Assurant 2014 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2014 Assurant annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161

|

|

8 ▪ 2014 ASSURANT ANNUAL REPORT

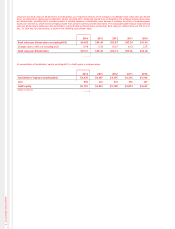

4 A reconciliation of stockholders’ equity, excluding AOCI, to GAAP equity is as shown below:

3 Assurant uses book value per diluted share, excluding AOCI, as an important measure of the Company’s stockholder value. Book value per diluted

share, excluding AOCI, equals total stockholders’ equity, excluding AOCI, divided by diluted shares outstanding. The Company believes book value

per diluted share, excluding AOCI, provides investors a valuable measure of stockholder value because it excludes the effect of unrealized gains

(losses) on investments, which tend to be highly variable from period -to -period and other AOCI items. The comparable GAAP measure would be book

value per diluted share defi ned as total stockholders’ equity divided by diluted shares outstanding. Book value per diluted share was $72.61 as of

Dec. 31, 2014 and, for prior periods, as shown in the following reconciliation table.

2014 2013

2012 2011 2010

Book value per diluted share (excluding AOCI) $64.82 $59.48 $53.87 $47.34 $41.65

Changes due to effect of including AOCI 7.79 5.76 10.27 6.12 2.75

Book value per diluted share $72.61 $65.24 $64.14 $53.46 $44.40

2014 2013

2012 2011 2010

Stockholders’ equity (excluding AOCI) $4,625 $4,407 $4,355 $4,316 $4,346

AOCI 556 426 830 558 287

GAAP equity $5,181 $ 4,833 $5,185 $4,874 $4,633

(dollars in millions)