

rebuilt in the event of damage. It protects both the lender’s

interest and the borrower’s interest and equity. We also

provide insurance on foreclosed properties managed by our

clients. This type of insurance is Real Estate Owned (“REO”)

insurance. This market experienced signifi cant growth in prior

years as a result of the housing crisis, but has stabilized in

recent years and is expected to decline.

In the majority of cases, we use a proprietary insurance-tracking

administration system linked with the administrative systems

of our clients to monitor clients’ mortgage portfolios to verify

the existence of insurance on each mortgaged property and

identify those that are uninsured. If there is a potential lapse

in insurance coverage, we begin a process of notifi cation

and outreach to both the homeowner and the last-known

insurance carrier or agent through phone calls and written

correspondence. This process takes up to 90 days to complete.

If coverage cannot be verifi ed at the end of this process,

the lender procures a lender-placed policy for which the

homeowner is responsible for paying the related premiums.

The percentage of insurance policies placed to loans tracked

represents our placement rates. The homeowner is still

encouraged, and always maintains the option, to obtain or

renew the insurance of his or her choice.

To meet the changing needs of the lending and housing

industries, Assurant Specialty Property has worked with

regulators to introduce a next generation lender-placed

homeowners product to address some of the unanticipated

issues that developed during the housing crisis. This product

combines fl exibility and best practices to address the concerns

of various parties. The product contains expanded geographic

ratings within each state to further differentiate rates for

properties more exposed to catastrophes from those where

the risk is lower, added premium rating fl exibility from

deductible options that can be modifi ed based on factors such

as coverage amount and delinquency status, and continued

enhancements to our already extensive customer notifi cation

process to make it more clear to borrowers when they have

lender-placed insurance.

Lender-placed and voluntary manufactured

housing insurance

Manufactured housing insurance is offered on a lender-placed

and voluntary basis. Lender-placed insurance is issued after an

insurance tracking process similar to that described above. The

tracking is performed by Assurant Specialty Property using a

proprietary insurance tracking administration system, or by the

lenders themselves. A number of manufactured housing retailers

in the U.S. use our proprietary premium rating technology to

assist them in selling property coverage at the point of sale.