Air Canada 2012 Annual Report Download

Download and view the complete annual report

Please find the complete 2012 Air Canada annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ANNUAL REPORT 2012

Table of contents

-

Page 1

ANNUAL REPORT 2012 -

Page 2

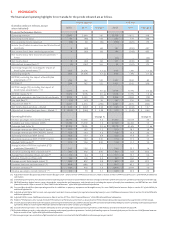

... section 20 "Non-GAAP Financial Measures" of the MD&A for additional information. (2) In the third quarter of 2012, Air Canada recorded an operating expense reduction of $124 million related to changes to the terms of the ACPA collective agreement pertaining to retirement age. (3) EBITDAR (earnings... -

Page 3

... ...81 Statement of Management's Responsibility for Financial Reporting ...83 Independent Auditor's Report ...84 Consolidated Financial Statements and Notes ...85 Officers and Directors ...148 Investor and Shareholder Information ...149 Official Languages at Air Canada ...149 Corporate Profile... -

Page 4

... for International Travel and Best North American Airline In-flight Experience. In early 2013, Air Canada was granted four-star status in the Skytrax Airline Star Ranking - the only North American network carrier to earn this distinction. Taken together our financial results and numerous service... -

Page 5

... in the mainline fleet, the Embraer 175, to a lower cost regional operator. Air Canada also created rougeTM in 2012 to serve leisure destinations more profitability with a lower cost structure largely made possible by new contractual agreements with our employees. Labour agreements now in place... -

Page 6

...-looking statements due to a number of factors, including without limitation, industry, market, credit and economic conditions, the ability to reduce operating costs and secure financing, pension issues, energy prices, employee and labour relations, currency exchange and interest rates, competition... -

Page 7

... of scheduled passenger services in the Canadian market, the Canada-U.S. transborder market and in the international market to and from Canada. In 2012, Air Canada, together with Jazz and other regional airlines operating flights on behalf of Air Canada under capacity purchase agreements, operated... -

Page 8

...-haul routes, primarily from Toronto and Montreal to destinations in the Northeast U.S. Air Canada will derive cost saving benefits from this initiative as Sky Regional's costs to operate these aircraft will be lower. The new collective agreement concluded with ACPA also provides Air Canada with... -

Page 9

...agreements, negotiated at market terms and rates, have resulted in meaningful unit cost savings and better aircraft turnaround times. Through its Business Transformation team, Air Canada is also working towards lowering fuel consumption; bettering aircraft turnaround times; reducing credit card fees... -

Page 10

...all customers to earn and redeem Aeroplan® Miles with Canada's leading coalition loyalty program; Competitive products and services, including lie-flat beds in the Executive First cabin, concierge services and Maple Leaf lounges; and Geographically well-positioned hubs (Toronto, Montreal, Vancouver... -

Page 11

... non-stop flights to Athens from Montreal's Trudeau Airport, in addition to its Toronto-Athens flights. Air Canada rougeTM customers will benefit from attractively priced through-fares from any point within Air Canada's extensive network on a single ticket as well as baggage checked through to... -

Page 12

... Air Canada's most frequent flyers, Air Canada Altitude offers a range of privileges, including priority travel services, upgrades to Executive Class, and recognition across Star Alliance. Air Canada Altitude members will continue to benefit from Air Canada's partnership with the Aeroplan program... -

Page 13

... encourage the development of a corporate culture which is focused on transformation and performance, Air Canada has a profit sharing program in place which allows eligible employees to be recognized for their contributions and share in the financial success of the airline. In 2013, the airline will... -

Page 14

... in Benefit plan amendments on its consolidated statement of operations related to the impact of those amendments on pension and other employee benefit liabilities. In 2012, adjusted CASM increased 1.0% from 2011, in line with the 0.75% to 1.25% increase projected in Air Canada's news release dated... -

Page 15

... fourth quarter of 2011. In 2012, adjusted CASM decreased 2.0% from the fourth quarter of 2011, in line with the 2.0% to 3.0% decrease projected in Air Canada's news release dated November 8, 2012. Refer to section 20 "Non-GAAP Financial Measures" for additional information. Operating income of $46... -

Page 16

... year of 2012 versus the full year of 2011. (Canadian dollars in millions, except per share figures) Operating revenues Passenger Cargo Other Total revenues Operating expenses Aircraft fuel Wages, salaries, and benefits Benefit plan amendments(1) Capacity purchase agreements Airport and navigation... -

Page 17

... American network and for leisure travel packages offered by Air Canada Vacations. Higher-yielding business market demand was also adversely affected. In addition, second quarter 2012 system capacity and, as a result, passenger revenues were negatively affected by aircraft scheduling changes due... -

Page 18

...-haul routes such as Boston, New York and Washington D.C. Components of the year-over-year change in U.S. transborder passenger revenues included: ï,· ï,· ï,· The introduction of a new baggage fee policy on U.S. transborder services effective October 27, 2011. The traffic increase of 3.1% which... -

Page 19

... fuel prices, fare increases, and the introduction of Tango® fares on all Asian routes, with reduced Aeroplan® Miles offered which, in turn, produced strong buy-up to higher-yielding Tango® Plus fares. A significant yield increase in the premium cabin, changes to the airline's fare structure... -

Page 20

... revenues of $7 million, mainly as a result of fewer aircraft leased to Jazz when compared to 2011. The decrease in ground package revenues at Air Canada Vacations was due to lower passenger volumes driven by increased industry capacity. The effect of passenger uncertainty in booking with Air Canada... -

Page 21

2012 Management's Discussion and Analysis CASM and Adjusted CASM increased 1.0% from 2011 The following table compares Air Canada's 2012 and 2011 CASM. Full Year (cents per ASM) Wages and salaries Benefits Benefit plan amendments(1) Aircraft fuel Capacity purchase agreements Airport and navigation ... -

Page 22

... of 1.4% in the average number of full-time equivalent ("FTE") employees, and an increase in expenses relating to employee profit sharing programs. In addition, in 2012, Air Canada recorded a liability of $18 million related to prior years' employee profit sharing payments. The liability is an... -

Page 23

... fees incurred in relation to various corporate strategic initiatives, including those related to cost saving and revenue generating initiatives. An increase of $12 million or 4% in expenses related to ground packages at Air Canada Vacations which was mainly due to a higher cost of ground packages... -

Page 24

... (Canadian dollars in millions) Foreign exchange gain (loss) Interest income Interest expense Interest capitalized Net financing expense relating to employee benefits Loss on financial instruments recorded at fair value Loss on investment in Aveos Other Total non-operating expense $ $ Change 2011... -

Page 25

...fourth quarter of 2012 versus the fourth quarter of 2011. Fourth Quarter (Canadian dollars in millions, except per share figures) Operating revenues Passenger Cargo Other Total revenues Operating expenses Aircraft fuel Wages, salaries, and benefits Capacity purchase agreements Airport and navigation... -

Page 26

... Air Canada Annual Report System passenger revenues increased 5.8% from the fourth quarter of 2011 In the fourth quarter of 2012, system passenger revenues of $2,513 million increased $139 million or 5.8% from 2011 fourth quarter system passenger revenues of $2,374 million due to a traffic increase... -

Page 27

2012 Management's Discussion and Analysis In the fourth quarter of 2012, Air Canada's system capacity was 1.3% higher than in the fourth quarter of 2011. Capacity growth was reflected in all markets. Components of the year-over-year change in fourth quarter system passenger revenues included: ï,· ... -

Page 28

...the year-over-year change in fourth quarter U.S. transborder passenger revenues included: ï,· The 4.2% traffic increase which reflected traffic growth on all major U.S. transborder services with the exception of U.S. long-haul routes. The introduction of a new baggage fee policy on U.S. transborder... -

Page 29

... fuel prices, fare increases, and the introduction of Tango® fares on services to Korea, with reduced Aeroplan® Miles offered which, in turn, produced strong buy-up to higher-yielding Tango® Plus fares. A significant yield increase in the premium cabin and changes to the airline's fare structure... -

Page 30

... pricing activities on services to South America and to traditional leisure destinations. ï,· The overall 4.1% RASM decline was mainly due to the lower yield. Cargo revenues increased 1.3% from the fourth quarter of 2011 In the fourth quarter of 2012, cargo revenues of $126 million increased... -

Page 31

... In the fourth quarter of 2012, other revenues of $202 million increased $2 million or 1% from the fourth quarter of 2011. An increase in ground package revenues at Air Canada Vacations and an increase in passenger-related fees, such as cancellation and change fees, were largely offset by a decrease... -

Page 32

... Aircraft fuel Capacity purchase agreements Airport and navigation fees Ownership (DAR)(1) Aircraft maintenance Sales and distribution costs Food, beverages and supplies Communications and information technology Other CASM Remove: Fuel expense and the cost of ground packages at Air Canada Vacations... -

Page 33

...in the average number of FTE employees, and an increase in expenses relating to employee profit sharing programs. In the fourth quarter of 2012, employee benefits expense of $110 million increased $1 million or 1% from the fourth quarter of 2011. Capacity purchase costs increased 5% from the fourth... -

Page 34

... in other expenses: Fourth Quarter (Canadian dollars in millions) Air Canada Vacations' land costs Terminal handling Building rent and maintenance Crew cycle Miscellaneous fees and services Remaining other expenses Other operating expenses $ $ Change $ $ - (1) 3 (1) 1 15 $ 17 2012 57 42 32 29 33... -

Page 35

... 30, 2012 closing exchange rate was US$1 = C$0.9832. A decrease in interest expense of $8 million which was mainly due to lower debt levels. In addition, in the fourth quarter of 2012, Air Canada recorded a one-time interest expense reduction of $5 million related to revised estimated cash flows on... -

Page 36

...regional airlines operating flights on behalf of Air Canada under capacity purchase agreements with Air Canada). Number of Operating Aircraft(1) Owned - Special Purpose Entities(2) - - 2 8 5 - 9 - - 24 Total Seats Average Age Owned (1) Finance Lease(2) Operating Lease Widebody Aircraft Boeing... -

Page 37

...31, 2015 2012 Fleet Changes Dec. 31, 2012 On October 1, 2012 Air Canada announced the planned addition of two new Boeing 777-300ER aircraft, scheduled to be delivered in June and August 2013, respectively, in order to pursue strategic growth opportunities for its international network. Air Canada... -

Page 38

2012 Air Canada Annual Report The following table provides, as at December 31, 2012, the number of aircraft operated by Jazz and by other airlines operating flights on behalf of Air Canada under the Air Canada Express banner pursuant to commercial agreements with Air Canada. As at December 31, 2012... -

Page 39

... 9.8 of this MD&A for information on Air Canada's capital commitments, pension funding obligations and contractual obligations. Air Canada monitors and manages liquidity risk by preparing rolling cash flow forecasts, monitoring the condition and value of assets available to be used as well as those... -

Page 40

... (including capitalized maintenance costs) of $115 million, and facility purchases of $85 million. Pension and other benefit liabilities decreased $874 million from December 31, 2011, mainly due to Air Canada having made pension funding payments of $433 million in 2012. The decrease also relates to... -

Page 41

...Management's Discussion and Analysis 9.4. Working Capital The following table provides information on Air Canada's working capital balances at December 31, 2012 and at December 31, 2011. (Canadian dollars in millions) Cash and short-term investments Accounts receivable Other current assets Accounts... -

Page 42

... of free cash flow for Air Canada for the periods indicated: Fourth Quarter (Canadian dollars in millions) Cash flows from (used for) operating activities Additions to property, equipment and intangible assets Free cash flow (1) (1) Full Year Change $ 77 (38) 39 2012 71 (94) (23) 2011 (6) (56... -

Page 43

... payments of principal and interest over the term to maturity. In addition, Air Canada has outstanding purchase commitments for the acquisition of five Boeing 777 aircraft, all of which will be added to Air Canada's mainline fleet in the second half of 2013 and the first half of 2014. Air Canada... -

Page 44

...price delivery payment interest calculated based on the 90-day U.S. LIBOR rate at December 31, 2012. 9.7. Pension Funding Obligations Air Canada maintains several pension plans, including defined benefit and defined contribution pension plans and plans providing other retirement and post-employment... -

Page 45

... plan members. Similar amendments will also be made to the defined benefit pension plans applicable to management and other non-unionized employees, which are also subject to regulatory approval. Based on the actuarial valuations of January 1, 2012, Air Canada has estimated that these changes... -

Page 46

... of operations. In 2012, Air Canada concluded agreements with the CAW in respect of crew schedulers and with the Canadian Airline Dispatchers Association ("CALDA"). The new collective agreements also include amendments to the defined benefit pension plans of crew schedulers and CALDA members which... -

Page 47

... Air Canada and the unrestricted cash and short-term investments of Air Canada. In 2012, Air Canada made no cash deposits under these agreements (nil in 2011). Air Canada also has agreements with another processor for the provision of certain credit card processing services requirements for markets... -

Page 48

2012 Air Canada Annual Report 9.9. Share Information The issued and outstanding shares of Air Canada, along with shares potentially issuable, as of the dates indicated below, are as follows: Number of Shares at January 31, 2013 Issued and outstanding shares Class A variable voting shares Class B ... -

Page 49

... shares as a single class for the purposes of applicable take-over bid requirements and early warning reporting requirements contained under Canadian securities laws. The Rights Plan is scheduled to expire at the close of business on the date immediately following the date of Air Canada's annual... -

Page 50

...the third quarter of 2012, Air Canada recorded an operating expense reduction of $124 million related to changes to the terms of the ACPA collective agreement pertaining to retirement age. EBITDAR, excluding the impact of benefit plan amendments, and EBITDAR are non-GAAP financial measures. Refer to... -

Page 51

2012 Management's Discussion and Analysis The following table provides major quarterly operating statistics for Air Canada for the last eight quarters. 2011 Q1 Revenue passenger miles (millions) Available seat miles (millions) Passenger load factor (%) RASM (cents) CASM (cents) Adjusted CASM (cents... -

Page 52

...884 11,441 In 2012, Air Canada recorded an operating expense reduction of $124 million related to changes to the terms of the ACPA collective agreement pertaining to retirement age. In 2008, Air Canada recorded a provision for cargo investigations of $125 million. In 2010, Air Canada recorded a net... -

Page 53

... into account all relevant factors, including credit margin, term and basis. The risk management objective is to minimize the potential for changes in interest rates to cause adverse changes in cash flows to Air Canada. The temporary investment portfolio, which earns a floating rate of return, is... -

Page 54

... exchange risk management activities and the adjustments recorded in 2012: ï,· As at December 31, 2012, Air Canada had outstanding foreign currency options and swap agreements to purchase U.S. dollars against Canadian dollars on $1,289 million (US$1,296 million) which mature in 2013 (2011 - $1,008... -

Page 55

... market conditions. Air Canada does not purchase or hold any derivative financial instrument for speculative purposes. In 2012: ï,· Air Canada recorded a loss of $43 million in Loss on financial instruments recorded at fair value on Air Canada's consolidated statement of operations related to fuel... -

Page 56

... The cost and related liabilities of Air Canada's pensions, other post-retirement and post-employment benefit programs are determined using actuarial valuations. The actuarial valuations involve assumptions, including discount rates, expected rates of return on assets, future salary increases... -

Page 57

... to the Statement of Investment Policy and Objectives of the Air Canada Pension Funds as amended during 2012. The investment return objective of the Fund is to achieve a total annualized rate of return that exceeds by a minimum of 1.0% before investment fees on average over the long term (i.e. 10... -

Page 58

... impairment at the individual asset level. Value in use is calculated based upon a discounted cash flow analysis, which requires management to make a number of significant assumptions including assumptions relating to future operating plans, discount rates and future growth rates. An impairment loss... -

Page 59

...period. The effect of any changes in estimates, including changes in discount rates, inflation assumptions, cost estimates or lease expiries, is also recognized in maintenance expense in the period. Assuming the aggregate cost for return conditions increases by 2%, holding all other factors constant... -

Page 60

..., Air Canada expects the three Fuel Facility Corporations that are consolidated under SIC-12 to no longer be consolidated. The anticipated impact on Air Canada's consolidated statement of financial position as at January 1, 2012 is summarized as follows: (Canadian dollars in millions) Cash and cash... -

Page 61

... 1, 2013, Air Canada expects restated net income for 2012 to be lower than originally reported under the current accounting standard. The decrease is expected to arise from net financing expense relating to the pension benefit liability which will be calculated using the discount rate used to value... -

Page 62

... on Air Canada's consolidated statement of operations, including the presentation of interest cost on the additional minimum funding liability, is an increase to Net financing expense relating to employee benefits of $272 million for the year ended December 31, 2012, and a decrease to Salary, wages... -

Page 63

... time management believes the amount is likely to be incurred. Guarantees in Fuel Facilities Arrangements Air Canada participates in fuel facility arrangements operated through Fuel Facility Corporations, along with other airlines that contract for fuel services at various major airports in Canada... -

Page 64

2012 Air Canada Annual Report When Air Canada, as a customer, enters into technical service agreements with service providers, primarily service providers who operate an airline as their main business, Air Canada has from time to time agreed to indemnify the service provider against certain ... -

Page 65

...and Analysis 16. RELATED PARTY TRANSACTIONS At December 31, 2012, Air Canada had no transactions with related parties as defined in the CICA Handbook - Part 1, except those pertaining to transactions with key management personnel in the ordinary course of their employment or directorship agreements... -

Page 66

... CASM is a non-GAAP financial measure. In 2012, CASM was adjusted to exclude the impact of benefit plan amendments, fuel expense and the cost of ground packages at Air Canada Vacations. Refer to section 20 of this MD&A for additional information. (Canadian dollars in millions) Key Variable Currency... -

Page 67

... Air Canada's control. Need for Additional Capital and Liquidity Air Canada faces a number of challenges in its business, including in relation to economic conditions, pension plan funding, labour issues, volatile fuel prices, contractual covenants which require Air Canada to maintain minimum cash... -

Page 68

... of the Canadian, U.S. or world economies could have a material adverse effect on Air Canada, its business, results from operations and financial condition. Airline fares and passenger demand have fluctuated significantly in the past and may fluctuate significantly in the future. Air Canada is not... -

Page 69

... effect on Air Canada, its business, results from operations and financial condition. Due to the competitive nature of the airline industry, Air Canada may not be able to pass on increases in fuel prices to its customers by increasing its fares. Based on 2012 volumes, management estimates that... -

Page 70

...other labour costs or work rules may result in increased labour costs or other charges, which could have a material adverse effect on Air Canada, its business, results from operations and financial condition. Most of Air Canada's employees are unionized. In 2011, tentative collective agreements with... -

Page 71

... profit margins and high fixed costs. The costs of operating any particular flight do not vary significantly with the number of passengers carried and, therefore, a relatively small change in the number of passengers or in fare pricing or traffic mix would have a significant effect on Air Canada... -

Page 72

...operations and financial condition. Aeroplan® Through its commercial agreement with Aeroplan, Air Canada is able to offer its customers who are Aeroplan® members the opportunity to earn Aeroplan® Miles. Based on customer surveys, management believes that rewarding customers with Aeroplan® Miles... -

Page 73

...of hub airports, including Toronto Pearson International Airport. Delays or disruptions in service, including those due to security or other incidents, weather conditions, labour conflicts with airport workers, baggage handlers, air traffic controllers and other workers not employed by Air Canada or... -

Page 74

2012 Air Canada Annual Report As at December 31, 2012, Air Canada has a provision of $29 million relating to outstanding claims in this matter, which is recorded in accounts payable and accrued liabilities on Air Canada's consolidated statement of financial position. This provision is an estimate ... -

Page 75

..., airport security and other costs. Any resulting reduction in passenger revenues and/or increases in costs, including insurance, security or other costs could have a material adverse effect on Air Canada, its business, results from operations and financial condition. Epidemic Diseases (Severe... -

Page 76

... decisions, will not be adopted or rendered, from time to time, and these could impose additional requirements or restrictions, which may adversely impact Air Canada, its business, results from operations and financial condition. Availability of Insurance Coverage and Increased Insurance Costs The... -

Page 77

...design of internal controls over financial reporting. The Corporation's Audit, Finance and Risk Committee reviewed this MD&A and the audited consolidated financial statements, and the Corporation's Board of Directors approved these documents prior to their release. Management's Report on Disclosure... -

Page 78

... factors, including international market conditions, geopolitical events, jet fuel refining costs and Canada/U.S. currency exchange rates. Air Canada also incurs expenses related to ground packages at Air Canada Vacations, which some airlines without comparable tour operator businesses may not incur... -

Page 79

2012 Management's Discussion and Analysis Adjusted CASM is reconciled to GAAP operating expense as follows: (Canadian dollars in millions, except where indicated) GAAP operating expense Remove: Aircraft fuel Cost of ground packages at Air Canada Vacations Benefit plan amendments Operating expense, ... -

Page 80

2012 Air Canada Annual Report The following reflects the share amounts used in the computation of basic and diluted earnings per share on an adjusted net income per share basis: Fourth Quarter (Canadian dollars in millions) Weighted average number of shares outstanding - basic Effect of dilution ... -

Page 81

...financial instruments recorded at fair value and unusual items. Refer to section 20 of this MD&A for additional information. Atlantic passenger and cargo revenues - Refers to revenues from flights that cross the Atlantic Ocean with origins and destinations principally in Europe. Available Seat Miles... -

Page 82

2012 Air Canada Annual Report Revenue Passenger Miles or RPMs - Refers to a measure of passenger traffic calculated by multiplying the total number of revenue passengers carried by the miles they are carried. Revenue Ton Miles or RTMs - Refers to the mathematical product of weight in tons of a ... -

Page 83

... external auditor; and, pre-approves audit and audit-related fees and expenses. The Board of Directors approves the Corporation's consolidated financial statements, management's discussion and analysis and annual report disclosures prior to their release. The Audit, Finance and Risk Committee meets... -

Page 84

... position of Air Canada and its subsidiaries as at December 31, 2012 and December 31, 2011 and their financial performance and their cash flows for the years then ended in accordance with International Financial Reporting Standards. 1 Montreal, Quebec February 6, 2013 1 CPA auditor, CA, public... -

Page 85

2012 Consolidated Financial Statements and Notes CONSOLIDATED STATEMENT OF FINANCIAL POSITION (Canadian dollars in millions) ASSETS Current Cash and cash equivalents Short-term investments Total cash, cash equivalents and short-term investments Restricted cash Accounts receivable Aircraft fuel ... -

Page 86

... Annual Report CONSOLIDATED STATEMENT OF OPERATIONS For the year ended December 31 (Canadian dollars in millions except per share figures) Operating revenues Passenger Cargo Other Total revenues Operating expenses Aircraft fuel Wages, salaries and benefits Benefit plan amendments Capacity purchase... -

Page 87

... 2012 2011 CONSOLIDATED STATEMENT OF CHANGES IN EQUITY Share capital (Canadian dollars in millions) January 1, 2011 Net income (loss) Net loss on employee benefit liabilities Total comprehensive income (loss) Share-based compensation Shares purchased in trust for employee recognition award Shares... -

Page 88

... Changes in non-cash working capital balances Provision for cargo investigations Other Net cash flows from operating activities Financing Proceeds from borrowings Reduction of long-term debt and finance lease obligations Shares purchased for cancellation Distributions related to aircraft special... -

Page 89

...Air Canada and Jazz. Air Canada offers international cargo services on routes between Canada and major markets in Europe, Asia, South America and Australia using cargo capacity on Boeing 777 and other wide body aircraft operated by Air Canada. Air Canada Vacations is a leading Canadian tour operator... -

Page 90

..., baggage handling and flight schedules. Revenues are allocated based upon formulas specified in the agreements and are recognized as transportation is provided. Passenger revenue also includes certain fees and surcharges and revenues from passenger-related services such as ticket changes, seat... -

Page 91

...-retirement and post-employment benefits earned by employees is actuarially determined annually as at December 31. The cost is determined using the projected unit credit method and assumptions including market interest rates, management's best estimate of expected plan investment performance, salary... -

Page 92

... to Wages, salaries and benefits based on the estimated annual payment under the plan. I) SHARE-BASED COMPENSATION PLANS Certain employees of the Corporation participate in Air Canada's Long-Term Incentive Plan, which provides for the grant of stock options and performance share units ("PSUs... -

Page 93

...airport terminal handling costs, professional fees and services, crew meals and hotels, advertising and promotion, insurance costs, ground costs for Air Canada Vacations packages, and other expenses. Other operating expenses are recognized as incurred. L) FINANCIAL INSTRUMENTS Under the Corporation... -

Page 94

2012 Air Canada Annual Report The Corporation enters into interest rate, foreign currency, fuel derivatives and share forward contracts to manage the associated risks. Derivative instruments are recorded on the Consolidated Statement of Financial Position at fair value, including those derivatives ... -

Page 95

... CASH The Corporation has recorded Restricted cash under Current assets representing funds held in trust by Air Canada Vacations in accordance with regulatory requirements governing advance ticket sales, as well as funds held in escrow accounts relating to Air Canada Vacations credit card booking... -

Page 96

... immediately in the statement of operations when it is clear that the transactions are established at fair value. If the sale price is below fair value, any loss is recognized immediately except that, if the loss is compensated for by future lease payments at below market price, it is deferred... -

Page 97

...) fleet levels for aircraft and related assets supporting the operating fleet. Parked aircraft not used in operations and aircraft leased or subleased to third parties are assessed for impairment at the individual asset level. Value in use is calculated based upon a discounted cash flow analysis... -

Page 98

... Executive Officer. Air Canada is managed as one operating segment based on how financial information is produced internally for the purposes of making operating decisions. EE) ACCOUNTING STANDARDS AND AMENDMENTS ISSUED BUT NOT YET ADOPTED The following is an overview of accounting standard changes... -

Page 99

... collect the contractual cash flows, and that have contractual cash flows that are solely payments of principal and interest on the principal outstanding are generally measured at amortized cost at the end of subsequent accounting periods. All other financial assets including equity investments are... -

Page 100

... financing expense relating to the pension benefit liability which will be calculated using the discount rate used to value the benefit obligation. As the discount rate is lower than the expected rate of return on plan assets, consistent with the Corporation's current view and long-term historical... -

Page 101

...liabilities and related arrangements on an entity's financial position. IAS 27 addresses accounting for subsidiaries, jointly controlled entities and associates in non-consolidated financial statements. IAS 28 has been amended to include joint ventures in its scope and to address the changes in IFRS... -

Page 102

... asset's or cash-generating unit's fair value less costs to sell and its value in use. Value in use is calculated based upon a discounted cash flow analysis, which requires management to make a number of significant assumptions including assumptions relating to future operating plans, discount rates... -

Page 103

... losses of $46 related to the fleet of A340-300 (2011 - $46) for a net book value of $259 (2011 - $339). Depreciation expense for 2012 for this aircraft and flight equipment amounted to $50 (2011 - $46). Interest capitalized during 2012 amounted to $18 at an interest rate of 10.85% (2011 $4 at an... -

Page 104

... amount of the cash-generating units has been measured based on its value in use, using a discounted cash flow model. Cash flow projections are based on the annual business plan approved by the Board of Directors of Air Canada. In addition, management-developed projections are made covering... -

Page 105

... asset not exceeding the carrying value was remote. Key assumptions used for the value in use calculations in fiscal 2011 were as follows: 2011 Pre-tax discount rate Long-term growth rate Jet fuel price range per barrel 15.6% 2.5% $125 - $135 The recoverable amount of both cash-generating units... -

Page 106

... impairment using the fair value less cost to sell model at the operating segment level. Air Canada is managed as one operating segment based on how financial information is produced internally for the purposes of making operating decisions. In assessing the goodwill for impairment, the Corporation... -

Page 107

... OTHER ASSETS 2012 2011 $ 182 138 65 54 20 24 51 24 37 $ 595 Restricted cash Aircraft related deposits (a) Prepayments under maintenance agreements Aircraft lease payments in excess of rent expense Deposit related to the pension and benefits agreement Other deposits Investment in Aveos Asset backed... -

Page 108

... Bank of the United States ("EXIM"). In 2012, the Corporation received net financing proceeds of $41 (US$42), after financing fees of $1, to refinance amounts related to four Airbus A319 aircraft, with refinanced terms of five years. (b) In 2010, the Corporation completed a private offering of two... -

Page 109

2012 Consolidated Financial Statements and Notes (d) Other CDN dollar secured financings are fixed rate financings that are secured by certain assets with a carrying value of $218, of which $165 relates to certain items of property and equipment and $53 relates to cash and cash equivalents (2011 - ... -

Page 110

... centre and airport check-in and gate agents employed by Air Canada and with the Canadian Union of Public Employees ("CUPE"), the union representing the airline's 6,800 flight attendants. The agreements include amendments to the defined benefit pension plans of CAW and CUPE represented plan members... -

Page 111

... reports for current service (including the applicable discount rate used or assumed in the actuarial valuation), the plan demographics at the valuation date, the existing plan provisions, existing pension legislation and changes in economic conditions (mainly the return on fund assets and changes... -

Page 112

... report, the solvency deficit and related compensation to Aimia for transferred employees is not material. The net benefit obligation is recorded in the statement of financial position as follows: 2012 Accrued benefit liabilities for Pension benefits obligation Other employee future benefits... -

Page 113

... other employee future benefits claims to be paid during 2013. The current portion is included in Accounts payable and accrued liabilities. The following table presents financial information related to the changes in the pension and other post-employment benefits plans: Pension Benefits 2012 Change... -

Page 114

... other employee future benefits expense as follows: Pension Benefits 2012 Consolidated Statement of Operations Components of cost Current service cost Past service cost from plan amendments Actuarial (gains) losses Total cost Recovered from Aveos Net cost recognized in Wages, salaries and benefits... -

Page 115

... determine the cost and related liabilities of the Corporation's employee future benefits. Financial assumptions Discount Rate The discount rate used to determine the pension obligation was determined by reference to market interest rates on corporate bonds rated "AA" or better with cash flows that... -

Page 116

...4.90% Other Employee Future Benefits 2012 2011 2011 Sensitivity Analysis Sensitivity analysis on 2012 pension expense and net financing expense relating to pension benefit liabilities, based on different actuarial assumptions with respect to discount rate and expected return on plan assets, is as... -

Page 117

2012 Consolidated Financial Statements and Notes Defined Contribution Pension Plans The Corporation's management, administrative and certain unionized employees may participate in defined contribution pension plans or multi-employer plans which are accounted for as defined contribution plans. ... -

Page 118

...-current provision is recorded in Other long-term liabilities. (c) A liability of $18 was recorded in Wages, salaries and benefits related to employee profit sharing payments. The liability is an estimate based upon a number of assumptions and the Corporation's assessment as to the expected outcome... -

Page 119

2012 Consolidated Financial Statements and Notes 11. OTHER LONG-TERM LIABILITIES 2012 Proceeds from contractual commitments (a) Deferred income tax Collateral held in leasing arrangements and other deposits Aircraft rent in excess of lease payments Long-term employee liabilities Other Note 10(b) $ ... -

Page 120

... (70) The applicable statutory tax rate is 26.49% (2011 - 28.05%). The Corporation's applicable tax rate is the Canadian combined rates applicable in the jurisdictions in which the Corporation operates. The decrease is mainly due to the reduction of the Federal income tax rate in 2012 from 16.5% to... -

Page 121

2012 Consolidated Financial Statements and Notes Deferred income tax assets are recognized to the extent that the realization of the related tax benefit is probable. The Corporation has unrecognized tax loss carryforwards of $1,662 and temporary differences of $6,999 for which no deferred income ... -

Page 122

2012 Air Canada Annual Report 13. SHARE CAPITAL Number of shares At January 1, 2011 Shares purchased in trust for employee recognition award Shares issued for employee recognition award Shares purchased and cancelled under issuer bid Shares issued on the settlement of performance share units Shares... -

Page 123

2012 Consolidated Financial Statements and Notes Voting Shares may only be held, beneficially owned and controlled, directly or indirectly, by Canadians. An issued and outstanding Voting Share shall be converted into one Variable Voting Share automatically and without any further act of Air Canada ... -

Page 124

2012 Air Canada Annual Report Under the terms of the Rights Plan, one right (a "Right") has been issued with respect to each Class B Voting Share and each Class A Variable Voting Share (each a "Share") of Air Canada issued and outstanding as of the close of business on March 30, 2011 or ... -

Page 125

... valuation model are as follows: 2012 Compensation expense ($ millions) Number of stock options granted to Air Canada employees Weighted average fair value per option granted ($) Aggregated fair value of options granted ($ millions) Weighted average assumptions: Share price Risk-free interest rate... -

Page 126

... be redeemed for Air Canada shares purchased on the secondary market and/or equivalent cash at the discretion of the Board of Directors. The compensation expense related to PSUs in 2012 was $6 (2011 - recovery of ($1)). A summary of the Long-term Incentive Plan performance share unit activity is as... -

Page 127

... to mitigate the cash flow exposure to the PSUs granted. Employee Recognition Award In 2011, Air Canada's Board of Directors approved a special one-time Employee Recognition Award in the form of Air Canada shares granted to all eligible unionized and certain non-unionized employees worldwide, where... -

Page 128

... in issue after deducting shares held in trust for the purposes of the Employee Recognition Award. Excluded from the 2012 calculation of diluted earnings per share were 7,865,000 (2011 - 5,897,000) outstanding options where the options' exercise prices were greater than the average market price of... -

Page 129

... and, where applicable, deferred price delivery payment interest calculated based on the 90-day US LIBOR rate at December 31, 2012. Other capital purchase commitments relate principally to building and leasehold improvement projects. 2013 Capital commitments $ 558 $ 2014 834 $ 2015 550 $ 2016 973... -

Page 130

... rates. 2013 Subleases $ 51 $ 2014 25 $ 2015 16 $ 2016 4 $ 2017 - Thereafter $ - $ Total 96 For accounting purposes, the Corporation acts as an agent and subleases certain aircraft to Jazz on a flow-through basis, which are reported net on the statement of operations. These subleases relate... -

Page 131

... for 2013 is $224. The annual commitment is based on 85% of the average total Aeroplan Miles® actually issued in respect of Air Canada flights or Air Canada airline affiliate products and services in the three preceding calendar years. During 2012, the Corporation purchased $257 of Aeroplan Miles... -

Page 132

2012 Air Canada Annual Report 17. FINANCIAL INSTRUMENTS AND RISK MANAGEMENT Summary of Financial Instruments Carrying Amounts December 31, 2012 Financial instruments classification Held for trading Financial Assets Cash and cash equivalents Short-term investments Restricted cash Accounts receivable... -

Page 133

...into account all relevant factors, including credit margin, term and basis. The risk management objective is to minimize the potential for changes in interest rates to cause adverse changes in cash flows to the Corporation. The short-term investment portfolio which earns a floating rate of return is... -

Page 134

2012 Air Canada Annual Report The following are the current derivatives employed in interest rate risk management activities and the adjustments recorded during 2012: ï,· As at December 31, 2012, the Corporation had two interest rate swap agreements in place with terms to July 2022 and January ... -

Page 135

... pension funding obligations as described in Note 9 and covenants in credit card agreements as described below. The Corporation monitors and manages liquidity risk by preparing rolling cash flow forecasts, monitoring the condition and value of assets available to be used as well as those assets... -

Page 136

... the result of sales of tickets to individuals, often through the use of major credit cards, through geographically dispersed travel agents, corporate outlets, or other airlines. Credit rating guidelines are used in determining counterparties for fuel hedging. In order to manage its exposure to... -

Page 137

... reviews to adjust the strategy in light of market conditions. The Corporation does not purchase or hold any derivative financial instrument for speculative purposes. During 2012: ï,· The Corporation recorded a loss of $43 in Loss on financial instruments recorded at fair value related to fuel... -

Page 138

... value measurements at reporting date using: Quoted prices in active markets for identical assets (Level 1) Significant other observable inputs (Level 2) Significant unobservable inputs (Level 3) December 31, 2012 Financial Assets Held-for-trading securities Cash equivalents Short-term investments... -

Page 139

... reactivated. Management views Porter's counterclaim as being without merit. Pay Equity The Canadian Union of Public Employees ("CUPE"), which represents Air Canada's flight attendants, filed a complaint in 1991 before the Canadian Human Rights Commission alleging gender-based wage discrimination... -

Page 140

... Air Canada-Air Canada Pilots Association collective agreement, which incorporated provisions of the pension plan terms and conditions applicable to pilots requiring them to retire at age 60. Air Canada has fully or partially resolved some of these complaints and is defending others. At this time... -

Page 141

... technical service agreements with service providers, primarily service providers who operate an airline as their main business, the Corporation has from time to time agreed to indemnify the service provider against certain liabilities that arise from third party claims, which may relate to services... -

Page 142

... Air Canada Annual Report 19. INVESTMENTS IN AVEOS On March 18, 2012, Aveos Fleet Performance Inc. ("Aveos") announced that it had ceased operating its airframe maintenance facilities in Montreal, Winnipeg and Vancouver. On March 19, 2012, Aveos filed for court protection pursuant to the Companies... -

Page 143

... Superintendent of Financial Institutions ("OSFI"), where required, assets and obligations under the pension, other post-retirement and post-employment benefits plans pertaining to the transferred unionized employees are to be transferred to Aveos, with Air Canada to provide compensation payments to... -

Page 144

2012 Air Canada Annual Report 20. GEOGRAPHIC INFORMATION A reconciliation of the total amounts reported by geographic region for Passenger revenues and Cargo revenues on the Consolidated Statement of Operations is as follows: Passenger Revenues Canada US Transborder Atlantic Pacific Other $ $ 2012... -

Page 145

...PURCHASE AGREEMENTS Air Canada has capacity purchase agreements with Jazz Aviation LP and certain other regional carriers. The following table outlines the capacity purchase fees and pass-through expenses under these agreements for the periods presented: 2012 Capacity purchase fees Pass-through fuel... -

Page 146

... with similar terms and risks. Market capitalization is based on the closing price of Air Canada's shares multiplied by the number of outstanding shares. This definition of capital is used by management and may not be comparable to measures presented by other public companies. The Corporation also... -

Page 147

... Chief Operating Officer, Executive Vice-President and Chief Financial Officer, and Executive Vice-President and Chief Commercial Officer. Compensation awarded to key management is summarized as follows: 2012 Salaries and other benefits Post-employment benefits Other long-term benefits Share-based... -

Page 148

... Network Planning President and Chief Executive Officer, Leisure Group Vice President, E-Commerce, Product Distribution and Sales Development Vice President, Revenue Management Corporate Secretary Vice President and Controller Vice President, Financial Planning and Analysis Vice President, Marketing... -

Page 149

... CHOICE Ofï¬cial Languages at Air Canada For Air Canada, offering service in the language chosen by its customers is essential. Verbal exchanges with clients, public-address announcements at the airport and on board as well as brieï¬ng of passengers with special needs all constitute the very heart... -

Page 150

... million customers. Air Canada provides scheduled passenger service directly to 59 Canadian cities, 55 destinations in the United States and 64 cities in Europe, the Middle East, Asia, Australia, the Caribbean, Mexico and South America. Air Canada is a founding member of Star Allianceâ„¢, the world...