Allegheny Power 2010 Annual Report Download

Download and view the complete annual report

Please find the complete 2010 Allegheny Power annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2010 ANNUAL REPORT

Table of contents

-

Page 1

2010 ANNUAL REPORT -

Page 2

...9 Maintained annual dividend of $2.20 per share Generated nearly $3.1 billion in cash from operations Completed the transition to fully competitive markets for electricity in Pennsylvania 9 9 Our competitive subsidiary, FirstEnergy Solutions, nearly tripled the number of its retail customers and now... -

Page 3

... The merger of FirstEnergy and Allegheny Energy expands our utility customer base by 35 percent, increases our generating resources by 70 percent, and creates more opportunities to grow our retail generation sales. In addition, with our contiguous service areas and strategically located power plants... -

Page 4

... operations. On the regulated side of our business, electricity deliveries increased nearly 6 percent in 2010 compared with the previous year, reï¬,ecting the moderate recovery of the economy and favorable weather. Deliveries to industrial customers were up 8 percent - primarily related to increased... -

Page 5

... 8,000 chamber members in western Pennsylvania. In addition, FES is expanding into new markets outside our traditional utility service areas by acquiring retail customers in southern Ohio, Michigan and Illinois. Pursuing Strategic, Generation-Backed Sales Opportunities We continue to strengthen our... -

Page 6

... market rates for generation - set through wholesale power purchases - to customers who do not choose alternative suppliers. With this process now in place throughout our Pennsylvania service area, all of our utilities outside of West Virginia now offer customers market-based pricing for generation... -

Page 7

... completed on time and under budget. The project was recognized as the industry's construction project of the year at the 2010 Platts Global Energy Awards and received honors from Power Engineering magazine. We also continue to pursue new sources of clean, renewable energy and other opportunities... -

Page 8

..., we will create new opportunities for growth across the entire electric power value chain. I'd like to thank the management teams and employees of FirstEnergy and Allegheny Energy for expeditiously completing our merger and building a stronger foundation for our Company. I look forward to... -

Page 9

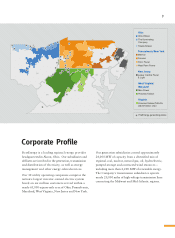

... energy-related services. Our 10 utility operating companies comprise the nation's largest investor-owned electric system based on six million customers served within a nearly 65,000-square-mile area of Ohio, Pennsylvania, Maryland, West Virginia, New Jersey and New York. Our generation subsidiaries... -

Page 10

10 FirstEnergy Board of Directors Dear Shareholders: On behalf of your Board of Directors, I congratulate our management team and employees for successfully completing the merger of FirstEnergy and Allegheny Energy. Through this combination, we are creating a premier regional energy provider that ... -

Page 11

...permits and oversight by the Nuclear Regulatory Commission), adverse legal decisions and outcomes related to Metropolitan Edison Company's and Pennsylvania Electric Company's transmission service charge appeal at the Commonwealth Court of Pennsylvania, any impact resulting from the receipt by Signal... -

Page 12

Annual Report 2010 Contents Glossary of Terms Selected Financial Data Management's Discussion and Analysis Management Reports Report of Independent Registered Public Accounting Firm Consolidated Statements of Income Consolidated Balance Sheets Consolidated Statements of Common Stockholders' Equity ... -

Page 13

... Company, an Ohio electric utility operating subsidiary FirstEnergy Nuclear Operating Company, operates nuclear generating facilities FirstEnergy Solutions Corp., provides energy-related products and services FirstEnergy Service Company, provides legal, financial and other corporate support services... -

Page 14

...C. Provider of Last Resort; an electric utility's obligation to provide generation service to customers whose alternative supplier fails to deliver service Pennsylvania Public Utility Commission Power Supply Agreement Public Service Commission of West Virginia Prevention of Significant Deterioration... -

Page 15

...Purpose Entity Rate Certainty Plan Renewable Energy Credits Request for Proposal Regional Transmission Expansion Plan Regulatory Transition Charge Regional Transmission Organization Standard & Poor's Ratings Service Ohio Amended Substitute Senate Bill 221 Societal Benefits Charge U.S. Securities and... -

Page 16

FIRSTENERGY CORP. SELECTED FINANCIAL DATA For the Years Ended December 31, 2010 2009 2008 2007 2006 (In millions, except per share amounts) Revenues Income From Continuing Operations Earnings Available to FirstEnergy Corp. Basic Earnings per Share of Common Stock: Income from continuing operations ... -

Page 17

... common stock as of December 31, 2010 and January 31, 2011, respectively. Information regarding retained earnings available for payment of cash dividends is given in Note 11 to the consolidated financial statements. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE... -

Page 18

FIRSTENERGY CORP. MANAGEMENT DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS Forward-Looking Statements: This Form 10-K includes forward-looking statements based on information currently available to management. Such statements are subject to certain risks and uncertainties.... -

Page 19

... 11, 2010, FirstEnergy and Allegheny announced a proposed merger that would create the nation's largest electric utility system, with: • more than 6 million customers across ten regulated electric distribution subsidiaries in Ohio, Pennsylvania, New Jersey, Maryland and West Virginia, generation... -

Page 20

.../2013 auction had 28 market participants, with 13,038 MW of unforced capacity clearing at a price of $20.46/MW-day. FirstEnergy plans to integrate its operations into PJM by June 1, 2011. Nuclear Generation On February 28, 2010, the Davis-Besse Nuclear Plant (908 MW) shut down for its 16th scheduled... -

Page 21

... bank borrowings ($63 million) and debt owed to FirstEnergy ($258 million) with the balance to be used for other general corporate purposes. In February 2010, S&P issued a report lowering FirstEnergy's and its subsidiaries' credit ratings by one notch, while maintaining its stable outlook. Moody... -

Page 22

... August 2010. That ESP provides customers with no overall increase to base distribution rates during the plan period and limits the costs they will pay related to certain PJM transmission projects. The ESP provides the Ohio Companies with recovery of capital invested in their distribution businesses... -

Page 23

...• Energy Delivery Services transmits and distributes electricity through our seven utility distribution companies and ATSI, serving 4.5 million customers within 36,100 square miles of Ohio, Pennsylvania and New Jersey. This segment also purchases power for its POLR and default service requirements... -

Page 24

... nuclear, coal, natural gas, wind and pumped storage. In response to reduced customer demand and uncertainty related to proposed new federal environmental regulations, FirstEnergy announced in August 2010 operational changes at several fossil plants. Affected are nine units at four plants located... -

Page 25

...and Increased depreciation expenses and reduced capitalized interest, primarily associated with the Sammis plant environmental project. Distribution deliveries and non-fuel, non-outage O&M expenses including employee benefits are expected to be essentially flat in 2011 compared to 2010. FirstEnergy... -

Page 26

.... Planned capital initiatives promote reliability, improve operations, and support current environmental and energy efficiency directives. Actual capital spending for 2010 and projected capital spending for 2011 are as follows: Capital Spending by Business Unit Energy Delivery Nuclear Fossil... -

Page 27

...® load-management program utilizes twoway communication capability with customers' non-critical equipment such as air conditioners in New Jersey and Pennsylvania to help manage peak loading on the electric distribution system. FirstEnergy has also made an online interactive energy efficiency tool... -

Page 28

...could adversely affect our financial results; once the pending merger is closed the combined company will have a higher percentage of coal-fired generation capacity compared to FirstEnergy's previous generation mix. As a result, FirstEnergy may be exposed to greater risk from regulations of coal and... -

Page 29

... generating units is dependent on retaining the necessary licenses, permits, and operating authority from governmental entities, including the NRC; future changes in financial accounting standards may affect our reported financial results; increases in taxes and fees; interest rates and/or a credit... -

Page 30

... company debt, corporate support services revenues and expenses, noncontrolling interests and the elimination of intersegment transactions. Summary of Results of Operations - 2010 Compared with 2009 Financial results for FirstEnergy's major business segments in 2010 and 2009 were as follows: Energy... -

Page 31

Energy 2009 Financial Results Revenues: External Electric Other Internal* Total Revenues Expenses: Fuel Purchased power Other operating expenses Provision for depreciation Amortization of regulatory assets Deferral of new regulatory assets Impairment of long lived assets General taxes Total Expenses... -

Page 32

... Between 2010 and 2009 Financial Results Increase (Decrease) Energy Delivery Services Competitive Energy Services Other and Reconciling Adjustments FirstEnergy Consolidated (In millions) Revenues: External Electric Other Internal* Total Revenues Expenses: Fuel Purchased power Other operating... -

Page 33

... increases in other operating expenses. Lower generation revenues were offset by lower purchased power expenses. Revenues - The decrease in total revenues resulted from the following sources: Revenues by Type of Service Distribution services Generation sales: Retail Wholesale Total generation sales... -

Page 34

...their transmission rider and transmission costs incurred with no material effect on earnings. Energy efficiency program costs, which are also recovered through rates, increased $41 million in 2010 compared to 2009. Labor and employee benefit expenses decreased by $34 million due to lower pension and... -

Page 35

...from new government aggregation contracts with communities in Ohio that provide generation to 1.5 million residential and small commercial customers at the end of 2010 compared to approximately 600,000 customers at the end of 2009. Increases in direct sales were partially offset by lower unit prices... -

Page 36

...to higher nuclear fuel unit prices following the refueling outages that occurred in 2009 and 2010. Purchased power costs increased $728 million. Increased volumes purchased primarily relate to the assumption of a 1,300 MW third party contract from Met-Ed and Penelec. Fossil operating costs decreased... -

Page 37

... items, including interest expense on holding company debt and corporate support services revenues and expenses, resulted in a $135 million decrease in earnings available to FirstEnergy in 2010 compared to 2009. The decrease resulted primarily from increased income tax expense ($342 million) due in... -

Page 38

Energy 2008 Financial Results Revenues: External Electric Other Internal Total Revenues Expenses: Fuel Purchased power Other operating expenses Provision for depreciation Amortization of regulatory assets Deferral of new regulatory assets Impairment of long lived assets General taxes Total Expenses ... -

Page 39

... revenues, increased purchased power costs and decreased deferrals of new regulatory assets, partially offset by lower other operating expenses. Revenues - The decrease in total revenues resulted from the following sources: Revenues by Type of Service Distribution services Generation sales: Retail... -

Page 40

..., effective June 1, 2009, the Ohio Companies' transmission tariff ended and transmission costs became a component of the generation rate established under the CBP. Wholesale generation sales decreased principally as a result of JCP&L selling less available power from NUGs due to the termination of... -

Page 41

... pension expenses resulting from reduced pension plan asset values at the end of 2008. Storm-related costs were $16 million lower in 2009 compared to the prior year. An increase in other operating expenses of $40 million resulted from the recognition of economic development and energy efficiency... -

Page 42

...Ohio). The higher sales to the Pennsylvania Companies were due to increased Met-Ed and Penelec generation sales requirements supplied by FES partially offset by lower sales to Penn due to decreased default service requirements in 2009 compared to 2008. Additionally, while unit prices for each of the... -

Page 43

...). Nuclear Fuel costs increased $13 million as higher unit prices ($26 million) were partially offset by lower generation ($13 million). Purchased power costs increased $217 million due to a mark-to-market adjustment ($205 million) relating to purchased power contracts for delivery in 2010 and 2011... -

Page 44

... supplier fails to deliver power to any one of the Utilities' service areas, the Utility serving that area may need to procure the required power in the market in their role as a POLR. Unregulated Commodity Sourcing FES provides energy and energy related services, including the generation and sale... -

Page 45

... of its subsidiaries. FirstEnergy's business is capital intensive, requiring significant resources to fund operating expenses, construction expenditures, scheduled debt maturities and interest and dividend payments. During 2011, FirstEnergy expects to satisfy these requirements with a combination of... -

Page 46

... the applicable borrower's borrowing sub-limit. The revolving credit facility contains financial covenants requiring each borrower to maintain a consolidated debt to total capitalization ratio of no more than 65%, measured at the end of each fiscal quarter. As of December 31, 2010, FirstEnergy's and... -

Page 47

... drawings on the irrevocable direct pay LOCs. The subsidiary obligor is required to reimburse the applicable LOC bank for any such drawings or, if the LOC bank fails to honor its LOC for any reason, must itself pay the purchase price. The LOCs for FirstEnergy variable interest rate PCRBs were issued... -

Page 48

... Operating Activities FirstEnergy's consolidated net cash from operating activities is provided primarily by its competitive energy services and energy delivery services businesses (see Results of Operations above). Net cash provided from operating activities was $3.1 billion in 2010, $2.5 billion... -

Page 49

...rate swaps during the second and third quarters of 2010, changes in investment securities of $121 million, increased accrued taxes and decreased prepayments primarily related to prepaid taxes ($279 million) and changes in uncertain tax positions ($176 million), partially offset by increased accounts... -

Page 50

... distribution facilities. Capital spending by the competitive energy services segment is principally generation-related. The following table summarizes investing activities for 2010, 2009 and 2008 by business segment: Summary of Cash Flows Provided from (Used for) Investing Activities Sources (Uses... -

Page 51

... energy and energy-related payments of its subsidiaries involved in energy commodity activities principally to facilitate or hedge normal physical transactions involving electricity, gas, emission allowances and coal. FirstEnergy also provides guarantees to various providers of credit support... -

Page 52

... Mansfield Plant, Perry Unit 1 and Beaver Valley Unit 2, which are satisfied through operating lease payments. The total present value of these sale and leaseback operating lease commitments, net of trust investments, was $1.6 billion as of December 31, 2010. MARKET RISK INFORMATION FirstEnergy uses... -

Page 53

... regional prices for electricity and an estimate of related price volatility. FirstEnergy uses these results to develop estimates of fair value for financial reporting purposes and for internal management decision making (see Note 6 to the consolidated financial statements). Sources of information... -

Page 54

...on an accumulated benefit obligation basis as of December 31, 2010. A decline in the value of FirstEnergy's pension plan assets could result in additional funding requirements. FirstEnergy intends to voluntarily contribute $250 million to its pension plan in 2011. Nuclear decommissioning trust funds... -

Page 55

... incentives Customer receivables for future income taxes Loss on reacquired debt Employee postretirement benefits Nuclear decommissioning, decontamination and spent fuel disposal costs Asset removal costs MISO/PJM transmission costs Deferred generation costs Distribution costs Other Total $ 2010 770... -

Page 56

...October 2009 MRO filing; a 6% generation discount to certain low-income customers provided by the Ohio Companies through a bilateral wholesale contract with FES (initial auctions scheduled for October 20, 2010 and January 25, 2011); no increase in base distribution rates through May 31, 2014; a load... -

Page 57

... to establish separate accounts for marginal transmission loss revenues and related interest and carrying charges and the plan for the use of these funds to mitigate future generation rate increases commencing January 1, 2011. The PPUC approved this plan on June 7, 2010. On April 1, 2010, Met-Ed and... -

Page 58

... electric and gas utilities in order to achieve the goals of the EMP. On April 16, 2010, the NJBPU issued an order indefinitely suspending the requirement of New Jersey utilities to submit Utility Master Plans until such time as the status of the EMP has been made clear. At this time, FirstEnergy... -

Page 59

... parties filed responsive comments or studies on May 28, 2010 and reply comments on June 28, 2010. FirstEnergy and a number of other utilities, industrial customers and state commissions supported the use of the beneficiary pays approach for cost allocation for high voltage transmission facilities... -

Page 60

...restriction regulations. This requires AS to obtain prior FERC authorization to make sales to the Utilities when it successfully participates in the Utilities' POLR auctions. FES currently supplies the Ohio Companies with a portion of their capacity, energy, ancillary services and transmission under... -

Page 61

...provide capacity, energy, ancillary services, and congestion costs to the Ohio Companies for the tranches won. Under the ESP in effect for these time periods, the Ohio Companies are responsible for payment of noncontrollable transmission costs billed by PJM for POLR service. On October 18, 2010, FES... -

Page 62

... made in those three complaints. The states of New Jersey and Connecticut filed CAA citizen suits in 2007 alleging NSR violations at the Portland Generation Station against GenOn Energy, Inc. (the current owner and operator), Sithe Energy (the purchaser of the Portland Station from Met-Ed in... -

Page 63

... occurring during maintenance outages dating back to 1990 triggered the pre-construction permitting requirements under the PSD and NNSR programs. FGCO received a request for certain operating and maintenance information and planning information for these same generating plants and notification that... -

Page 64

... for electric generating plants and other stationary sources until January 2, 2011, at the earliest. In May 2010, the EPA finalized new thresholds for GHG emissions that define when permits under the CAA's NSR program would be required. The EPA established an emissions applicability threshold... -

Page 65

... emitting gas-fired and nuclear generators. Clean Water Act Various water quality regulations, the majority of which are the result of the federal Clean Water Act and its amendments, apply to FirstEnergy's plants. In addition, Ohio, New Jersey and Pennsylvania have water quality standards applicable... -

Page 66

... fee applications. Under the terms of the settlement, no payments are being made by FirstEnergy or Merger Sub. A formal stipulation of settlement was filed with the Maryland Court on October 18, 2010 and it was approved and became final on January 12, 2011. The separate Pennsylvania federal... -

Page 67

... of unbilled sales and revenues requires management to make estimates regarding electricity available for retail load, transmission and distribution line losses, demand by customer class, applicable billing demands, weather-related impacts, number of days unbilled and tariff rates in effect... -

Page 68

Regulatory Accounting FirstEnergy's energy delivery services segment is subject to regulation that sets the prices (rates) the Utilities are permitted to charge customers based on costs that the regulatory agencies determine the Utilities are permitted to recover. At times, regulators permit the ... -

Page 69

... value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. Asset Retirement Obligations FirstEnergy recognizes an ARO for the future decommissioning of FirstEnergy's nuclear power plants... -

Page 70

... taken or expected to be taken on the tax return. FirstEnergy includes net interest and penalties in the provision for income taxes. Goodwill In a business combination, the excess of the purchase price over the estimated fair values of the assets acquired and liabilities assumed is recognized... -

Page 71

... registered public accounting firm, has expressed an unqualified opinion on the Company's 2010 consolidated financial statements. The Company's internal auditors, who are responsible to the Audit Committee of the Company's Board of Directors, review the results and performance of operating units... -

Page 72

Report of Independent Registered Public Accounting Firm To the Stockholders and Board of Directors of FirstEnergy Corp.: In our opinion, the accompanying consolidated balance sheets and the related consolidated statements of income, common stockholders' equity, and cash flows present fairly, in all... -

Page 73

FIRSTENERGY CORP. CONSOLIDATED STATEMENTS OF INCOME For the Years Ended December 31, 2010 2009 2008 (In millions, except per share amounts) REVENUES: Electric utilities Unregulated businesses Total revenues* EXPENSES: Fuel Purchased power Other operating expenses Provision for depreciation ... -

Page 74

...Power purchase contract asset Other $ LIABILITIES AND CAPITALIZATION CURRENT LIABILITIES: Currently payable long-term debt Short-term borrowings Accounts payable Accrued taxes Accrued compensation and benefits Derivatives Other CAPITALIZATION: Common stockholders' equityCommon stock, $0.10 par value... -

Page 75

..., net of $107 million of income tax benefits (Note 3) Comprehensive income Stock options exercised Restricted stock units Stock-based compensation Cash dividends declared on common stock Balance, December 31, 2010 Comprehensive Income Common Stock Number Par of Shares Value 304,835,407 $ 31 Other... -

Page 76

... income taxes and investment tax credits, net Impairment of long-lived assets (Note 19) Investment impairment (Note 2(E)) Deferred rents and lease market valuation liability Stock based compensation Accrued compensation and retirement benefits Gain on asset sales Electric service prepayment programs... -

Page 77

... OF REGULATION FirstEnergy accounts for the effects of regulation through the application of regulatory accounting to its operating utilities since their rates are established by a third-party regulator with the authority to set rates that bind customers; are cost-based; and can be charged to... -

Page 78

...AND RECEIVABLES The Utilities' principal business is providing electric service to customers in Ohio, Pennsylvania and New Jersey. The Utilities' retail customers are metered on a cycle basis. Electric revenues are recorded based on energy delivered through the end of the calendar month. An estimate... -

Page 79

... 304 3 307 4.41 4.38 (D) PROPERTY, PLANT AND EQUIPMENT Property, plant and equipment reflects original cost (except for nuclear generating assets which are adjusted to fair value), including payroll and related costs such as taxes, employee benefits, administrative and general costs, and interest... -

Page 80

... primarily relates to its energy delivery services segment. FirstEnergy's aggregated reporting units are consistent with its operating segments -- energy delivery services and competitive energy. Goodwill is allocated to these operating segments based on the original purchase price allocation... -

Page 81

...of the reporting units, which are aggregated into operating segments, is based on the forecasted operating cash flow for the current year, projected operating cash flows for the next five years (determined using forecasted amounts as well as an estimated growth rate) and a terminal value beyond five... -

Page 82

... stockholders' equity except those resulting from transactions with stockholders and adjustments relating to noncontrolling interests. Accumulated other comprehensive income (loss), net of tax, included on FE's, FES' and the Utilities' Consolidated Balance Sheets as of December 31, 2010 and 2009, is... -

Page 83

... employees and non-qualified pension plans that cover certain employees. The plans provide defined benefits based on years of service and compensation levels. FirstEnergy's funding policy is based on actuarial computations using the projected unit credit method. On September 2, 2009, the Utilities... -

Page 84

... Amounts Recognized in Accumulated Other Comprehensive Income Prior service cost (credit) Actuarial loss Net amount recognized Assumptions Used to Determine Benefit Obligations as of December 31 Discount rate Rate of compensation increase Allocation of Plan Assets As of December 31 Equity securities... -

Page 85

... Periodic Pension and OPEB Costs 2010 2009 2008 2010 Other Benefits 2009 2008 FES OE CEI TE JCP&L Met-Ed Penelec Assumptions Used to Determine Net Periodic Benefit Cost for Years Ended December 31 Weighted-average discount rate Expected long-term return on plan assets Rate of compensation increase... -

Page 86

... last reported sales price on the last business day of the plan year. Market values for real estate investment trusts and certain fixed income securities are based on daily quotes available on public exchanges as with other publicly traded equity and fixed income securities. Level 2 - Pricing inputs... -

Page 87

... fair value of pension investments classified as Level 3 in the fair value hierarchy during 2010 and 2009: Private Equity Funds Balance as of January 1, 2009 Actual return on plan assets: Unrealized gains (losses) Realized gains (losses) Purchases, sales and settlements Transfers in (out) Balance as... -

Page 88

As of December 31, 2010 and 2009, the other postretirement benefit investments measured at fair value were as follows: December 31, 2010 Level 1 Level 2 Level 3 Total Asset Allocation (In millions) Cash and short-term securities Equity investment Domestic International Mutual funds Fixed income ... -

Page 89

... on plan assets: Unrealized gains Realized gains (losses) Purchases, sales and settlements Transfers in (out) Balance at December 31, 2010 $ (in millions) 2 $ 1 1 4 (1) $ 3 $ Real Estate Funds 10 (3) 7 2 9 In selecting an assumed discount rate, FirstEnergy considers currently available rates of... -

Page 90

... (20) Taking into account estimated employee future service, FirstEnergy expects to make the following pension benefit payments from plan assets and other benefit payments, net of the Medicare subsidy and participant contributions: Pension Benefits Other Benefits 2011 2012 2013 2014 2015 Years... -

Page 91

... eligible employees allowing them to purchase a specified number of common shares at a fixed grant price over a defined period of time. Stock option activities under FirstEnergy stock option programs during 2010 were as follows: Weighted Average Grant-Date Fair value $ 34.69 Number of Stock Option... -

Page 92

... period. During that time, dividend equivalents are converted into additional shares. The final account value may be adjusted based on the ranking of FirstEnergy stock performance to a composite of peer companies. Compensation expense (income) recognized for performance shares during 2010, 2009 and... -

Page 93

... credit ratings similar to those of FirstEnergy, FES and the Utilities. (B) INVESTMENTS All temporary cash investments purchased with an initial maturity of three months or less are reported as cash equivalents on the Consolidated Balance Sheets at cost, which approximates their fair market value... -

Page 94

...values of investments held in nuclear decommissioning trusts, nuclear fuel disposal trusts and NUG trusts as of December 31, 2010 and 2009: December 31, 2010 Cost Basis Debt securities FirstEnergy...13 6 December 31, 2009 FirstEnergy FES OE TE JCP&L Met-Ed Penelec $ Sales Proceeds 2,229 1,379 132 169... -

Page 95

... or direct placements, warrants, securities of FirstEnergy, investments in companies owning nuclear power plants, financial derivatives, preferred stocks, securities convertible into common stock and securities of the trust fund's custodian or managers and their parents or subsidiaries. During 2010... -

Page 96

... interest rate swaps. Level 3 - Pricing inputs include inputs that are generally less observable from objective sources. These inputs may be used with internally developed methodologies that result in management's best estimate of fair value. FirstEnergy develops its view of the future market price... -

Page 97

...Utilities and classified as Level 3 in the fair value hierarchy for the years ending December 31, 2010 and 2009: Derivative Asset NUG Contracts(1) January 1, 2010 Balance Realized gain (loss) Unrealized gain (loss) Purchases Issuances Sales Settlements Transfers in (out) of Level 3 December 31, 2010... -

Page 98

... and $15 million as of December 31, 2010 and 2009, respectively, of receivables, payables and accrued income associated with the financial instruments reflected within the fair value table. Primarily consists of cash and cash equivalents. Ohio Edison Company The following tables provide the fair... -

Page 99

... (2) Excludes $2 million as of December 31, 2009 of receivables, payables and accrued income associated with the financial instruments reflected within the fair value table. Primarily consists of cash and cash equivalents. Jersey Central Power & Light Company The following tables provide the fair... -

Page 100

... Contracts(1) January 1, 2010 Balance Realized gain (loss) Unrealized gain (loss) Purchases Issuances Sales Settlements Transfers in (out) of Level 3 December 31, 2010 Balance January 1, 2009 Balance Realized gain (loss) Unrealized gain (loss) Purchases Issuances Sales Settlements Transfers in (out... -

Page 101

... whose performance is benchmarked against the S&P 500 Index or Russell 3000 Index. Excludes $(9) million and $1 million as of December 31, 2010 and 2009, respectively, of receivables, payables and accrued income associated with the financial instruments reflected within the fair value table. 86 -

Page 102

... are subject to regulatory accounting and do not impact earnings. Pennsylvania Electric Company The following tables provide the fair value measurement amounts for assets and liabilities recorded on Penelec's Consolidated Balance Sheets at fair value as of December 31, 2010 and 2009: December 31... -

Page 103

... Contracts(1) January 1, 2010 Balance Realized gain (loss) Unrealized gain (loss) Purchases Issuances Sales Settlements Transfers in (out) of Level 3 December 31, 2010 Balance January 1, 2009 Balance Realized gain (loss) Unrealized gain (loss) Purchases Issuances Sales Settlements Transfers in (out... -

Page 104

6. DERIVATIVE INSTRUMENTS FirstEnergy is exposed to financial risks resulting from fluctuating interest rates and commodity prices, including prices for electricity, natural gas and energy transmission. To manage the volatility relating to these exposures, FirstEnergy uses a variety of derivative ... -

Page 105

...97 846 876 Total Commodity Derivatives $ $ $ Electricity forwards are used to balance expected sales with expected generation and purchased power. Natural gas futures are entered into based on expected consumption of natural gas, primarily used in FirstEnergy's peaking units. Heating oil futures... -

Page 106

..., as compared to unamortized losses of $15 million ($9 million net of tax) as of December 31, 2009. The net of tax change resulted from a net $1 million loss related to current hedging activity offset by $15 million of net hedge losses reclassified to earnings during 2010. Based on current estimates... -

Page 107

... NGC purchased 158.5 MW of lessor equity interests in the TE and CEI 1987 sale and leaseback of Beaver Valley Unit 2. The Ohio Companies continue to lease these MW under their respective sale and leaseback arrangements and the related lease debt remains outstanding. Rentals for capital and operating... -

Page 108

... Units 1, 2 and 3 sale and leaseback transactions. The PNBV and Shippingport arrangements effectively reduce lease costs related to those transactions (see Note 8). The future minimum consolidated operating lease payments as of December 31, 2010 are as follows: Lease Operating Leases 2011 2012 2013... -

Page 109

... divested Oyster Creek Nuclear Generating Station, of which $310 million was outstanding as of December 31, 2010. FirstEnergy and its subsidiaries reflect the portion of VIEs not owned by them in the caption noncontrolling interest within the consolidated financial statements. The change in... -

Page 110

...that render the applicable plant worthless. Net discounted lease payments would not be payable if the casualty loss payments were made. The following table discloses each company's net exposure to loss based upon the casualty value provisions mentioned above as of December 31, 2010: Maximum Exposure... -

Page 111

... under the Medicare Part D retiree subsidy program. As retiree healthcare liabilities and related tax impacts under prior law were already reflected in FirstEnergy's consolidated financial statements, the change resulted in a charge to FirstEnergy's earnings in 2010 of approximately $13 million and... -

Page 112

...&L Met-Ed Penelec (In millions) 2010 Book income before provision for income taxes Federal income tax expense at statutory rate Increases (reductions) in taxes resulting fromAmortization of investment tax credits State income taxes, net of federal tax benefit Manufacturing deduction Medicare Part... -

Page 113

... Regulatory transition charge Customer receivables for future income taxes Deferred customer shopping incentive Deferred MISO/PJM transmission costs Other regulatory assets - RCP Deferred sale and leaseback gain Nonutility generation costs Unamortized investment tax credits Unrealized losses... -

Page 114

... which reduced taxable income and increased the amount of tax refunds that were applied to FirstEnergy's 2010 estimated federal tax payments. Due to the flow through of the Pennsylvania state income tax benefit for this change in accounting, FirstEnergy's effective tax rate was reduced by $6 million... -

Page 115

... in unrecognized tax benefits for the three years ended December 31, 2010 are as follows: FE FES OE CEI TE JCP&L Met-Ed Penelec Balance, January 1, 2010 Increase for tax positions related to the current year Increase for tax positions related to prior years Decrease for tax positions related to... -

Page 116

... the 2010 tax year audit began in February 2010. Management believes that adequate reserves have been recognized and final settlement of these audits is not expected to have a material adverse effect on FirstEnergy's financial condition or results of operations. FirstEnergy has pre-tax net operating... -

Page 117

...be recovered in rates. Still, any future inability on FirstEnergy's part to comply with the reliability standards for its bulk power system could result in the imposition of financial penalties that could have a material adverse effect on its financial condition, results of operations and cash flows... -

Page 118

...October 2009 MRO filing; a 6% generation discount to certain low-income customers provided by the Ohio Companies through a bilateral wholesale contract with FES (initial auctions scheduled for October 20, 2010 and January 25, 2011); no increase in base distribution rates through May 31, 2014; a load... -

Page 119

... to establish separate accounts for marginal transmission loss revenues and related interest and carrying charges and the plan for the use of these funds to mitigate future generation rate increases commencing January 1, 2011. The PPUC approved this plan on June 7, 2010. On April 1, 2010, Met-Ed and... -

Page 120

... the requirement of New Jersey utilities to submit Utility Master Plans until such time as the status of the EMP has been made clear. At this time, FirstEnergy and JCP&L cannot determine the impact, if any, the EMP may have on their operations. (E) FERC MATTERS Rates for Transmission Service Between... -

Page 121

... parties filed responsive comments or studies on May 28, 2010 and reply comments on June 28, 2010. FirstEnergy and a number of other utilities, industrial customers and state commissions supported the use of the beneficiary pays approach for cost allocation for high voltage transmission facilities... -

Page 122

...restriction regulations. This requires AS to obtain prior FERC authorization to make sales to the Utilities when it successfully participates in the Utilities' POLR auctions. FES currently supplies the Ohio Companies with a portion of their capacity, energy, ancillary services and transmission under... -

Page 123

... and timing of all dividend declarations are subject to the discretion of the Board of Directors and its consideration of business conditions, results of operations, financial condition and other factors. In addition to paying dividends from retained earnings, each of FirstEnergy's electric utility... -

Page 124

... which consist primarily of bondable transition property. Bondable transition property represents the irrevocable right under New Jersey law of a utility company to charge, collect and receive from its customers, through a non-bypassable TBC, the principal amount and interest on transition bonds and... -

Page 125

... of December 31, 2010, FirstEnergy's currently payable long-term debt includes approximately $827 million (FES $778 million, Met-Ed - $29 million and Penelec - $20 million) of variable interest rate PCRBs, the bondholders of which are entitled to the benefit of irrevocable direct pay bank LOCs. The... -

Page 126

...-Ed and Penelec primarily relate to the decommissioning of the TMI-2 nuclear generating facility. FES and the Utilities use an expected cash flow approach to measure the fair value of their nuclear decommissioning AROs. FirstEnergy, FES and the Utilities maintain nuclear decommissioning trust funds... -

Page 127

...million of short-term indebtedness as of December 31, 2010, comprised of borrowings under a $2.75 billion revolving line of credit. Total short-term bank lines of committed credit to FirstEnergy and the Utilities as of January 31, 2011 were approximately $3.2 billion of which $2.5 billion was unused... -

Page 128

...0.72 % As of December 31, 2010, FirstEnergy Corp. had four receivables securitizations for five of its seven public utilities. These transactions enable the company to access up to $395 million of financing at costs based on commercial paper rates plus annual fees. Each of the facilities matures in... -

Page 129

... with respect to a nuclear power plant to $12.6 billion (assuming 104 units licensed to operate) for a single nuclear incident, which amount is covered by: (i) private insurance amounting to $375 million; and (ii) $12.2 billion provided by an industry retrospective rating plan required by the NRC... -

Page 130

... energy and energy-related payments of its subsidiaries involved in energy commodity activities principally to facilitate or hedge normal physical transactions involving electricity, gas, emission allowances and coal. FirstEnergy also provides guarantees to various providers of credit support... -

Page 131

... the Commonwealth of Pennsylvania and the State of New York intervened and have filed a separate complaint regarding the Homer City Station. Mission Energy Westside, Inc. is seeking indemnification from Penelec, the co-owner and operator of the Homer City Power Station prior to its sale in 1999. The... -

Page 132

... occurring during maintenance outages dating back to 1990 triggered the pre-construction permitting requirements under the PSD and NNSR programs. FGCO received a request for certain operating and maintenance information and planning information for these same generating plants and notification that... -

Page 133

... emitting gas-fired and nuclear generators. Clean Water Act Various water quality regulations, the majority of which are the result of the federal Clean Water Act and its amendments, apply to FirstEnergy's plants. In addition, Ohio, New Jersey and Pennsylvania have water quality standards applicable... -

Page 134

... fee applications. Under the terms of the settlement, no payments are being made by FirstEnergy or Merger Sub. A formal stipulation of settlement was filed with the Maryland Court on October 18, 2010 and it was approved and became final on January 12, 2011. The separate Pennsylvania federal... -

Page 135

... are expected to increase. FirstEnergy continues to evaluate the status of its funding obligations for the decommissioning of these nuclear facilities. On August 27, 2010, FENOC submitted an application to the NRC for renewal of the Davis-Besse Nuclear Power Station operating license for an... -

Page 136

.... The Energy Delivery Services segment transmits and distributes electricity through FirstEnergy's eight utility operating companies, serving 4.5 million customers within 36,100 square miles of Ohio, Pennsylvania and New Jersey, and purchases power for its POLR and default service requirements in... -

Page 137

... in inventory. Reconciling adjustments to segment operating results from internal management reporting to consolidated external financial reporting primarily consist of interest expense related to holding company debt, corporate support services revenues and expenses and elimination of intersegment... -

Page 138

... payable to the Ohio Companies and Penn related to the 2005 intra-system generation asset transfers. The primary affiliated company transactions for FES and the Utilities during the three years ended December 31, 2010 are as follows: Affiliated Company Transactions - 2010 Revenues: Electric sales... -

Page 139

... formulas used and their bases include multiple factor formulas: each company's proportionate amount of FirstEnergy's aggregate direct payroll, number of employees, asset balances, revenues, number of customers, other factors and specific departmental charge ratios. Management believes that... -

Page 140

... and intercompany balances and transactions and the entries required to reflect operating lease treatment associated with the 2007 Bruce Mansfield Unit 1 sale and leaseback transaction. FIRSTENERGY SOLUTIONS CORP. CONSOLIDATING STATEMENTS OF INCOME For the Year Ended December 31, 2010 FES FGCO... -

Page 141

... CORP. CONSOLIDATING STATEMENTS OF INCOME For the Year Ended December 31, 2009 FES FGCO NGC (In thousands) Eliminations Consolidated REVENUES EXPENSES: Fuel Purchased power from affiliates Purchased power from non-affiliates Other operating expenses Provision for depreciation General taxes... -

Page 142

... CORP. CONSOLIDATING STATEMENTS OF INCOME For the Year Ended December 31, 2008 FES FGCO NGC (In thousands) Eliminations Consolidated REVENUES EXPENSES: Fuel Purchased power from affiliates Purchased power from non-affiliates Other operating expenses Provision for depreciation General taxes... -

Page 143

... provision for depreciation Construction work in progress INVESTMENTS: Nuclear plant decommissioning trusts Investment in associated companies Other DEFERRED CHARGES AND OTHER ASSETS: Accumulated deferred income tax benefits Customer intangibles Goodwill Property taxes Unamortized sale and leaseback... -

Page 144

... CHARGES AND OTHER ASSETS: Accumulated deferred income taxes Customer intangibles Goodwill Property taxes Unamortized sale and leaseback costs Derivatives Other $ LIABILITIES AND CAPITALIZATION CURRENT LIABILITIES: Currently payable long-term debt Short-term borrowingsAssociated companies Accounts... -

Page 145

FIRSTENERGY SOLUTIONS CORP. CONDENSED CONSOLIDATING STATEMENTS OF CASH FLOWS For the Year Ended December 31, 2010 FES FGCO NGC (In thousands) Eliminations Consolidated NET CASH PROVIDED FROM (USED FOR) OPERATING ACTIVITIES CASH FLOWS FROM FINANCING ACTIVITIES: New FinancingLong-term debt Short-... -

Page 146

FIRSTENERGY SOLUTIONS CORP. CONDENSED CONSOLIDATING STATEMENTS OF CASH FLOWS For the Year Ended December 31, 2009 NET CASH PROVIDED FROM (USED FOR) OPERATING ACTIVITIES CASH FLOWS FROM FINANCING ACTIVITIES: New FinancingLong-term debt Equity contributions from parent Redemptions and RepaymentsLong-... -

Page 147

... as a result of the operational changes. FirstEnergy used various assumptions in evaluating whether the FGCO units' carrying value was recoverable. The estimated undiscounted cash flows were based on assumptions about budgeted net operating income; the impact of current market conditions on... -

Page 148

... to generate electricity principally with biomass, and instead permanently shut down the units as of December 31, 2010. Since the Burger biomass repowering project was announced, market prices for electricity have fallen significantly and no longer supported a repowered Burger Plant. FirstEnergy... -

Page 149

....0 239.0 Revenues Income (Loss) Income (Loss) Before Income Taxes (In millions) Income Taxes (Benefit) Earnings Available To FirstEnergy * Includes a $4.8 million adjustment that increased net income in the fourth quarter of 2009 related to prior periods. (See Note 9 for description of adjustment... -

Page 150

... 31, 2009 JCP&L March 31, 2010 March 31, 2009 June 30, 2010 June 30, 2009 September 30, 2010 September 30, 2009 December 31, 2010 December 31, 2009 ** Income (Loss) Before Income Taxes (In millions) Income Taxes (Benefit) Earnings Available To FirstEnergy Revenues Income (Loss) $ 132.5 244... -

Page 151

.... FirstEnergy and Allegheny currently anticipate completing the merger in the first quarter of 2011. Although FirstEnergy and Allegheny believe that they will receive the required authorizations, approvals and consents to complete the merger, there can be no assurance as to the timing of... -

Page 152

...Price/Earnings Ratio (a) Book Value per Common Share Market Price per Share Ratio of Market Price to Common Share Book Value OPERATING STATISTICS (b) Generation Kilowatt-Hour Sales (Millions): Residential Commercial Industrial Other Total Retail Total Wholesale Total Sales Distribution Kilowatt-Hour... -

Page 153

... time. For Internet access to general shareholder and account information, visit the AST website at www.amstock.com/company/firstenergy.asp. Direct Dividend Deposit Shareholders can have their dividend payments automatically deposited to checking and savings accounts at any financial institution... -

Page 154

PRESORTED STD. U.S. POSTAGE PAID AKRON, OHIO PERMIT NO. 561 76 South Main Street, Akron, OH 44308 -1890