Allegheny Power 2010 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2010 Allegheny Power annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.3

FIRSTENERGY CORP.

MANAGEMENT DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS

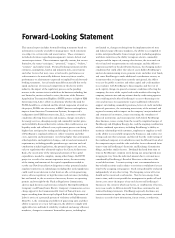

Forward-Looking Statements: This Form 10-K includes forward-looking statements based on information currently

available to management. Such statements are subject to certain risks and uncertainties. These statements include

declarations regarding management’s intents, beliefs and current expectations. These statements typically contain, but are

not limited to, the terms “anticipate,” “potential,” “expect,” “believe,” “estimate” and similar words. Forward-looking statements

involve estimates, assumptions, known and unknown risks, uncertainties and other factors that may cause actual results,

performance or achievements to be materially different from any future results, performance or achievements expressed or

implied by such forward-looking statements.

Actual results may differ materially due to:

• The speed and nature of increased competition in the electric utility industry.

• The impact of the regulatory process on the pending matters in the various states in which we do business.

• Business and regulatory impacts from ATSI’s realignment into PJM Interconnection, L.L.C., economic or weather

conditions affecting future sales and margins.

• Changes in markets for energy services.

• Changing energy and commodity market prices and availability.

• Financial derivative reforms that could increase our liquidity needs and collateral costs, replacement power costs

being higher than anticipated or inadequately hedged.

• The continued ability of FirstEnergy’s regulated utilities to collect transition and other costs.

• Operation and maintenance costs being higher than anticipated.

• Other legislative and regulatory changes, and revised environmental requirements, including possible GHG

emission and coal combustion residual regulations.

• The potential impacts of any laws, rules or regulations that ultimately replace CAIR.

• The uncertainty of the timing and amounts of the capital expenditures needed to resolve any NSR litigation or other

potential similar regulatory initiatives or rulemakings (including that such expenditures could result in our decision to

shut down or idle certain generating units).

• Adverse regulatory or legal decisions and outcomes (including, but not limited to, the revocation of necessary

licenses or operating permits and oversight) by the NRC.

• Adverse legal decisions and outcomes related to Met-Ed's and Penelec's transmission service charge appeal at the

Commonwealth Court of Pennsylvania.

• Any impact resulting from the receipt by Signal Peak of the Department of Labor's notice of a potential pattern of

violations at Bull Mountain Mine No.1.

• The continuing availability of generating units and their ability to operate at or near full capacity.

• The ability to comply with applicable state and federal reliability standards and energy efficiency mandates.

• Changes in customers’ demand for power, including but not limited to, changes resulting from the implementation of

state and federal energy efficiency mandates.

• The ability to accomplish or realize anticipated benefits from strategic goals (including employee workforce

initiatives).

• The ability to improve electric commodity margins and the impact of, among other factors, the increased cost of coal

and coal transportation on such margins and the ability to experience growth in the distribution business.

• The changing market conditions that could affect the value of assets held in the registrants’ nuclear

decommissioning trusts, pension trusts and other trust funds, and cause FirstEnergy to make additional

contributions sooner, or in amounts that are larger than currently anticipated.

• The ability to access the public securities and other capital and credit markets in accordance with FirstEnergy’s

financing plan and the cost of such capital.

• Changes in general economic conditions affecting the registrants.

• The state of the capital and credit markets affecting the registrants.

• Interest rates and any actions taken by credit rating agencies that could negatively affect the registrants’ access to

financing or their costs and increase requirements to post additional collateral to support outstanding commodity

positions, LOCs and other financial guarantees.

• The continuing uncertainty of the national and regional economy and its impact on the registrants’ major industrial

and commercial customers.

• Issues concerning the soundness of financial institutions and counterparties with which the registrants do business.

• The expected timing and likelihood of completion of the proposed merger with Allegheny, including the timing,

receipt and terms and conditions of any required governmental and regulatory approvals of the proposed merger

that could reduce anticipated benefits or cause the parties to abandon the merger, the diversion of management’s

time and attention from FirstEnergy’s ongoing business during this time period, the ability to maintain relationships

with customers, employees or suppliers as well as the ability to successfully integrate the businesses and realize

cost savings and any other synergies and the risk that the credit ratings of the combined company or its

subsidiaries may be different from what the companies expect.

• The risks and other factors discussed from time to time in the registrants’ SEC filings, and other similar factors.

Dividends declared from time to time on FirstEnergy's common stock during any annual period may in aggregate vary from

the indicated amount due to circumstances considered by FirstEnergy's Board of Directors at the time of the actual

declarations. The foregoing review of factors should not be construed as exhaustive. New factors emerge from time to time,

and it is not possible for management to predict all such factors, nor assess the impact of any such factor on the registrants’

business or the extent to which any factor, or combination of factors, may cause results to differ materially from those