Alcoa 2010 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2010 Alcoa annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

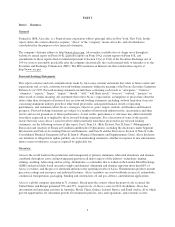

Alumina Refining Facilities and Capacity

Alcoa is the world’s leading producer of alumina. Alcoa’s alumina refining facilities and its worldwide alumina

capacity are shown in the following table:

Alcoa Worldwide Alumina Refining Capacity

Country Facility

Owners

(% of Ownership)

Nameplate

Capacity1

(000 MTPY)

Alcoa

Consolidated

Capacity2

(000 MTPY)

Australia Kwinana AofA3(100%) 2,190 2,190

Pinjarra AofA (100%) 4,234 4,234

Wagerup AofA (100%) 2,555 2,555

Brazil Poços de Caldas Alumínio4(100%) 390 390

São Luís (Alumar) AWA Brasil3(39%)

Rio Tinto Alcan Inc.5(10%)

Alumínio (15%)

BHP Billiton5(36%) 3,500 1,890

Jamaica Jamalco Alcoa Minerals of Jamaica, L.L.C.3(55%)

Clarendon Alumina Production Ltd.6(45%) 1,4787841

Spain San Ciprián Alúmina Española, S.A.3(100%) 1,500 1,500

Suriname Suralco Suralco3(55%)

AMS8(45%) 2,20792,207

United States Point Comfort, TX Alcoa World Alumina LLC3(100%) 2,30510 2,305

TOTAL 20,359 18,112

1Nameplate Capacity is an estimate based on design capacity and normal operating efficiencies and does not necessarily

represent maximum possible production.

2The figures in this column reflect Alcoa’s share of production from these facilities. For facilities wholly-owned by

AWAC entities, Alcoa takes 100% of the production.

3This entity is part of the AWAC group of companies and is owned 60% by Alcoa and 40% by Alumina Limited.

4This entity is owned 100% by Alcoa.

5The named company or an affiliate holds this interest.

6Clarendon Alumina Production Ltd. is wholly-owned by the Government of Jamaica.

7In August 2007, Hurricane Dean substantially damaged the Rocky Point port from which Jamalco ships alumina. The

facility is shipping alumina from temporary on-site port facilities constructed in 2007. Due to capital expenditure

restrictions, permanent repairs to the Rocky Point Pier are expected to be completed in 2013, instead of 2011 as

previously planned. The refinery is operating at approximately 95% of nameplate capacity.

8In July 2009, AWA LLC acquired the BHP Billiton subsidiary that was a 45% joint venture partner in the Surinamese

bauxite mining and alumina refining joint ventures. Prior to the AWA LLC buy out, BHP Billiton’s subsidiary held a

45% interest to Suralco’s 55% interest in the two joint ventures. After the acquisition of the BHP Billiton subsidiary, its

name was changed to N.V. Alcoa Minerals of Suriname (AMS). AWA LLC is part of the AWAC group of companies

and is owned 60% by Alcoa and 40% by Alumina Limited.

9In May 2009, the Suralco alumina refinery announced curtailment of 870,000 mtpy. The decision was made to protect

the long-term viability of the industry in Suriname. The curtailment was aimed at deferring further bauxite extraction

until additional in-country bauxite resources are developed and market conditions for alumina improve.

10 Reductions in production at Point Comfort resulted mostly from the effects of curtailments initiated in late 2008 through

early 2009, as a result of overall market conditions. The reductions included curtailments of approximately 1,500,000

mtpy. Of that amount, 800,000 mtpy remain curtailed.

7