Aetna 2005 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2005 Aetna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

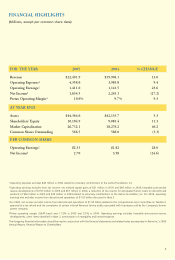

In addition, we made good progress in 2005 achieving an

operating expense ratio of 19.4 percent, compared to the full-year

2004 level of 20.1 percent. We will strive to make continued

improvements in operating efficiency in 2006 and beyond.

Overall, Aetna’s 2005 operating earnings increased 28 percent to

$2.33 per share from the $1.82 per share we reported for 2004,

excluding favorable prior-period reserve development. Both figures

are adjusted for the stock split we announced in January 2006.

RETURNING SIGNIFICANT VALUE TO SHAREHOLDERS

As a result of Aetna’s strong financial performance, we were able

to return significant value to our shareholders:

■Our share price increased by more than 51 percent for the year;

outperforming, by far, our peers, and exceeding that of the S&P

500 Index and the Morgan Stanley HMO Index.

■Twice in less than 12 months Aetna’s stock price rose to the

point where we completed a two-for-one stock split.

■Since the beginning of Aetna’s turnaround in May 2001 – when

Aetna’s stock price fell below $6, adjusted for splits – to

year-end 2005, Aetna’s stock price has appreciated more than

711 percent.

CREATING INNOVATIVE PRODUCTS

One of the ways we have differentiated Aetna is through our

innovative products. In 2001, Aetna was the first national

company to offer a consumer-directed plan with our Aetna

HealthFund®Health Reimbursement Arrangement product and

in 2004, the first insurer to launch a Health Savings Account

option. We also are unique in our ability to integrate

performance-based networks with consumer-directed health plans.

6

Our share price

increased by more than

51 percent for the year;

outperforming our peers,

and the S&P 500 and

Morgan Stanley indices.

From the beginning of

Aetna’s turnaround in

May 2001 to year-end

2005, Aetna’s stock price

has appreciated more

than 711 percent.