Air Canada 2012 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2012 Air Canada annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2012 Management’s Discussion and Analysis

21

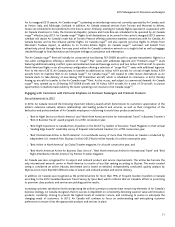

CASM and Adjusted CASM increased 1.0% from 2011

The following table compares Air Canada’s 2012 and 2011 CASM.

Full Year Change

(cents per ASM) 2012 2011 cents %

Wages and salaries 2.41 2.31 0.10 4.3

Benefits 0.72 0.69 0.03 4.3

Benefit plan amendments(1) (0.18) – (0.18) –

Aircraft fuel 5.29 5.08 0.21 4.1

Capacity purchase agreements 1.59 1.51 0.08 5.3

Airport and navigation fees 1.47 1.52 (0.05) (3.3)

Ownership (DAR)(2) 1.51 1.60 (0.09) (5.6)

Aircraft maintenance 1.00 1.03 (0.03) (2.9)

Sales and distribution costs 0.90 0.92 (0.02) (2.2)

Food, beverages and supplies 0.43 0.42 0.01 2.4

Communications and information technology 0.28 0.29 (0.01) (3.4)

Other 1.95 1.83 0.12 6.6

CASM 17.37 17.20 0.17 1.0

Remove:

Benefit plan amendments(1) 0.18 - 0.18 -

Fuel expense and the cost of ground packages at Air Canada Vacations (5.77) (5.54) (0.23) 4.2

Adjusted CASM(1) (3) 11.78 11.66 0.12 1.0

(1) In the third quarter of 2012, Air Canada recorded an operating expense reduction of $124 million related to changes to the terms of the ACPA collective agreement

pertaining to retirement age.

(2) DAR refers to the combination of depreciation, amortization and impairment, and aircraft rent expenses.

(3) Adjusted CASM is a non-GAAP financial measure. Refer to section 20 “Non-GAAP Financial Measures” of this MD&A for additional information.

Operating expenses increased 2% from 2011

In 2012, operating expenses of $11,683 million increased $250 million or 2% from operating expenses of $11,433 million

recorded in 2011. This growth in operating expenses was mainly due to increases in fuel expense, wages, salaries and benefits

expense, capacity purchase costs and other expenses. Offsetting these increases was the impact of an operating expense

reduction of $124 million related to changes to the terms of the ACPA collective agreement pertaining to retirement age, and

a decrease in depreciation, amortization and impairment expense.

In 2012, the unfavourable impact of a weaker Canadian dollar on foreign currency denominated operating expenses (mainly

U.S. dollars), when compared to 2011, increased operating expenses by $75 million.

Fuel expense increased 6% from 2011

In 2012, fuel expense of $3,561 million increased $186 million or 6% from 2011. The increase in fuel expense was mainly due

to higher jet fuel prices year-over-year, which accounted for an increase of $98 million, the unfavourable impact of a weaker

Canadian dollar in 2012, when compared to 2011, which accounted for an increase of $55 million, and a greater volume of

fuel consumed, which accounted for an increase of $33 million. The higher jet fuel price in 2012 was mainly due to higher

refining costs (also known as crack spreads) as the WTI-equivalent price was only slightly higher than in 2011.