Air Canada 2012 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2012 Air Canada annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2012 Air Canada Annual Report

20

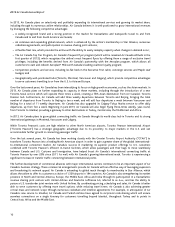

Cargo revenues increased 1.5% from 2011

In 2012, full year cargo revenues of $488 million increased $7 million or 1.5% from 2011 due to traffic growth of 4.9% partly

offset by a lower yield of 3.1%.

The table below provides cargo revenue by geographic region for 2012 and 2011.

Cargo Revenue Full Year 2012

$ Million

Full Year 2011

$ Million $ Change % Change

Canada 68 66 2 3.0

U.S. transborder 17 17 – 4.7

Atlantic 177 194 (17) (9.0)

Pacific 166 146 20 13.9

Other 60 58 2 4.0

System 488 481 7 1.5

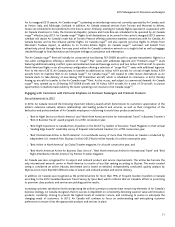

The table below provides year-over-year percentage changes in cargo revenues and operating statistics for 2012 versus 2011.

Full Year 2012

Versus

Full Year 2011

Cargo

Revenue

% Change

Capacity

(ETMs)

% Change

Rev / ETM

% Change

Traffic

(RTMs)

% Change

Yield / RTM

% Change

Canada 3.0 – 3.1 7.6 (5.1)

U.S. transborder 4.7 (1.5) 6.2 4.3 0.4

Atlantic (9.0) (0.2) (8.8) (4.6) (4.6)

Pacific 13.9 1.8 12.0 15.3 (1.2)

Other 4.0 2.3 1.6 6.2 (2.1)

System 1.5 0.6 1.0 4.9 (3.1)

Components of the year-over-year change in full year cargo revenues included:

The 4.9% traffic increase which reflected traffic growth in all markets with the exception of the Atlantic market. The

Pacific market experienced strong demand in spite of increased industry cargo capacity while the Atlantic market

continued to be negatively impacted by weak economic conditions in Europe.

The 3.1% yield decrease which reflected, in large part, the impact of increased competitive pricing activities, particularly

in the domestic and Atlantic markets.

Refer to section 7 of this MD&A for year-over-year percentage changes in cargo revenues, capacity, traffic, passenger load

factor, yield and RASM by quarter for the fourth quarter 2012 and each of the previous four quarters.

Other revenues decreased 3% from 2011

Other revenues consist primarily of revenues from the sale of the ground portion of vacation packages, ground handling

services, and other airline-related services, as well as revenues related to the lease or sublease of aircraft to third parties.

In 2012, other revenues of $895 million decreased $28 million or 3% from 2011. The decrease in other revenues was largely

due to a reduction in property rent revenues from Aveos of $18 million, a decline in ground package revenues at Air Canada

Vacations of $8 million, as well as lower aircraft lease revenues of $7 million, mainly as a result of fewer aircraft leased to Jazz

when compared to 2011. The decrease in ground package revenues at Air Canada Vacations was due to lower passenger

volumes driven by increased industry capacity. The effect of passenger uncertainty in booking with Air Canada as a result of

the labour disruptions experienced in March and April 2012 negatively impacted revenues at Air Canada Vacations. These

decreases were partly offset by growth in cancellation and change fees year-over-year.