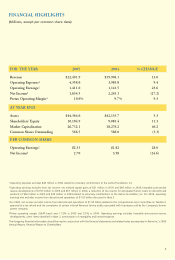

Aetna 2005 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2005 Aetna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

■We also continued to see strong growth in our specialty

products. Membership in dental products increased more than

9 percent to 13.1 million, while membership in our pharmacy

products increased approximately 12 percent to 9.4 million.

■We now serve 27.9 million unique members.

An overwhelming majority of the increase in membership

was organic – from winning customers in the marketplace – not

purchased in a business acquisition.

On a percentage basis, we experienced stronger organic

membership growth than any of our national competitors. This

speaks to the strength of Aetna’s product offerings, as well as

customers’ desire for integrated product solutions. For example,

more than 50 percent of our January 1, 2006, sales among

National Accounts customers included two or more Aetna

products. We believe this trend will continue and fuel significant

cross-sell opportunities among all of our products – medical,

pharmacy, dental, behavioral health, group life, long-term

care and disability, and medical management – and across all

customer markets.

Our rigorous focus on health care quality and costs also

contributed significantly to our results. For our customers, we

managed a full-year commercial risk medical cost trend of

a little over 8 percent. Our stable medical cost trend and

a disciplined approach to pricing allowed Aetna to continue

having one of the best medical cost ratios in the industry.

In the full-year 2005, Aetna’s commercial risk medical cost

ratio was 78.4 percent, excluding favorable prior-period

reserve development.

5

2005 Increase

in Membership

8%

Increase in

medical members

9%

Increase in

dental members

12%

Increase in

pharmacy members

27.9 million

Unique members

served in 2005

On a percentage basis,

we experienced stronger

organic membership

growth than national

competitors.