Aetna 2014 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2014 Aetna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report- Page 8

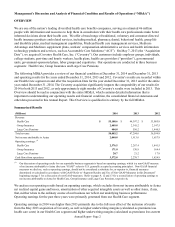

The table presented below reconciles net income attributable to Aetna to operating earnings (1):

(Millions) 2014 2013 2012

Net income attributable to Aetna $ 2,193.4 $ 1,912.5 $ 1,692.5

Net realized capital gains, net of tax (41.5) (.7) (56.6)

Amortization of other acquired intangible assets, net of tax 157.4 136.6 89.4

Transaction, integration-related and restructuring costs, net of tax 134.2 219.0 14.1

Release of litigation-related reserve, net of tax (67.0) — —

Litigation-related settlement, net of tax —— 78.0

Severance charge, net of tax —— 24.1

Operating earnings $ 2,376.5 $ 2,267.4 $ 1,841.5

(1) In addition to net realized capital gains and amortization of other acquired intangible assets, the following other items are excluded from

operating earnings because we believe they neither relate to the ordinary course of our business nor reflect our underlying business

performance:

• In 2014, we incurred transaction and integration-related costs related to the acquisitions of Coventry, InterGlobal and bSwift of

$134.2 million ($200.7 million pretax), which was entirely recorded in the Health Care segment. In 2013 and 2012, we incurred

transaction, integration-related and restructuring costs related to the acquisition of Coventry of $233.5 million ($332.8 million

pretax) and $25.4 million ($32.6 million pretax), respectively, of which $219.0 million ($310.5 million pretax) and $14.1 million

($15.2 million pretax), respectively, were recorded in the Health Care segment. Restructuring costs, primarily comprised of

severance and real estate consolidation costs, are related to the acquisition of Coventry and Aetna’s expense management and

cost control initiatives. Transaction costs include advisory, legal and other professional fees which are not deductible for tax

purposes and are reflected in our GAAP Consolidated Statements of Income in general and administrative expenses. Transaction

costs also include transaction-related payments as well as expenses related to the negative cost of carry associated with the

permanent financing that we obtained in November 2012 for the Coventry acquisition. Prior to the Acquisition Date, that

negative cost of carry associated with the permanent financing was excluded from operating earnings. The components of the

negative cost of carry are reflected in our GAAP Consolidated Statements of Income in interest expense, net investment income,

and general and administrative expenses. On and after the Acquisition Date, the interest expense and general and administrative

expenses associated with the permanent financing are no longer excluded from operating earnings.

• In 2012, we recorded a charge of $78.0 million ($120.0 million pretax) related to the settlement of purported class action

litigation regarding Aetna’s payment practices related to out-of-network health care providers. That charge included the estimated

cost of legal fees of plaintiffs’ counsel and the costs of administering the settlement. In 2014, we exercised our right to terminate

the settlement agreement. As a result, we released the reserve established in connection with the settlement agreement, net of

amounts due to the settlement administrator, which reduced 2014 other general and administrative expenses by $67.0 million

($103.0 million pretax). Refer to Note 18 beginning on page 127 for additional information on the termination of the settlement

agreement.

• In 2012, we recorded a severance charge of $24.1 million ($37.0 million pretax) related to actions taken in 2012 and 2013.

Operating earnings in 2014 increased compared to 2013.

In 2014, operating earnings increased compared to the corresponding period in 2013, primarily due to the May 2013

acquisition of Coventry, as well as higher underwriting margins in both our Government and Commercial

businesses, partially offset by increased investment spend to support our growth initiatives, primarily in our

Government, Healthagen® and Consumer businesses. In 2013, operating earnings increased compared to the

corresponding period in 2012, primarily due to the acquisition of Coventry in May 2013, as well as higher

underwriting margins primarily in our Commercial business, partially offset by lower underwriting margins in our

Government business. Refer to our discussion of Commercial and Government results below for additional

information.

We calculate our medical benefit ratio (“MBR”) by dividing health care costs by health care premiums. Our MBRs

by product for the last three years were:

2014 2013 2012

Commercial 80.2% 80.1% 81.1%

Government 84.9% 87.5% 84.9%

Total 82.2% 82.9% 82.2%