Amazon.com 2004 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2004 Amazon.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

To our shareholders:

Our ultimate financial measure, and the one we most want to drive over the long-term, is free cash flow per

share.

Why not focus first and foremost, as many do, on earnings, earnings per share or earnings growth? The

simple answer is that earnings don’t directly translate into cash flows, and shares are worth only the present value

of their future cash flows, not the present value of their future earnings. Future earnings are a component—but

not the only important component—of future cash flow per share. Working capital and capital expenditures are

also important, as is future share dilution.

Though some may find it counterintuitive, a company can actually impair shareholder value in certain

circumstances by growing earnings. This happens when the capital investments required for growth exceed the

present value of the cash flow derived from those investments.

To illustrate with a hypothetical and very simplified example, imagine that an entrepreneur invents a

machine that can quickly transport people from one location to another. The machine is expensive—$160 million

with an annual capacity of 100,000 passenger trips and a four year useful life. Each trip sells for $1,000 and

requires $450 in cost of goods for energy and materials and $50 in labor and other costs.

Continue to imagine that business is booming, with 100,000 trips in Year 1, completely and perfectly

utilizing the capacity of one machine. This leads to earnings of $10 million after deducting operating expenses

including depreciation—a 10% net margin. The company’s primary focus is on earnings; so based on initial

results the entrepreneur decides to invest more capital to fuel sales and earnings growth, adding additional

machines in Years 2 through 4.

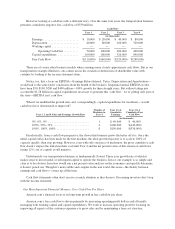

Here are the income statements for the first four years of business:

Earnings

Year 1 Year 2 Year 3 Year 4

(in thousands)

Sales ............................ $100,000 $200,000 $400,000 $800,000

Units sold ..................... 100 200 400 800

Growth ....................... N/A 100% 100% 100%

Gross profit ....................... 55,000 110,000 220,000 440,000

Gross margin .................. 55% 55% 55% 55%

Depreciation ...................... 40,000 80,000 160,000 320,000

Labor & other costs ................. 5,000 10,000 20,000 40,000

Earnings .......................... $ 10,000 $ 20,000 $ 40,000 $ 80,000

Margin ....................... 10% 10% 10% 10%

Growth ....................... N/A 100% 100% 100%

It’s impressive: 100% compound earnings growth and $150 million of cumulative earnings. Investors

considering only the above income statement would be delighted.